Forex Noise: Influences from Suspicious Data and Rhetoric

Yesterday’s GDP numbers from Japan served as evidence regarding things to be considered this week regarding the rather complex web central banks and governments have created for financial institutions and day traders. There are plenty of risk events ahead that should be given attention this week.

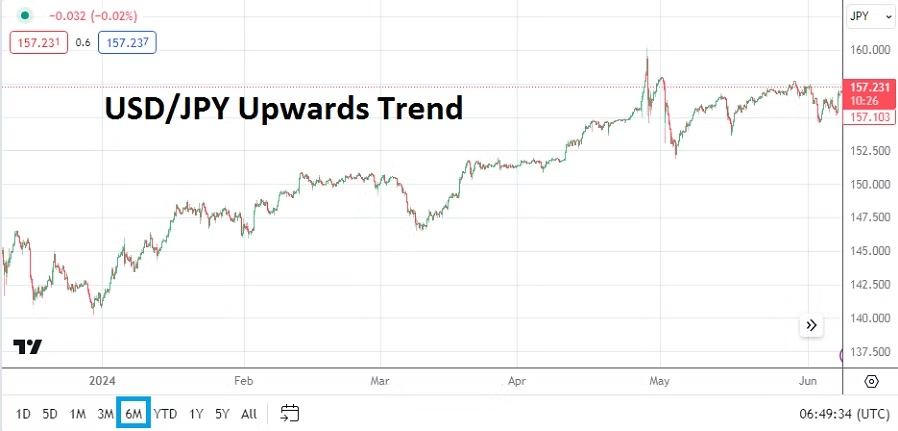

The USDJPY is now again in a dangerous value range near-term as it battles within a higher trend. The BoJ did intervene twice – in late April and early May – to try and damper speculative buying zeal of the USD/JPY and stop overly exuberant selling of the JPY. But they have been acting duplicitous as they have also wanted to no doubt allow a weaker Yen – while keeping its value within control. The BoJ has likely been hoping the Fed is going to sound more dovish this week, but if the Fed sounds more cautious than had been anticipated it could set the table for remarkably dynamic price action in the USD/JPY this week and next. If the currency pair moves too high, the BoJ could intervene again, particularly after the Fed’s FOMC pronouncements. So traders need to be careful.

Traders likely know that tomorrow CPI data and the Fed are on the schedule and these will be key events, but the noise generated around the inflation statistics and FOMC rhetoric should be viewed through the eyes of not only potential reactions from financial institution behavioral sentiment, but the possibility many of the ‘big houses’ have already positioned for the outcomes they believe will play out. In other words day traders should be ready for whipsaw trading results in the immediate aftermath of the Fed’s FOMC Statement and Press Conference.

Last week’s Non-Farm Employment Change numbers provided intriguing forensic data which will stir the suspicions of large players in Forex, equity indices and Treasuries. The jobs numbers via the headline stats looked strong. However, it must be said U.S government hiring continues to pick up, which can be looked at as an expensive way to fuel a sugar high for Americans as the States go into an election season.

Also full time workers continue to add part-time work to their tasks, this to battle rising inflation no doubt which is making their paychecks actually less effective, even if they are getting raises and receiving extra money from the added work loads they are taking on. The costs of products in the U.S are outpacing rising income. Also there is a fact that while part-term hiring is on the rise, full-time hiring is declining along with the average amount of hours employees are working per week.

The Gross Domestic Product numbers from the U.S are in decline. If folks push aside their political ideologies and look at real job numbers on the back pages of Friday’s report, and then ask why people are working less hours it is easy to conclude many businesses are actually cutting back expenses in order to try and remain profitable.

All three major stock indices from the U.S remain in sight of record highs, while there is caution surrounding the mid-term, investors still seem to be banking (wagering) on the U.S Fed to become more dovish over the long-term. Part of this analysis includes the belief that weaker GDP will eventually start to impact inflation and that this conclusion will affect the decision making of the U.S Federal Reserve at some juncture.

The Fed finds itself in a precarious position right now. They need to sound cautiously optimistic. It is an election year and they know this too. The Fed cannot publicly say they want growth to slow down because that would irritate most Americans and the White House, but they know full well that slowing GDP eventually should lower demand for products and thus erode inflation pressures.

