Quick Hits: Inflation, USD, China and U.S Trade and WTI

Yesterday’s weaker than anticipated CPI data from the U.S cements the realization that inflation is eroding in the States statistically in a rather consistent fashion. Today’s PPI numbers will be watched, but yesterday’s results clearly show the Federal Reserve has been far too cautious.

Media reported yesterday’s inflation results differently showing bias as some pointed out that inflation rose, compared to some outlets that showed it came in less than expected. Bottom line – inflation has been below expectations consistently and tariff concerns as of yet have not killed the U.S economy with higher prices. The Fed’s insistence on being cautious are comparable to the instincts of an overly protective parent. Day traders need to understand their perceptions are in danger of being affected by folks with confirmation bias.

The EUR/USD climbed above the 1.15000 level again yesterday confirming mid-term outlook for a weaker USD based on the notion the Federal Reserve will have to lower the Federal Funds Rate exists. While perhaps kicking and screaming against their desires to remain hawkish, the Fed will start feeling the heat to act. Next week’s FOMC meeting is unlikely to be the actual date. However, financial institutions have certainly been leaning into a weaker USD since April, and the upwards trajectory in values by major currencies against the USD may prove to be a solid baseline via support prices moving forward.

Certainly, day traders should consider the notion that larger traders have bet against the USD already, thus leaving the door open to the potential of reversals. Yet, mid-term price levels are what financial institutions are gearing their outlooks towards via cash forward transactions for commercial companies. If financial institutions believe the Fed will have to indicate the potential of a rate cut not only in July, but another one in September this could spur on additional USD weakness. Folks should also consider the notion that the White House won’t be against a somewhat weaker USD in order to help U.S manufacturers and producers export.

U.S stock indices didn’t climb on the results of the China tariff news proclaiming a working agreement has been attained over the past two days. Perhaps markets are inclined to believe there will be more fireworks regarding rhetoric from the U.S and China over the coming months – which appears logical given the circumstances between the two nations.

While rare earth metals got the headlines, there appears to be plenty of line items in the tariff negotiations that still must be worked on. The announcement that the deadline has been pushed back again, this time until the 9th of August shows that talks are making progress – but slowly. Red lines keep getting erased.

Financial markets reacted rather passively to the U.S and China news, seemingly indicating larger players are now focused on other matters, and funds have played most of their cards regarding the China and U.S saga via their existing trading positions. Noteworthy, is the fact, the USD/CNY has reacted in a rather correlated fashion with the broad Forex market the past six months. For all the talk about a catastrophe for China and U.S trade, the USD/CYN has behaved quite well, showing the Chinese government is playing a long game against President Trump and doesn’t want to create a huge firefight via currency manipulation accusations.

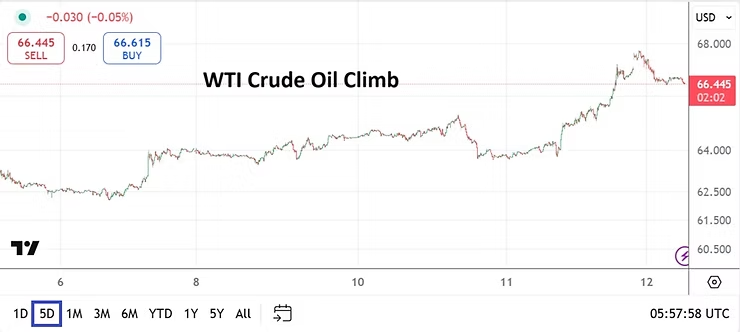

Middle East Escalation: WTI Crude Oil jumped late yesterday as news quickly filtered through social circles of embassy evacuations in various proximities within reach of Iran. The loud whispers certainly caused the price of the commodity to surge to almost $67.75 last night, but this morning’s values suggest some deep breaths have been taken as WTI trades near $66.45.

For options traders who want to buy cheap calls on WTI, they will likely have to look several months out and speculate on military escalation under rather speculative circumstances. If traders want an idea of what larger players are doing in options they can use CME (Chicago Mercantile Exchange) info to get some thoughts on positioning pattens in WTI Crude Oil calls and puts. The call options did get more expensive last night – meaning that some large traders are hedging against the threat of higher WTI Crude Oil prices because they are likely leaning into cheaper oil for the time being, or they are betting on the price of the commodity to rise if chaos breaks out in the Middle East.

Related posts:

Market Trading Risks: Speculative, Anxious Impatient Results

Market Trading Risks: Speculative, Anxious Impatient Results

Market Volatility Shelf Life Doesn’t Have an Expiration Date

Market Volatility Shelf Life Doesn’t Have an Expiration Date

USD/CAD Risk Premium Shifts from Ultra to Prudent Nervousness

USD/CAD Risk Premium Shifts from Ultra to Prudent Nervousness

USD/JPY: Bank of Japan Actually Does its Job: Raises Rate

USD/JPY: Bank of Japan Actually Does its Job: Raises Rate

AMT Top Ten Miscellaneous Remarks for the 14th of July 2024

AMT Top Ten Miscellaneous Remarks for the 14th of July 2024