Risky Outlooks: Central Banks and Inflation Colliding

Most traders and investors begin their pursuit of financial assets with an optimistic perspective. However, the markets and ability to speculate also allows those who have other outlooks to equally participate. The past week once again delivered U.S inflation data which was not anticipated. While last Tuesday’s CPI results came in slightly stronger than expected, it was Thursday’s PPI which provided surprises for many.

Yet, some market participants may not have been utterly shocked by the results. Perhaps it was lucky to ‘guess’ the PPI numbers could cause volatility last Thursday, but the ability to be alert and attentive to the possibility of risk should not be ignored. Risk management is important for all traders.

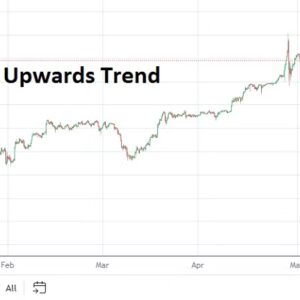

This coming week will continue to be intriguing for day traders as they try to sail through speculative waters which are going to deliver shifting behavioral sentiment tides. A parade of central banks are ready to step into the limelight and they will focus on the word: inflation. Technical traders who wager on support and resistance levels in the coming days should not be scorned, because sideways and volatile trading results are likely.

U.S equity indices began to struggle the middle of last week, Gold has traded lower and Treasury yields have ticked upwards in recent market action, this as sentiment has again had to acknowledge economic outlooks remains problematic. Trading decisions this week will depend not only on what the central banks say and ‘do’, but also focus on the duration that a speculative position intends to be working.

Monday, 18th of March, China Industrial Production – a gain of 7.0% has beaten the expectation per the data already published this morning. Retail Sales numbers came in slightly below estimates, but Fixed Asset Investment numbers were better than anticipated. However, China’s data remains troublesome and the economic path ahead for the nation must overcome deflation and trust issues from international investors. A lack of confidence from the Chinese public about the value of Real Estate and the over abundance of available property is causing major headwinds economically.

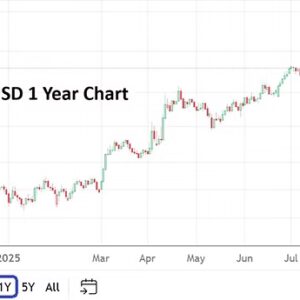

Monday, 18th of March, E.U Final Core Consumer Price Index – the European Union will release crucial inflation data. An expected gain of 3.1% is the estimate. While this data release is not considered vital by many investors, the inflation statistics should be watched. The EUR/USD has produced mixed results the past four months as shifting behavioral sentiment due to battling perceptions regarding central bank policy outlooks converge.

Tuesday, 19th of March, Bank of Japan – the BoJ will deliver their Monetary Policy Statement and Policy Rate. While no numerical change is expected from the BoJ, signs for a change in rhetoric will be looked for as central bank observers try to read the tea leaves. The Japanese economy is within an intriguing spot, there have been signs of improvement, but the Bank of Japan is likely to remain on a conservative path regarding negative interest rates for the moment. The USD/JPY remains within the higher realms of its price range as the currency pair grapples with global inflation outlooks.

Tuesday, 19th of March, Reserve Bank of Australia – the RBA is expected to parrot the pronouncements of the other central banks as they point to stubborn inflation and ‘improving yet lackluster’ economic outlook. Trading in the AUD/USD has been choppy and the volatility is likely to continue within the known price range.

Tuesday, 19th of March, Canada CPI – the Consumer Price Index data is anticipated to show inflation remains remains sticky in the ‘Northern Tundra’. The CPI report from Canada should be monitored because of the strong relationship between the U.S and Canadian economies. The USD/CAD will react to any surprises.

Wednesday, 20th of March, U.K Consumer Price Index – yet another important inflation report. Great Britain has been a ‘poster child’ regarding stagflation. The ugly word is not something central banks, nor governments want to discuss, but the simple truth is that problematic inflation and limited growth equal stagflation. The statistics from the U.K should be examined. The economic health of Great Britain is often a solid reflection of global conditions.

Wednesday, 20th of March, U.S Federal Reserve – the Federal Funds Rate, FOMC Statement and Fed Press Conference will be focal points for investors. Except importantly, not much is likely to be said be Jerome Powell that isn’t known already. Inflation reports from the U.S have highlighted stubborn higher prices. U.S economic numbers regarding manufacturing and consumer confidence have started to turn lower, but the Fed is not going to change its policy this week. Talk about ‘becoming’ dovish will be heard, but the U.S central bank still wants to see more proof that inflation can erode before they start to cut interest rates in the mid-term.

Thursday, 21st of March, E.U Manufacturing and Services PMI, readings will come from France, Germany and the U.K via the Purchasing Managers Index results. Most of the data will likely continue to point to lackluster outlooks, only the Services PMI from the U.K is expected to offer a glimmer of hope regarding ‘expansion’. If the Flash numbers come in worse than expected this could cast a shadow over behavioral sentiment for European investors.

Thursday, 21st of March, Bank of England – the BoE is likely to keep its Official Bank Rate within place and their pronouncements via the Monetary Policy Summary may sound like a replica of the U.S Federal Reserve. Inflation and growth will be spoken about and the BoE will try its best to paint an optimistic picture. The GBP/USD will react to the gyrations, but the range of the currency pair will have already seen tests in the preceding days. The past four months have produced a value as of the 18th of March, that is hovering slightly above late November and early December 2023 prices.

Friday, 22nd of March, U.K Retail Sales – a negative result of minus -0.3% is expected. The retail data will certainly be watched, but following the massive week of central bank statements and data which have already been published, this number may prove to be rather anti-climatic unless there is a massive surprise.

Friday, 22nd of March, E.U ECB and U.S Fed – Officials from both central banks will engage in a variety of speeches in Europe and the U.S, but again after the week’s worth of central bank rhetoric which has been heard, investors are unlikely to react much to these soundbites from members of the European Central Bank and Federal Reserve. Existing behavioral sentiment which has been produced in the dynamic days beforehand should remain the central theme as investors go into the weekend.