FOMO Potential Could Fuel FX and Equities with Calm Winds

Traders should not run towards their trading screens as the week begins, steady attitudes and risk taking tactics will be needed. Yet, there may be reasons to get excited. The return of full market volume as U.S financial institutions open and employees get back in their offices after the long holiday weekend needs to be monitored. The term ‘FOMO’ – fear of missing out – may be heard this week if U.S equity indices continue to shine, Forex demonstrates additional USD weakness and U.S Treasury yields decline further. There will be a whirlwind of economic data and opportunities for ‘official’ rhetoric in the days ahead.

Day traders should ask questions about the results which were seen technically via their charts last week, assets all struggled to find momentum last Thursday and Friday. And earlier in the week many Forex pairs produced choppy results. But here’s the thing, behavioral sentiment was rather muted as large speculators and financial institutions understood that trading volumes would be light – this caused strong bursts and sudden reversals early – but by the end of the week rather calm waters.

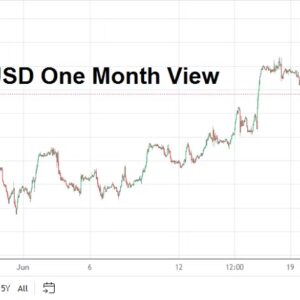

Many trading houses could increase their speculative positions this week based on their outlooks. Financial institutions clearly have believed the USD had been overbought and the ability of the GBP, EUR and JPY to gain in the past two weeks are possible signs large ‘players’ remain positioned for further USD weakness.

Equity markets have done well in November, but the major indices including the Dow 30, S&P 500 and the NASDAQ Composite all started to garner strength in the last week of October. Mid-term highs are being achieved in U.S indices. The parade of buyers may not be done quite yet.

Economic data results are vital for day traders to understand because they provide insights into the thinking of financial institutions regarding their outlooks. It is not the trading of small speculators that moves markets, it is the power of large cash positions which drives results. Questions regarding where the cash is going and the allotments financial institutions are pursuing is a key to understanding how the markets are going to react. This information is not readily available for day traders, instead smaller speculators need to try to comprehend outlooks regarding positioning and timeframes of larger players.

Part of the FOMO factor could develop as financial institutions begin to question how much money they will hold in money market accounts for their clients. While the practices of large investors are always comforted by the notion they are making guaranteed returns, the pursuit of better results and the desire for risk appetite does drive behavioral sentiment when bullish markets are being exhibited.

This week will be intriguing as full volumes return to the marketplace today and tomorrow. From today until the 13th of December FOMC Statement from the U.S Federal Reserve, results in the financial markets could be speculative. Financial markets are starting to signal that optimism is creeping back into the mindsets of large investors who may believe mid-term economic scenarios have improved.

Monday, 27th of November, E.U. ECB President Lagarde – the European Central Bank leader will deliver thoughts regarding monetary policy to the European Parliament. While the E.U still is sufferning from recessionary numbers, economic data last week came in slightly better than estimated. However, the EUR/USD remains in a USD centric mode and this will continue this week.

Tuesday, 28th of November, U.S Consumer Confidence via the Conference Board, the numbers are expected to be slightly weaker than last month’s outcome. U.S economic data has been showing signs of being weaker than expected, last week’s Core Durable Goods Orders report followed this trend.

While this may be read as bad news by some people, day traders should note – particularly Forex speculators – that slightly weaker U.S economic data currently is music to the ears of many financial institutions because they believe the Federal Reserve will have to shift their rhetoric from aggressive to neutral.

Tuesday, U.S Federal Reserve Officials – a slew of FOMC members will be speaking at various events during the day. The Fed likes to give clues to the financial markets regarding their outlooks and perceptions regarding interest rates. The Federal Reserve has certainly paused their interest rate hikes.

The question now is if the U.S central bank will start to say while they remain diligent regarding inflation, that they now see signs of a ‘soft landing’ emerging within the U.S economy. If the Fed speakers begin to sound not only neutral, but offer hints of becoming potentially dovish by the spring of 2024 regarding monetary policy, this could spur USD selling.

Wednesday, 29th of November, Germany Preliminary Consumer Price Index – the inflation results are expected to be slightly weaker than last month’s outcome. German economic data has been recessionary, financial institutions know this, what large traders would like to see is stable results that are not wildly surprising.

Wednesday, 29th of November, U.S Preliminary Gross Domestic Product – the growth numbers are expected to show a slight increase. Equity markets, Forex and commodity markets will react to these results. The U.S economy has been surprisingly strong regarding growth. A slight slowdown regarding the GDP numbers would not be the worse thing, if growth numbers did come in below the estimate this could fuel additional USD weakness.

But traders should not get overly ambitious and bet against the GDP numbers. If the expected outcome of 5.0% is delivered, equity markets could use this as additional fuel. The number is sure to be a talking point, but unless their is a massive divergence it may simply be a way to create noise for ‘talking heads’, when in fact behavioral sentiment regarding risk appetite remains optimistic.

Thursday, 30th of November, China Manufacturing PMI – the result is forecast to show a slight improvement. China economic numbers remain a concern, particularly from the real estate sector which is suffering and is causing cascading troubles on other sectors within the nation. Global demand for products, as an example from European countries, that are suffering recessionay pressures also is slowing China’s manufacturing. A slight improvement would be welcomed by global investors participating in China financial assets.

Thursday, 30th of November, OPEC and JMMC Conference – the oil producers will certainly make their policies known and energy markets will react to the news and rumors. Commodity traders should note that WTI Crude Oil, Brent, Natural Gas and Unleaded Gasoline markets have been under price pressure and important mid-term cash support levels are in sight.

Thursday, 30th of November, U.S Core Personal Consumption Expenditures Index – this inflation reading is important and should be watched. The result is expected to be weaker than the previous month. If the outcome matches the anticipated reading of 0.2% or less, this could spur additional USD weakness. The Core PCE Index is an important reading for the U.S Federal Reserve regarding its inflation insights.

Friday, 1st of December, U.S Fed Chairman Jerome Powell – the Fed leader will be speaking at a college event in Atlanta. Traders should remember that about ten days before the Fed’s pause in November regarding its FOMC Statement, Powell delivered a large hint regarding monetary policy. The Fed Chairman’s comments will come late on Friday and could cause a reaction early next week if Powell’s remarks fuel more Forex speculation.

Additional note – the U.S jobs numbers will not be released this Friday, the Non-Farm Employment Change and Average Hourly Earnings results will be published on the 8th of December.