Fed Plays Catch Up and Sets a Calm Table for Day Traders

The Fed essentially played a game of catch up on Wednesday when they cut the Federal Funds Rate by 0.50%. The interest rate cut was bigger than AMT expected because of the Fed’s rather cautious stance the past handful of years. However, the move by the FOMC was certainly justified and welcomed, and now financial institutions have been given what most thought was bound to happen, a roadmap to at least a 0.75% Federal Funds Rate cut over the next six months. Longer term many believe the Fed will continue to be aggressively dovish if U.S economic conditions cooperate.

Traders certainly seem to be leaning into the notion another 0.25% will be trimmed by the Federal Reserve in November. And this sets the table for day traders to now face potentially calmer market conditions that react solely to economic data, geopolitical events and the occasional flashes of news. The U.S presidential election will certainly be a big event on the 5th of November. Long-term investors are likely feeling rather tranquil and have not been surprised. Behavioral sentiment over the next month should be easier to gauge.

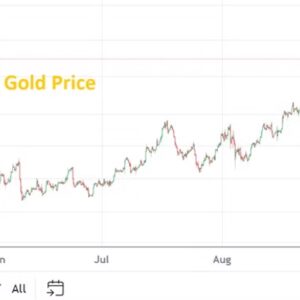

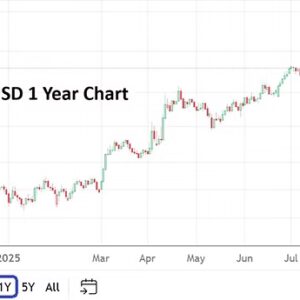

So what happens near-term? The Bank of Japan today, like the BoE yesterday, stood in place. The USD/JPY is trading near 142.300 as of this writing. The GBP/USD is near 1.32890. Gold is hovering near 2,600.00 and WTI Crude Oil is approximately 72.00 USD. Perhaps short-term traders should keep one eye on the Middle East this weekend, but for the moment it doesn’t appear a major escalation is about to ignite in the region. Yes, there is saber rattling, but composure may actually prevail. Those looking for a sudden emergence of a strong USD trend may find that headwinds keep the greenback within the lower realms of the USD Cash Index.

Next week’s U.S GDP numbers on Thursday the 26th, and the Core PCE Price Index results on Friday the 27th will get plenty of attention. What the Fed and financial institutions would like to see are stable economic numbers which do not spark fears of a recession. The almighty ‘soft landing’ being pursued by the Federal Reserve is likely being hoped for too by financial institutions via their mid-term outlooks.

The Federal Reserve is supposed to be an independent entity not associated with the Executive Branch of the U.S government regarding oversight. There has been some bantering about the potential that the Fed cut by 0.50% before the U.S elections and Powell proclaimed the U.S economy is doing well to help the Democrats, but this is unlikely. Conspiracy thinking aside, the broad markets are now going to be a barometer regarding economic outlook based on data such as growth, jobs numbers and inflation; clarity regarding a more dovish Fed has been delivered in many respects, data has to justify their decision moving forward.

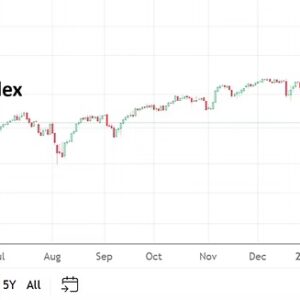

Day traders may have the ability to follow their technical charts and gather behavioral sentiment perspectives over the next month serenely by watching barometers like gold and U.S Treasury yields. As the U.S election draws closer financial institutions may start to position for potential outcomes, but with polls indicating a tight race currently they would be foolish to bet on one particular outcome. Meaning the broad markets including equity indices, Forex, U.S Treasury yields and even commodities may be moving within fairly priced equilibriums for the moment.

As the Dow 30 and S&P 500 move within record heights, the Nasdaq 100 is slightly below its all-time highs. Yet, it should be remembered the Nasdaq 100 still has done remarkably well the past year and although not at an apex level has the potential to scale upwards quickly. Optimism for the moment seems to be driving the financial markets and day traders should keep this in mind. However, speculators should remember risk management is essential, not over leveraging ideal, and keeping realistic price targets remains always important.