Week Ahead: Summer Begins with Questions Lurking for Traders

Monday, the 19th of June, China Foreign Direct Investment – data from China has been lackluster and last week’s announcement of a stimulus program from the government underscores economic concerns regarding growth.

Monday, the 19th of June, U.S banking holiday – for commemoration of Juneteenth.

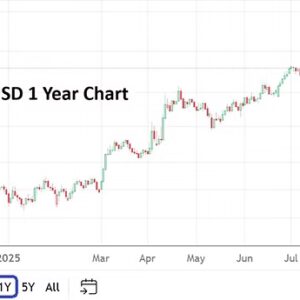

AUD/USD Three Month Chart as of 18th June 2023

Tuesday, the 20th of June, Australia Monetary Policy Meeting Minutes – report from the Reserve Bank of Australia will interest AUD traders and those with an interest in Asian Pacific economics.

Tuesday, the 20th of June, U.S FOMC member John Willliams – as the President of the New York Federal Reserve, Williams, is a key member regarding policy. Taking into consideration last week’s pause, traders may want to pay attention to the New York Fed Presidents’s remarks to see if the pause in Federal Funds Rates seen last week is looked upon as a halt or a ‘skip’ by Williams. The difference between a pause and a skip may appear to be semantics, but a skip would mean an interest rate hike is coming in July. Williams is not going to say what is going to happen at the next Federal Reserve meeting, but he may give a hint regarding his opinion on what should be done.

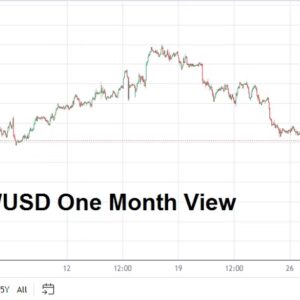

GBP/USD Three Month Chart as of 18th June 2023

Wednesday, the 21st of June, U.K Consumer Price Index – the data will be important regarding inflation insights for Britain. The Bank of England is expected to raise their Official Bank Rate on Thursday by 0.25%. Another report showing stubborn inflation could set the table for a rather hawkish Monetary Policy Statement from the BoE.

Wednesday, the 21st of June, U.S Federal Reserve Chairman Powell testimony – the Fed Chairman will begin two days of speaking and taking questions. The first day will be before the House of Representatives and the second day in front of the Senate. Because a major election is coming in the U.S in 2024, this will be an opportunity for politicians from both sides of the aisle to get airtime and take a ‘stance’ while bludgeoning Jerome Powell. The Fed Chairman’s remarks could stir the markets slightly, but Powell will be as careful as possible not to put a scare into the financial sector.

Thursday, the 22nd of June, U.K Bank of England – the Official Bank Rate, Monetary Policy Summary and vote count from the Monetary Policy Committee will be released. A hike has been widely expected by GBP traders and has been factored into the British Pound already.

Thursday, the 22nd of June, U.S Existing Home Sales – the housing report will cause a few murmurs in the marketplace because it is seen as an extension of consumer health and interest rate policy in the U.S regarding behavioral sentiment. Existing home sales numbers have been dropping as people with homes have decided to stay put in their current residences. ‘Locked in’ interest rates are more attractive, instead of taking on a higher rate via a new purchase due to costlier mortgages because of more expensive borrowing fees.

Friday, the 23rd of June, E.U Manufacturing and Services PMI – the flash reports from the likes of Germany, France and the U.K should be watched. Manufacturing readings have been producing recessionary readings while Services data is expected to show incremental decreases too.

Friday, the 23rd of June, U.S Manufacturing and Services PMI – the flash reports via the Purchasing Managers Index data need to be monitored too from the States. The readings give a rather good insight regarding outlook of U.S business sentiment.