Optimism in Challenging Conditions and Time Considerations

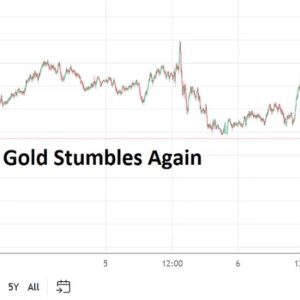

Traders by nature are optimists, after all they are wagering on outcomes they believe are valid with targets regarding future results. Global market conditions for the moment have created expensive price action unfortunately, this as plenty of day traders wagering on their perceptions have found out while whipsaw movements and fast velocity have taken place and caused losses.

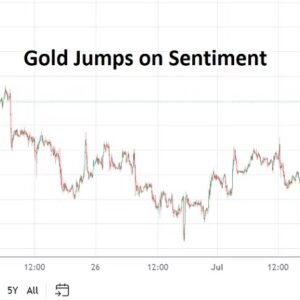

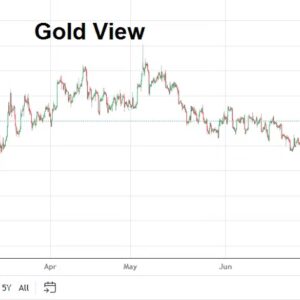

The USD continues to create turbulent higher values among many major currencies it is teamed against as financial institutions exhibit risk adverse tendencies. U.S Treasury yields may be going up because the U.S Federal Reserve continues to sound alarms regarding inflation, but the last two weeks of trading globally have seen an influx into U.S Treasuries as a safe haven move. Another signal that risk appetite is poor among global investors is because while the USD has gotten stronger, gold has also risen in value.

And importantly, global markets are trading in conditions which are not considered normal. Many inexperienced people within financial institutions have not dealt with markets like the ones being battled now. High interest rates combined with risk adverse conditions because of concerns regarding an escalation of war conditions in the Middle-East are causing a storm of volatility. U.S stock indices are trading at mid-term lows, and this may continue to be a theme over the next few weeks and beyond, but certainly there are those among us who look towards sunnier days.

So what does an optimist do if they are a day-trader? Perspective needs to be questioned at all times by speculators, and bias regarding all insights by individuals need to be given consideration. A trader must make sure they are not trading based on noise which is coming from the media and tainted with hyperbole. A trader must also question their personal instincts making sure they are free of preconceived notions. Behavioral sentiment gets affected from many angles when market noise becomes loud. Looking for a quiet place to think about market direction is vital for everyone.

Speculators need to remain calm and stick to risk management tactics that prove effective even during chaotic trading conditions. A variety of ways to be involved with the markets directly exists for all, Forex, equities and indices, commodities, bonds are only some of the avenues. Traders can go long or short on their chosen positions, they can participate in the ‘cash’ markets, but can also participate in futures and options trading via time related duration.

Famous investors are known for taking advantage of lower values when fear is high. They look for value via fundamentals within assets with long-term track records. It is not an accident the USD is strong, U.S Treasuries are being sought, gold is being bought currently.

Trends are there to be found and can be taken advantage of by day traders who are looking for quick hitting outcomes, but they must proceed carefully. Because it is also important to acknowledge that no matter how bad circumstances sometimes look in the short-term, that a positive quality among we as humans is to seek optimism. There are reasons to participate in trades with a perspective knowing more tranquil days will come and the markets will grow calm again, markets can reverse and suddenly display risk appetite.