AMT Top Ten Miscellaneous Wonders for the 12th of April 2024

10. Free Press: Brazil and the Lula de Silva government are cracking down on dissent in social media. ‘X’ – formerly Twitter – led by Elon Musk is fighting back and refusing to cooperate as Brazilian ‘leadership’ attempts to intimidate the ‘loyal opposition’ in the legislature.

9. GROOT: Nvidia is working on ‘humanoid’ robotics. Project GROOT was presented by Jensen Huang at the GTC Conference. The synergy between machine learning, semiconductors and robotics is an evolution taking place before our eyes. Tesla is involved in similar research as it works on Optimus.

8. Hot Chocolate: Speculation in Cocoa has brought the commodity above 10,400.00 USD per metric ton as of this writing. Questions about gravity and hypersonic speculative values are logical at this juncture.

7. Seclusion: Do humans still need each other? People are relying on their mobile devices for social interactions. Robotics with AI capabilities will make our existence potentially more lonely. Open source software DOBB-E will be part of this future as household chores are taken care of by ‘machines’.

6. Iran: Those with holiday excursion plans which include Teheran this weekend may need to check on ticket availability due to the possibility of flight cancellations.

5. Fed Liberty: President Joe Biden this week spoke about an interest rate cut coming from the Federal Reserve this year, yet Consumer Price Index statistics are demonstrating escalating expenses. Current U.S government leaders may want to spend less on ‘vote buying’ via student loan forgiveness and think about conservative fiscal practices. Why should Americans who choose not to attend universities pay for those who did via higher taxes? Are Fed and Treasury officials still independent?

4. Risk Averse: Gold is within sight of 2,400.00 USD this morning. In the meantime U.S bond yields have inverted completely except for the 30-Year issue. Financial institutions are showing nervous behavioral sentiment.

3. USD Centric: Forex has seen reactive trading this week as financial institutions begin to conclude the U.S Federal Reserve’s monetary policy ‘over time’ will remain disturbingly difficult and full of doublespeak.

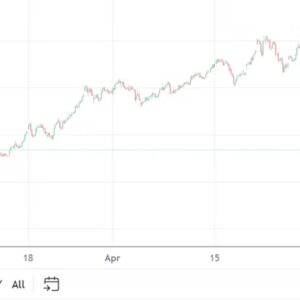

2. Caution: Mixed results are flourishing in the major U.S stock indices as the Nasdaq 100 and S&P 500 touch late March values, and the Dow Jones 30 has returned to February levels. Higher than anticipated interest rates are causing turbulence.

1. Energy Illusions: As the prices of food, transportation and housing escalates isn’t it time governments start to question their ‘green’ policies which are making the costs of energy production more expensive? We all want a clean planet, but logical strategies must be applied to create efficient use of resources.