AMT Top Ten Miscellaneous Insights for the 9th of February

10. Super Bowl AMT Prediction: Kansas City Chiefs 27 – San Francisco 49ers 24. After winning the MVP Travis Kelce will hug Taylor Swift and announce his retirement.

9. Jazz Fusion: Please listen to the song School Days played by Stanley Clarke while delivering a supreme bass guitar riff.

8. Tech: Google has announced its Bard A.I will now be known as Gemini in a rebranding. ‘Bard’ was a rather poor name, but is Gemini much better? Let’s ask Gemini what it thinks about the Google marketing team.

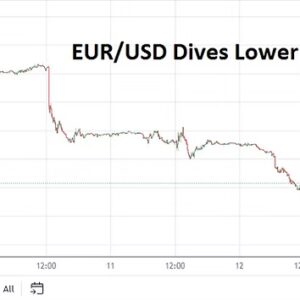

7. Banking Animal Kingdom: Central Banks parroting the same rhetoric globally as they choose to be ‘prey’ instead of ‘predators’, driving financial institutions and traders batty in Forex.

6. Crypto: The NBA is being sued by investors in a Class Action Complaint in conjunction with 4.2 billion USD in losses, because of alleged fraudulent actions by Voyager Digital Holdings, claiming the NBA bears responsibility for negligent marketing via the Dallas Mavericks. https://storage.courtlistener.com/recap/gov.uscourts.flsd.661881/gov.uscourts.flsd.661881.1.0.pdf

5. Deutsche Pfandbriefbank AG: A large slump in bond values for the German bank has sparked additional fears of exposure for banks involved with the commercial real estate sector. CRE appraisals remain unrealistically high in many European and North American cities as lending risks climb.

4. Cocoa: The price for the commodity was 4055.00 USD per metric ton on the 8th of January, as of yesterday it was 5666.00, a rise in cost of 39.72% in a month. Our sweet tooth just got more expensive.

3. Data: Yesterday’s Weekly Unemployment Claims showed negative revisions upwards from the previous two weeks; another ‘hidden’ piece of data not being fully considered by traders, perhaps like the Non Farm Employment Change data last week reporting declining workweek hours.

https://www.angrymetatraders.com/post/usd-hidden-jobs-data-shows-potentially-intriguing-weakness

2. China Economy: Deflation continues to be reported via the CPI and PPI statistics. Also, value of properties for housing and commercial real estate face significant headwinds. The real estate sector including ancillary infrastructure is at least 21% of China’s total GDP.

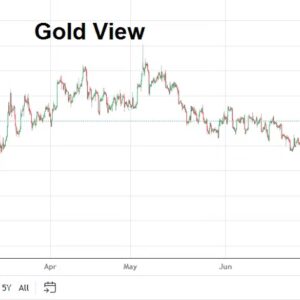

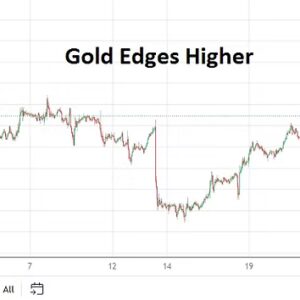

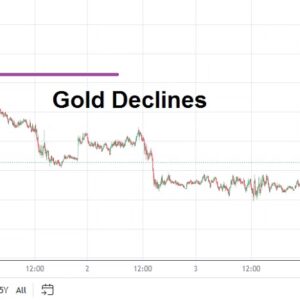

1. Risk Appetite: U.S equity indices finished Thursday’s trading achieving apex highs. The S&P 500 is challenging the 5000.00 level. Gold is near 2033.00 USD and WTI Crude Oil is above 76.00 USD as of this writing.

Related posts:

Anxiety and Surprising U.S Data for Day Traders to Consider

Anxiety and Surprising U.S Data for Day Traders to Consider

Forex and Equities Storm: Crucial Data will Impact Markets

Forex and Equities Storm: Crucial Data will Impact Markets

AMT Top Ten Miscellaneous Remarks for the 14th of July 2024

AMT Top Ten Miscellaneous Remarks for the 14th of July 2024

Reactions and Risks as Trading Clarity Remains Hard to Grasp

Reactions and Risks as Trading Clarity Remains Hard to Grasp

Retail Traders Caught Out by Shifting Sentiment as Data Hits

Retail Traders Caught Out by Shifting Sentiment as Data Hits