AMT Top Ten Miscellaneous Notions for the 8th of March 2024

10. Social Credit Score: George Orwell in our Age of the All Knowing State via public cameras using facial and body language recognition, along with listening devices that can gather voices and other sounds would chill him to the bone.

9. French Revolution: It was ‘wrong’ to say madame and monsieur after the ‘ancien regime‘ was replaced, instead the expression ‘citizen’ (citoyen) was invoked. Not using the proper words could bring the guillotine into your future.

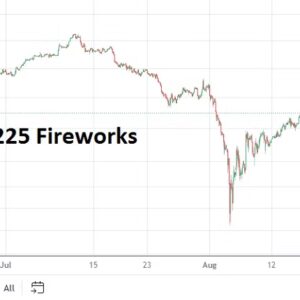

8. Japan: Nikkei 225 has come off the top, but remains highly valued. GDP numbers will come from the nation next Monday, and the BoJ is on the calendar the 19th of March.

7. Tech Espionage: Linwei Ding, a Chinese national, who worked for Google as a software engineer has been accused of stealing information regarding supercomputing and artificial intelligence. The U.S government has filed criminal charges against Ding in San Francisco, California.

6. Central Banks: Federal Reserve Chairman Powell per his testimony in Washington D.C remained cautious, saying he wants data to confirm inflation is eroding. The ECB yesterday also voiced care while trying to sound optimistic about economic conditions which remain lackluster.

5. FOMO: ‘Fear of missing out’ is being seen in many asset classes including cryptos and equities. Day traders while speculating should remain realistic and practice solid risk management.

4. U.S Indices: Apex heights persist as the S&P 500, Nasdaq 100 and Dow Jones 30 receive massive inflows of capital.

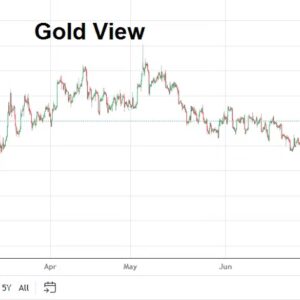

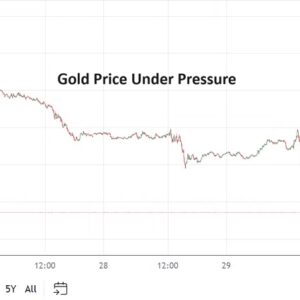

3. Gold: Record prices have been attained in the precious metal as speculative elements have pushed value above 2160.00 USD as of this writing.

2. Forex: The USD has seen weakness re-emerge the past handful of days as the ‘masses’ have seemingly energized again upon the notion of a change to the Federal Funds Rate.

1. U.S Data: Non-Farm Employment Change and Hourly Average Earnings statistics will be published today, either helping confirm or confront financial institutions behavioral sentiment. Weaker hiring and a diminishing of wage inflation is anticipated. Will it happen? Forex, U.S Treasury yields and equities will react.