AMT Top Ten Miscellaneous Rays for the 15th of March 2024

10. Argentina: President Javier Milei is practicing fiscal sanity. The health of the Argentine Peso has improved, and monthly inflation data has begun to show signs of erosion.

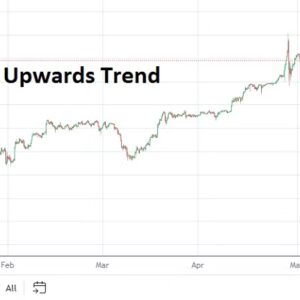

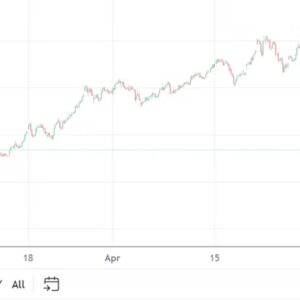

9. Copper: The commodity has shown a steady increase since the 9th of February and is challenging values last seen in April of 2023. Demand could signal better global economic outlooks emerging.

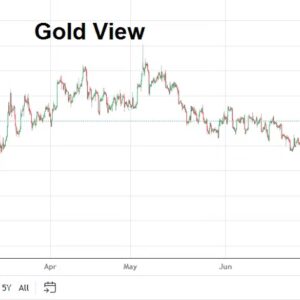

8. Gold: The precious metal is near 2167.00 USD which appears high momentarily, this as questions about USD near-term direction lurks and Forex remains choppy.

7. Aramco: Profits for the energy producer were an approximately 121 billion USD for 2023, this as Saudi Arabia is propelling the nation’s infrastructure towards an elite future.

6. Bubble Watch: Binance Coin is around 580.00 USD as of this writing. BNB/USD was near 200.00 in the middle of October 2023.

5. Centrists: Will the adults be allowed back into the political arena to govern and brush away populists?

4. Inflation: Consumer prices are causing pain and household arrears are growing. Total U.S credit card debt is estimated over 1 trillion USD by the Reserve Bank of New York.

3. China: New Home Prices are still losing value via data released today. And the Shanghai Composite Index is near 3050.00 which looks suspiciously like a member of the ‘too expensive club’.

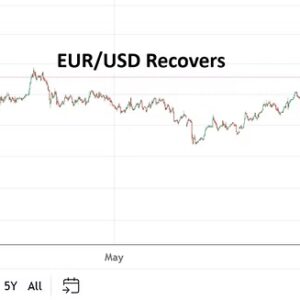

2. Data: U.S Producer Price Index stats were sharply higher yesterday, while Retail Sales came in below estimates. University of Michigan Consumer Sentiment readings will be published today. The U.S economic outlook remains murky.

1. Prediction: Fed’s FOMC meeting next week will provide financial institutions cautious ‘vanilla’ remarks about monetary policy from Jerome Powell, meaning market conditions will likely continue to move sideways.