Central Banks Noise: Holiday Trading Put on Hold For a Bit

As suspected the Federal Reserve sounded more cautious than many analysts expected yesterday. While the Fed did cut the Federal Funds Rate by 0.25 to 4.50%, they essentially opened the door to allowing the current borrowing rate to simmer over the mid-term. Yes, they did suggest they would like to lower interest rates, but it sounded more like wishful thinking. In response to the more aggressive rhetoric (hawkish) from the Federal Reserve financial markets became volatile in equities, Forex and bonds.

The show is not over yet ladies and gentlemen, this morning the Bank of Japan repeated their typical historic stance of proving cautious, and later today the Bank of England will step onto centerstage with their Monetary Policy Summary and Official Bank Rate. And here is where things may get more odd, the BoE in many circles is not expected to cut its interest rate even though the U.K economy has been struggling and continues to publish lackluster statistics. The current borrowing rate via the Bank of England stands at 4.75%. Though the BoE should consider a rate cut of 0.25 certainly, and may even have enough reasons to decrease by 0.50, they may do absolutely nothing and that would be a mistake.

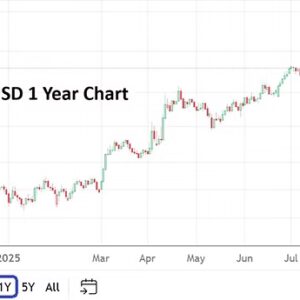

If the BoE decides to remain overtly guarded this will cause some bedlam with the GBP/USD. Large commercial players may choose to punish the GBP/USD as they consider their cash forward positions. Retail traders should be extremely careful if they choose to speculate on the British Pound in the coming hours. Not to say the GBP/USD is going to have a Liz Truss like moment from September 2022 today, but Forex traders have been selling the currency pair based on nervous outlooks over the past three months. If the Bank of England looks at the incoming headlights via the GBP/USD bearish trend and does not move, they might get run over by the truck.

Big and small traders certainly have the approaching holiday season on their minds and they might be getting things in order to take a break for the next couple of weeks, but financial markets because of the central banks actions yesterday and today will not allow for comfortable thoughts. And this is important, because some financial institutions are shuttering for the long holiday starting this Friday, they may be more prone to being quite cautious going into a period where trading volumes will light and assets will be exposed to the potential of sudden gyrations caused by large positions being placed in unbalanced markets. In other words, equities, Forex and bonds will be dangerous today and tomorrow. Behavioral sentiment will be the power.