Significant Highs All Around as Speculation Grows Frothy

Gold, platinum, and the major U.S indices are all flirting with record values. Fast trading is being seen on all fronts, dangerous reversals are also being displayed and causing harm for day traders. The U.S government shutdown remains in full force. Not enough pain has been heard from the U.S public yet which would make politicians pause and actually try to negotiate a deal.

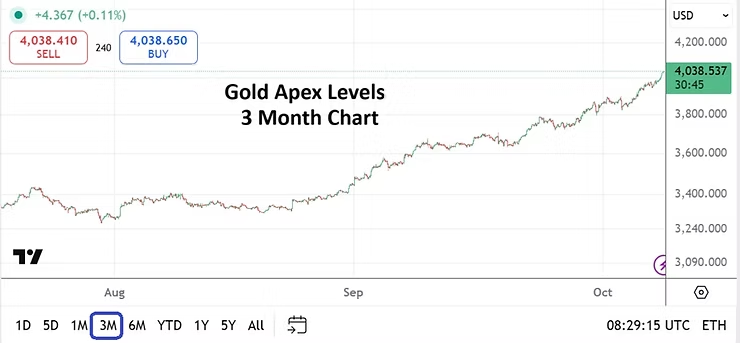

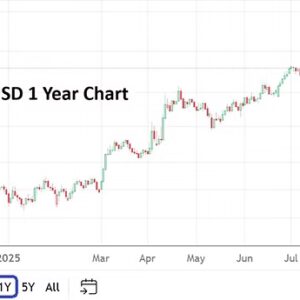

Milestone apex values have been experienced. Gold has produced the 4,000.00 USD per ounce level and sustained value, the Nasdaq 100 toppled 25,000.00 the past two days, but has moved lower for the moment. Conditions for day traders are swift and they need to be careful. And while the U.S government is shuttered, the Federal Reserve is still expected to announce their FOMC interest rate decision on the 29th of October. A Federal Funds Rate cut of 25 basis points is still anticipated.

Forex has seen jittery results as the EUR, GBP, JPY have struggled in recent trading versus the USD. And while some people may point to the stellar results and values within Gold and Bitcoin as evidence for safe haven wagers being placed, large speculators are playing a key ingredient in the broad markets too. Investors are certainly looking for value and have a belief that buying now represents a discount compared to what Gold and equity values will be over the long-term. However, day traders should also remember that a large amount of influence in the markets derives via behavioral sentiment, and as record highs are being challenged anxiousness grows regarding potential responses from speculative forces particularly when profit taking remains a part of wagering.

While questions and concerns are heard about a possible AI bubble being experienced and too much money being invested in equities like Nvidia, Oracle, Microsoft, etc., folks need to understand long-term investors are gearing their portfolios towards outlooks. Betting on these companies playing a significant role in technological advancements is a long-term viewpoint which works on optimism. Artificial intelligence is important, but the motor that runs AI infrastructure via semiconductors, big data distribution, servers and cybersecurity are crucial. The promise of quantum computing is also experiencing a surge of investment because of a belief in the future.

And that is what day traders who are tempted to bet against the trends in the marketplace need to remember. Investors will not bet against Wall Street because of the government shutdown. In fact, they will certainly be heard joking that corporations run more effectively with less government intrusion.

This is not a simple puzzle. Complexity certainly needs to be considered regarding valuations in the EUR/USD, GBP/USD and USD/JPY. Intriguingly, day traders may want to take a look at the South African Rand too, because technically it continues to be strong against the USD, which is rather out of step and a rather interesting non-correlation. The broad Forex market has lost some its luster for day traders the past year because of a lack of perceived volatility across the board. But volatility may be on the way, the Japanese Yen certainly stands out and should be watched via the USD/JPY and JPY crosses in the coming days and weeks.