Behavioral Sentiment: False Narratives and Noisy Realities

The past handful of months in Forex have provided day traders problems if they have been trying to pursue steady trends. Constant flashes of rhetoric and news pervading tariff implications, U.S Federal Reserve interpretations from various media and analytical corners, and mixed economic data has caused a rather mired reality for speculators trying to operate.

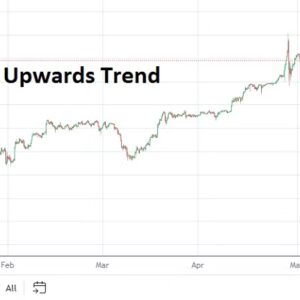

However, if the noise is turned down by day traders and sometimes given less importance regarding potential influences, signals become visible and some perceptions can be looked upon as roadmaps. While many want to to throw their hands up and proclaim some sort of developing economic meltdown and a coming apocalypse, the major U.S indices are actually performing quite well as a barometer. The S&P 500 is continuing to challenge all-time values. Yes, the Nasdaq 100 and Dow Jones 30 are not marching in lockstep with the S&P 500 to new highs, but they are not far behind. The stock market has never guaranteed people an ability to constantly move upwards, but it does offer the potential to judge outlook and mid-term sentiment.

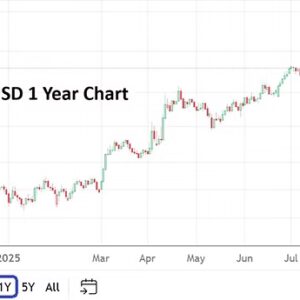

The USD has been extremely choppy since the start of this year, this as the Trump administration has taken over, but its trend towards weakness has been rather clear. The EUR/USD and GBP/USD have done reasonably well regarding mid-term strength. Yes, the USD/JPY has produced whipsaw movements and the Japanese Yen remains awkward, but this is a direct reflection of mitigating Japanese government policy (some may call it incompetence) regarding its ability to manage fiscal concerns, interest rates, and fight deflation and now inflation (which has been going on for a few decades).

Gold is traversing record heights and is showing signs of sustaining values above 3,600.00 as of yesterday. After languishing (albeit within elevated realms) near 3,350.00 the past handful of months with prevalent volatility, the precious metal has bolted out of its consolidation. And the likely reason for this is the anticipated Federal Reserve policy changes regarding interest rates. 10 Year U.S Treasury yields have also been pushed lower recently – this as financial institutions await a definite cut in interest rates by the Fed on the 17th of September. But folks who believe a 50 point basis reduction is coming late next week are likely wrong.

The Federal Reserve under Chairman Jerome Powell has been quite conservative, this will probably not change next Wednesday. It is more likely a cut of 25 basis points will take place on the 17th, and the FOMC Statement will offer the potential of another interest rate cut in October. Tomorrow’s PPI numbers and Thursday’s CPI results will influence the Fed’s coming meeting and mid-term outlook.

What we are left with is a broad market that is having a lot of noise applied to it by people with a variety of biases. Political bantering has reached a threshold in which it might be best to simply not pay attention to anything – but that is dangerous too. Yes, some people do talk sense, and some people do show signs of actually trying to engage in adult decision making regarding their insights, but it often feels like wanting to sound correct is more important than outcomes. Technical traders may be enjoying a quiet laugh at the expense of fundamental players right now.