AMT Top Ten Miscellaneous Complexities for the 14th of June

10. International Tech Research: Universities and institutions around the world are developing innovative systems to deliver a quantum future. Cal-Berkeley, MIT, Cambridge, the Barcelona Supercomputing Center, the Institut Polytechnique de Paris, and the Cleveland Clinic are only a few of the places in the ‘West’ that investors should monitor for developments, Asia is also very focused on high speed computing.

9. Musk Schedule: The tech mogul has had a busy week. His Tesla stock option compensation package was approved by shareholders yesterday. In 2018 Musk negotiated a package with Tesla that included a massive compensation agreement via stock options if he met valuation targets over a 10 year period. He achieved the valuation goals within only a few years. Musk also formally dropped his lawsuit against OpenAI and Sam Altman in recent days, this after the enterprise released emails showing Musk backed OpenAI’s pursuit of profits in the past. Around 2015 Musk invested about 45 million USD into OpenAI.

8. Muted Data: The U.S Consumer Sentiment and Inflation Expectations numbers will be released today via the University of Michigan. However these numbers are likely not going to impact financial assets in the U.S. The Fed and CPI results from the States published this past Wednesday will dominate the investing narrative. Searching for meaning regarding why assets move in a particular direction is the media’s job, but perceived realities always remain open to complex interpretations as real time prices are exhibited. Day traders need to be cautious of revisionist history.

7. Petrol Dollar: Saudi Arabia has not reconfirmed its commitment to transact Crude Oil exports with USD. The formal agreement reached in 1974 has expired. Forex traders should not panic about this development yet. Speculators should note that Saudi Arabia is likely to still demand most of their payments in USD since they can count on the valuation of the currency to remain relatively tranquil compared to other instruments like China’s Yuan. What the absence of an agreement between the U.S and Saudi Arabia does indicate unfortunately, is that U.S foreign policy continues to look vulnerable.

6. Optimism: A South Africa government coalition agreement could be formalized soon and create a better economic outlook for the nation. While geo-political concerns remain, and the ANC is not a 100% friendly philosophical match with the Democratic Alliance and some of the other political parties which will be involved, it appears a working agreement can be reached. The question in South Africa is if transparent fiscal and anti-corruption mandates can be accomplished while diverse political outlooks will be heard and demanded from different factions. For the moment, financial institutions seem to like what they are hearing and the USD/ZAR has edged lower in the past week.

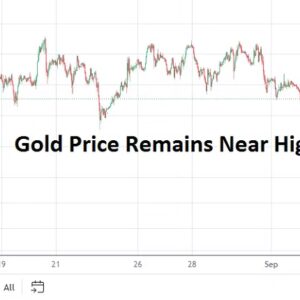

5. Highly Valued: Gold is over 2300.00, BTC/USD is near 67,000, and Cocoa is within sight of 11,000. Speculative large players remain active, and traders looking to take advantage of short and near-term fluctuations in these commodities need to remain vigilant. Cocoa, while extremely dangerous to trade, has outperformed gold and Bitcoin recently. Investors in gold think long-term, and Bitcoin influencers preach ‘hold on for dear life’ as non-believers shake their heads in disagreement. However, daily gyrations influenced by large players can still wreck havoc on those looking for short-term wagering opportunities.

4. Zombie Fed: Cautiously optimistic undertones were served from Jerome Powell as expected this past Wednesday, but intriguingly Powell admitted some government data remains open for interpretation, particularly the suspiciously strong headline jobs numbers which are being questioned. The Fed now says its outlook is for one interest rate cut this year. Financial institutions likely believe the Fed remains too reactive. The U.S GDP has shown signs of struggling, and CPI numbers have begun to erode. Crude Oil prices remain under 80.00 USD. However, the Fed seems intent on still pumping the brakes in order to kill off inflation via the high Federal Funds Rate. It would help if the U.S govt stopped spending cash recklessly, and the U.S Treasury stopped printing money.

3. Equities: U.S political concerns as the election approaches will create more analysis paralysis than normal. Short-term behavioral sentiment may sound nervous, but a bullish trend and risk appetite remain evident. Day traders may be able to take advantage of technical trading via support and resistance in CFDs, but fundamentally financial institutions appear inclined to count on equity indices achieving record highs.

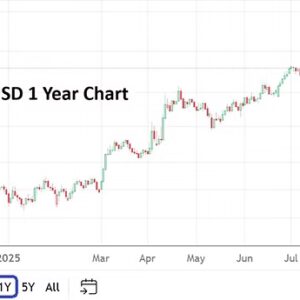

2. 157.000 – 158.000: Today’s BoJ decision to remain stuck in the mud has created more financial institutional dismay in some quarters, and the the Japanese Yen will be punished occasionally against the USD. But the folks at the BoJ are not stupid and likely anticipated the USD/JPY move higher which ensued. The BoJ is obviously preserving its ‘soft devaluation’ of the JPY in order to maintain an export advantage for the U.S and European consumer markets. The question is if and when the BoJ will buy billions worth of JPY in order to punish bullish USD/JPY Forex speculators occasionally.

1. Volatile Near-Term: EUR/USD and GBP/USD price action has been boiling. France and the U.K have crucial elections in the coming weeks, after policies in both nations have led to a lack of confidence in the ruling governments. The ruckus outcome from the E.U Parliament voting have created an intriguing complication. Oddly enough, the U.K may be the left’s torch bearer in the coming year, while other European nations drift towards the right. Can centrists create a middle ground? Volatility and the search for equilibrium via financial institutions may create a lot of opportunities for Forex day traders in the coming weeks in the EUR/USD and GBP/USD as reversals and trends are sought.