Hard Truth: No Secret Sauce, A Possibly Unfriendly Reminder

Day traders face constant battles. Choppy conditions in markets lead many salespeople within brokerage firms to proclaim the ability to take advantage of technical shifts to their clients, but it is much easier to demonstrate what has taken place before compared to what is going to happen next. Technical trading via charts often looks good for those offering its charms until reality bites.

Day traders also have the disadvantage of fighting large market institutional forces that have completely different timeframes, deeper pockets, and perhaps even a fair amount of analyses they can use to validate their reasons for taking a position – not necessarily a correct position – but enough to provide insurance regarding their decision making.

Institutional traders can fall back on the analyses they have at their disposal and point to it as the reason why they made a trade. Literally giving them an excuse to explain why things went wrong, so they can tell inquiring management when needed, this in order to protect their miscues. Institutional players do not get fired easily from their positions, they usually just wait a few years and shift to another company when too many bad trades have been made – that is a dirty little secret in the trading world.

Comparatively, day traders simply blow out their own accounts while losing money. Yes, sometimes they have to explain to their romantic partner why they can’t go on the trip they had been planning because there is a sudden lack of funds. Hopefully they didn’t wipe out too much money that they may have borrowed from family or friends, this via ambitions and proclamations that a coming trade was a once in a lifetime opportunity.

But wait, yes, there are speculators and large traders who do make money. These are the folks many allude to who are – in many peoples’ minds – sitting on a yacht in a lovely ocean locale and enjoying the fruits of their labors. They do exists and we should acknowledge this, even if we sometimes think they are merely lucky and one day will face a losing streak.

However, many of these anointed winners do not exists either. Beware of experts ladies and gentlemen. Influencers are often selling a dream they know a day trader desires. Commissions drive the brokerage business. Unfortunately, it is seldom profits made by an emerging victorious crowd via newly minted speculators that make brokerages money.

I am frequently warned that this is not what day traders want to read. They do not want to be reminded that 90% of their group usually loses most of their money, or at a minimum walks away with less money than they started. The U.S Fed’s Jackson Hole Symposium is now underway in Wyoming. Yet, most day traders will only be able to take advantage of this event by trying to ride on the sentiment tides created by large institutional traders in Forex. The headline: Fed Rhetoric and Jackson Hole, will be the talking point of the media today.

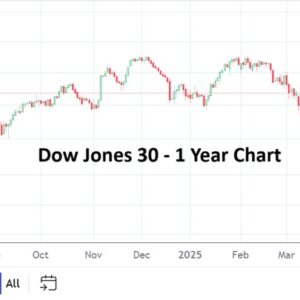

However wait a moment please, the retail brokerage business in the States must be pointed out as a reason for some positive momentum in the major U.S indices the past handful of years and needs to be watched regarding its sentiment. Reddit, X, Instagram, Quora and other social media sites can be monitored to gather this info. Behavioral sentiment is becoming important in the markets. While some institutional investors are showing caution via inquiries (polling) and actual market positions, some public cash appears to be supporting the S&P 500, Nasdaq 100 and Dow Jones 30 via purchases through reputable brokers who do buy the actual asset.

That is a contradiction of sorts compared to what has been written in previous paragraphs, but then again this is trading (and investing) we are discussing, so there are no straight lines, and often complexity rules. Perhaps you noticed that I didn’t say, institutional players are smarter than day traders. In many cases institutions and their managers merely have more money to wager with, and can do this without too much leverage and over much longer timeframes – giving them the ability to ride out financial storms and survive.

Under the current market circumstances the Fed is expected to cut interest rates in September by 25 basis points. But the U.S central bank is going to face a possible battle via murky data that will have to be factored into October, November and decisions beyond, meaning caution prevails. Trading choppiness in Forex will continue in the near term. The possibility that financial institutions may believe current pricing represents fair value is legitimate.

Let’s remember that the movements in Forex, stocks and indices, commodities, bonds and other assets always appear more volatile for smaller traders, because intraday price action and the absurd amount of leverage being used by many folks often leads to dangerous speculative circumstances.

Traders need patience, shouldn’t use too much leverage and allow for the ability to walk away from a losing trade with limited losses. Leaving enough cash in your account to participate again later can lead to other opportunities. There are no guarantees in trading. Good trading discipline is essential.