Yet turning this full circle, the hiring being done by the U.S government, and the as of yet unmentioned fact the U.S Treasury has increased its sales of Two Year Notes since around November; and the record amount of money the U.S is spending via a slew of suspicious costs like the ‘student loan forgiveness’, creates a muddled and over-heated fiscal policy which could be interpreted as trying to buy votes from those receiving the gifts. In other words, while the Fed is trying to stress it is battling inflation with higher interest rates and anticipates lowering them eventually, other facets of the U.S government are making this difficult because of the record amount of spending and interest rate payments they are making on short term Treasury notes. Jobs and money in the short-term are candy for voters, but the government has problems ahead regarding conflicting policies because it can lead to more economic problems.

So what do financial institutions think, well they are focused on returns for their clients. They are also looking ahead and trying to swim waters that are murky but offer the ability to profit for themselves too. They might believe they know the landscape just as well as the Fed does, and financial institutions also understand what will be said and can be done may be two different things. What to expect moving forward therefore remains confusing over the mid-term for everyone.

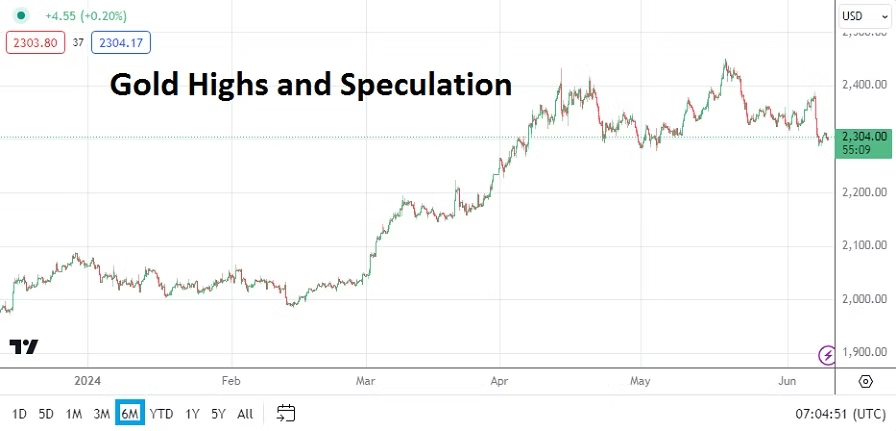

Gold remains highly valued and traders should continue to use it as a barometer. Speculative players are also betting on gold as the USD and its ultimate mid and long-term direction remains complex. The recent downside price action after making record highs in May for the precious metal could reflect the belief the USD is going to become weaker over the mid-term.

Also it should be noted that a handful of commodities are being influenced by an abundance of speculative forces in Copper, Coffee and Cocoa. There has been a lot of talk surrounding the meme stock GameStop the past month. Experienced commodity traders understand the dynamics of speculative influences, pump and dump schemes better than most. Traders tempted to wager in these commodities should ask the same questions speculators in GameStop need to, what is the real value and when will the pin pop the balloon?

Monday, 10th of June, Japan Final GDP Price Index – the result in yesterday’s inflation data came in negative with a climb of 3.4% compared to the expected outcome of 3.6%. This is noteworthy might create more cautious rhetoric from the Bank of Japan later this week.

Wednesday – 12th of June, U.S Consumer Price Index – the inflation reports will be watched by all market participants in the financial world. The broad monthly CPI result is expected to come in at 0.1%, which would be below the previous months’s outcome, but the Core monthly statistic is anticipated to match the previous result of 0.3%. The CPI numbers will certainly set the tone for the price action to come in Treasuries, equity indices and Forex. Weaker numbers could spark a selloff of the USD. Stronger numbers could create more bullish ability in the USD. No matter the outcome of these CPI numbers, the U.S Federal Reserve will be standing in the shadows and ready to take center stage a handful of hours later.

