Caution as GDP and Reactive Sentiment the Key for the Week

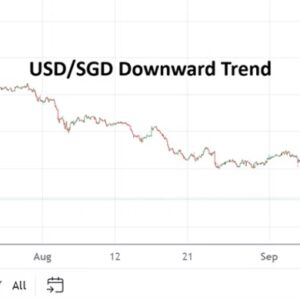

Forex markets have seen plenty of sideways action with the USD Cash Index lingering within the weaker parts of one and three month ranges. Yes, financial institutions appear to be leaning towards a belief the Federal Reserve will have to become more dovish over the mid-term, but last week’s price action before the onset of the long holiday weekend which has just passed did start to produce headwinds.

Risk appetite although high has climbed down from its peaks for the moment. Yet, financial institutions, investors and day traders likely still are aiming for more optimistic results. Speculative inclinations may believe more weakness is about to come from the USD, and major currencies are within sight of important technical barometers which could fuel more bets on a weaker USD to develop.

A taste for speculative buying in the equity indices while running out of some power last week remains within sight of highs. The Dow 30 and S&P 500 might have come off their records along with the Nasdaq, but the slight declines may be viewed as a buying opportunity by day traders.

However, before retail speculators dip their toes in the water they should understand that the Gross Domestic Product numbers this week will factor into existing behavioral sentiment. Again, taking a position for a short-term wager is different than buying an equity index as a long haul investment vehicle. The two are not the same and the daily fluctuations, even the weekly movements of the equity indices, do not bother investors who are gearing their outlooks for the long-term, while short-term moves can wipe out a person using too much leverage if they are pursing a casino like belief in direction without solid risk management.

Yesterday’s holidays in the U.S and U.K have likely given financial institutions a chance to reflect on events and outlooks which will be unfolding and affecting sentiment. The announcement on Wednesday of last week that Britain will have a national election on the 4th of July will certainly start to create concerns for the GBP/USD.

Tomorrow the South Africa election will be held. While not an event which will get the attention of all investors, the implications of the vote in South Africa and the potential for a coalition should be watched. If the African National Congress is forced to form a coalition, investment managers will be hoping that the political maneuvering doesn’t bring about a ‘hard-left’ ruling government. Again while the investment stakes may not be felt by everyone around the globe concerning the results in the South Africa election, its impact on geopolitics long-term could be substantial.

International mining companies with large amounts of infrastructure and investment in the nation will certainly be keeping their eyes on events. There is a high level of suspicion within South Africa that load-shedding (rolling electrical blackouts) which has largely disappeared the past few months could reappear after the election, which highlights some of the distrust citizens have regarding the current leadership. The ANC has been in power for 30 years and tomorrow’s election marks one of the first times their leadership may prove vulnerable.

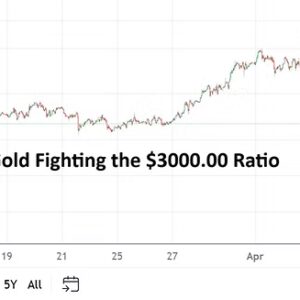

As a clue for speculators and the level of complexity being seen in the financial markets near-term is that the price of gold remains elevated. Although not at its apex values, the price is certainly within sight of highs. What is interesting is that the record levels have taken place as USD centric attitudes have turned weaker the past month, showing that their is likely a large speculative presence within the gold market.

Certainly governments via central banks and other investors could be buying gold. The apex values in gold coupled with weaker USD sentiment which has developed the past month shows that nervousness still lingers. Again, long-term players in gold have much less to fear than short-term day traders who are betting on intraday price changes. Gold is a remarkably strong inflation hedge historically, but retail wagers on the price of the precious metal is a constant battleground. If the USD stays weaker over the mid-term it will prove very interesting to see where gold starts to display a durable support level – if in fact it is tested. There are gold bugs who certainly believe the price of the commodity should be much higher in relation to the unreliability of paper money in many spheres.

For traders who are looking ahead to the economic data risk events, the price of WTI Crude Oil needs to be given attention too. The price of the energy source remains under 80.00 USD per barrel which is important. If the costs of WTI Crude Oil remains stable this may cool some inflation fears. It should be noted that OPEC will begin conducting a conference to discuss Crude Oil production on the 2nd of June.

Tuesday, 28th of May, U.S Consumer Confidence via the Conference Board – the University of Michigan Consumer Sentiment numbers came in slightly better than expected last week. However, today’s reading is expected to be slightly lower than the previous result. Weaker than anticipated data could actually help the USD remain within its bearish technical range in Forex.

Wednesday, 29th of May, Germany Preliminary Consumer Price Index – this CPI result will impact the EUR/USD. The expectation is for a weaker result of 0.2% compared to previous outcome of 0.5%. If this number matches the expectation, this could put the European Central Bank into a collision course with financial institutions who want the ECB to take on a proactive dovish policy and begin cutting interest rates.

Thursday, 30th of May, U.S Preliminary Gross Domestic Product – the growth and Price Index numbers via the GDP reports will be significant and cause a large impact in the financial markets. Forex, commodities and equity indices (and Treasuries) will all be affected. The growth number is expected to be weaker than last month’s. Having produced lower results last month, if this GDP statistic is below the anticipated level of 1.3% it could set off fireworks. The GDP Price Index will have many eyes upon it too, and it carries a expected gain of 3.1%. Inflation remains a chief catalyst for the Fed and in Forex. The combination of the growth and price numbers is certain to cause volatility.

Friday, 31st of May, China Manufacturing PMI – economic data from China has been mixed recently, but foreign investment is still weak and the nation is looking for positive outcomes. Traders should keep their eyes on these numbers and also remember that economic results from China are not exactly the most transparent. Consumer numbers via retail spending domestically in China are still struggling. China is hoping to attain better trade relationships in Europe, but its intentions are running into a more competitive export landscape and political complications which are making the chances for a quick fix for its economy elusive.

Friday, 31st of May, U.S Core PCE Price Index – this report should be watched by Forex traders because it is highly regarded by the Federal Reserve as an inflation gauge. An outcome of 0.2% is the expectation for this report and if met, the USD could turn weaker going into the weekend.