Digesting Holiday and Markets to Come as Fed Looms Next Week

Day traders trying to gauge markets may be feeling a bit of angst for the moment. Always wanting to participate when record highs are being made in the stock markets, the S&P 500 and Nasdaq 100 remain under their respective apexes from late October and early November. Though the markets have produced gains recently, they have not come particularly easily for those who like to ride momentum waves. As always timeframes matter, it is often easier to make mistakes and be impatient when short-term wagers factor into decision making.

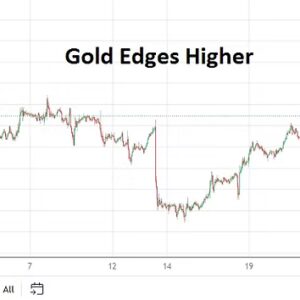

Gold has done well the past couple of weeks, regaining its upwards traction, but also remains under its apex values. The Federal Reserve will release its FOMC interest rate decision on the 10th of December, and this is what many in the markets may be waiting for in order to make their last big bets for the year per speculative plays.

The Forex market like equities and commodities continue to provide choppy behavior. The ISM Manufacturing numbers from the U.S came in below expectations yesterday. Retail Sales data and Consumer Confidence numbers last week from the States came in below expectations too. There will be jobs statistics via the ADP report on Wednesday and an ISM Services figure. Thursday will see U.S weekly Unemployment Claims. Friday will provide a rather interesting clue for Forex traders and likely influence bond yields when the Core PCE Price Index reading is provided – which the Federal Reserve pays quite a bit of attention regarding their interest rate decisions. The Consumer Sentiment Preliminary University of Michigan data will also be seen on Friday.

As Tuesday starts, day traders should also beware that full market volumes will emerge, this after last week’s Thanksgiving holiday in the States and perhaps a slow return to offices yesterday. The markets will provide plenty of action over the next couple of weeks, before the inevitable Christmas and New Year’s trading doldrums begin.