Wednesday – 12th of June – U.S Federal Reserve’s FOMC Statement and Federal Funds Rate – unless there is a massive surprise tomorrow, there will be no interest rate cut from the Fed. Anyone who was holding onto the idea of a cut, had these wrong thoughts killed off this past Friday because of the ‘better’ jobs numbers report. The Fed’s monetary policy statement is likely to try and sound cautiously optimistic and will certainly include the residuals of the CPI reports filed earlier in the day. However, financial institutions will want to hear if the Fed is leaning into the notion of cutting the Fed Funds Rate late in the summer as a possibility, or if the Fed sounds so cautious that they suggest a rate cut will not happen until later this year. Let’s remember this is an election year. Yes, the Fed is supposed to be an independent body, but like the Treasury there have been signs developing that the ironclad independence of Fed rhetoric can be influenced by U.S government influences from higher up the ladder. Or perhaps it is just all a happy coincidence and the White House, Treasury and Fed all simply agree on policies which remains rather questionable in the eyes of financial institutions and analysts.

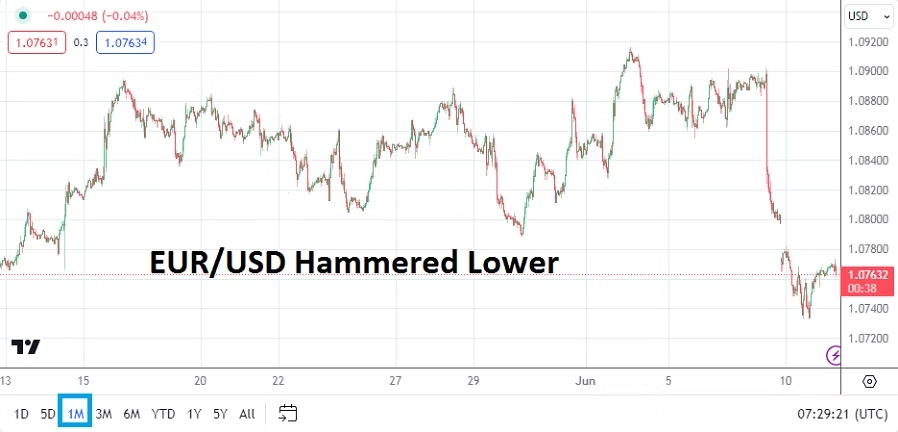

EUR/USD Consideration into Wednesday

On this note, price action in the EUR/USD is a good representative of behavioral sentiment and the different ways it can be interpreted. EUR/USD will need attention during and after the U.S Federal Reserves’s policy rhetoric. The ECB cut its interest rate last week. However the ECB refused to say it will cut rates more – leaving the EUR/USD in a neutral position. The EUR/USD sold off on Monday, this after selling off strongly this past Friday after the U.S jobs numbers.

The Fed was looked on as having to become more dovish this Wednesday, but that is now in question because of the suspiciously strong U.S jobs numbers this past Friday. And then there is the outcome of the European Parliament voting this past weekend and a turn towards the right which many in the media seem to believe is the end of the democracy, but may simply represent that some citizens of Europe want a return to law and order, solid economic practices, and respect for their historical and cultural heritage.

Meaning that financial institutions aren’t likely to be too scared about the voting outcomes regarding the European Parliament and are likely more focused on the coming U.S inflation report and FOMC meeting results. However, as much as Forex traders are considered to be sophisticated and financially astute, they still reacted to the stronger selling which was sparked yesterday. Perhaps the EUR/USD results the past couple of days will prove to be like the reaction in the India markets, this when the Nifty 50 selloff occurred early last week upon election results being in question, only to experience a reversal later.

Thursday, 13th of June, U.S Producer Price Index – these inflation reports will be watched, but the reaction to the outcome is likely to be muted because of Wednesday’s dynamics from the U.S and behavioral sentiment which will have already been stirred.

Friday, 14th of June, Bank of Japan – the BoJ is expected to keep its Policy Rate at 0.10%. The BoJ will certainly have been paying attention to the USD/JPY this week, this before they make their public announcements. The Bank of Japan like the Fed is in a difficult spot. The BoJ is trying to fuel a stronger Japanese economy with a weaker Japanese Yen, while trying to sound vigilant in order to stop speculative buyers of the USD/JPY who are trying to take advantage of the trend higher. The threat of intervention should be a concern for day traders, even though the BoJ likely doesn’t want to take this avenue because it is costly and they know the only real way to make the Japanese Yen stronger is by increasing the BoJ Policy Rate which they seemingly do not want to do for the moment.