The Fed: Beating a Dead Horse as the Bulls want to Run

Yesterday’s lackluster and underperforming GDP results from the U.S highlights our often discussed doubts surrounding the Federal Reserve. While Jerome Powell definitely has a right to be ‘uncertain’ and express his concerns regarding sudden inflation emerging, he has also proven to be wrong. The Fed should have begun cutting the Federal Funds Rate three months ago.

Although Powell may not be a fan of President Trump, the Fed Chairman and the FOMC has the ability to be more nimble in this era. Instead of being passive about interest rates, the Fed could have lowered borrowing costs and helped spur on the U.S economy months ago instead of watching GDP numbers falter.

For all of the consternation regarding potential tariff pratfalls, the effect from President Trump’s policies have not caused massive inflation. The Fed can begin cutting rates even before the next FOMC meeting in late July, but they will not. In fact, the Fed should now cut the Federal Funds Rate by 0.50% in late July, but again they won’t. We will be lucky to get a 25 point basis cut.

The Federal Reserve remains too passive and acts as if it doesn’t have data technology which can be more proactive. Instead, Fed Chairman Powell chooses to act as if cutting the Fed Funds Rate is an academic exercise and can be done via a polite semester like manner akin to a report card. Dangerously, the U.S is paying an exorbitant amount of interest on long-term Treasuries and short-term Notes. Lower borrowing costs would also help U.S consumers. Jerome Powell doesn’t seem to care about these factors, which raises the consideration regarding his loyalties.

In recent weeks there have been at least two FOMC members who have suggested that interest rates need to be cut sooner rather than later. And there are some financial institutions who are clamoring for aggressive interest rate cuts throughout the calendar year and into 2026 in order to jumpstart the U.S economy, this includes Goldman Sachs and UBS. Signs of evidence that interest rate cuts will develop can be seen in the 10-Year Treasury yields which have been eroding recently. Some may claim this is a false narrative and that it is merely risk premium starting to be discounted. Nevertheless yields have lowered in the past month.

Yes, President Trump speaks loudly and delivers brawling negotiations. July 9th is another deadline for tariff agreements. However, financial institutions and many governments have learned to cope with President Trump’s backstreet tactics, which academics like Jerome Powell are not fond of particularly. U.S stock markets are hovering near highs, but still cautious because they are waiting on impetus from the Federal Reserve.

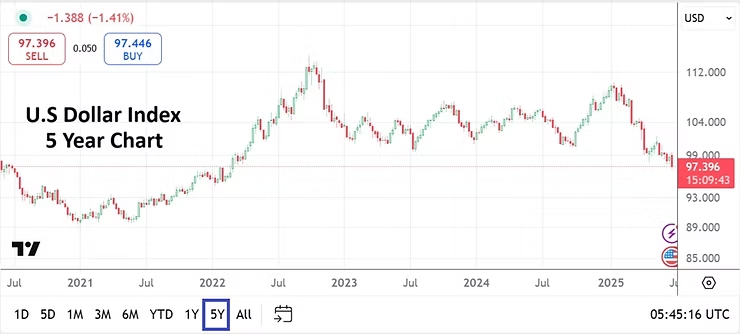

If the Fed fails to deliver an impactful FOMC Statement in late July this will not be greeted well by investors. Many believe the Fed needs to react, and it is quite apparent the S&P 500, Nasdaq 100 and even the Dow 30 are positioning for gates to be opened allowing for a bullish stampede. The USD has been weaker too the past few months as large commercial players anticipate lower U.S borrowing costs. The time for the Fed and Chairman Powell to act is now, making it clear that cuts to the Federal Funds Rate are coming.