India Insider: Why a Deep Corporate Bond Market is Needed

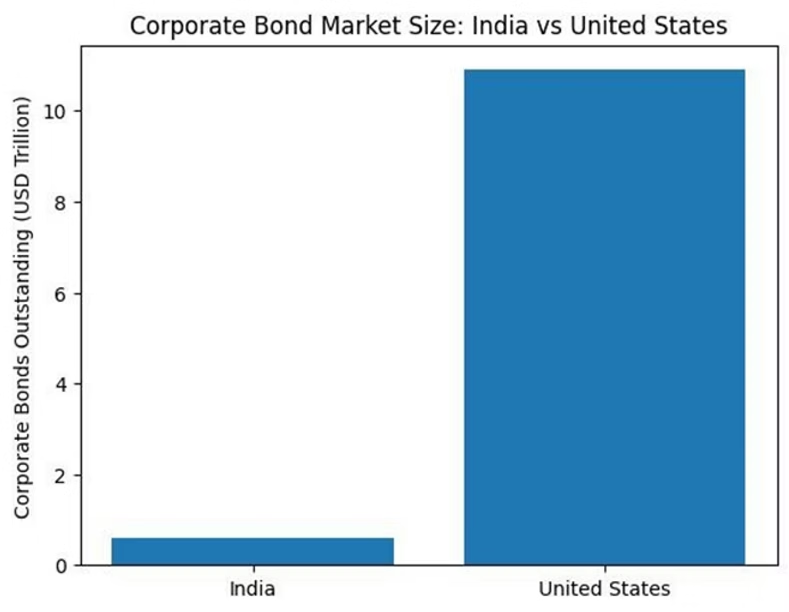

India’s corporate bond market remains small relative to the size and ambitions of its economy. This is often described as a regulatory shortcoming. In reality, it reflects a deeper structural choice: India’s financial system was built to channel savings through banks, not markets. That choice now imposes visible constraints on capital formation, governance, and risk pricing.

During the Covid-19 pandemic, several Indian companies including firms such as Arvind Fashions were forced to raise capital by diluting their equity in public markets. Equity issuance is not inherently wrong, especially during a crisis. However, businesses built on consumer brands, distribution networks, and long gestation cycles require patient, long term capital. Financing such models primarily through short term bank loans or repeated equity dilution creates a mismatch between the nature of the business and the nature of the capital supporting it.

In countries like the U.S, this gap is filled by intermediate forms of capital. Private equity firms often provide long duration funding through instruments such as mezzanine debt, while deep corporate bond markets allow companies to raise long term money aligned with their operating horizons. In India, the absence of such markets make corporate choose to either raise capital via short term debt that strains cash flows or equity dilution at unfavorable points in the cycle.

A corporate bond market also serves a broader purpose: governance and accountability. A Parliamentary Standing Committee report in 2022 noted that nearly ₹10 lakh crore ($110 Billion USD) of corporate bank loans were written off over the preceding five years. While write-offs do not automatically imply wrongdoing, they highlight a system in which credit losses are repeatedly absorbed by public sector balance sheets where the capital is often infused by taxpayers money. In bank dominated systems, credit assessment is periodic and opaque. Market discipline remains weak.

Traded securities impose a different standard. Michael Milken once observed that bond markets re-evaluate credit daily, not every six months. Prices respond immediately to new information. If sellers suddenly outnumber buyers, the market forces a reassessment of risk in real time. In effect, every trading day becomes a fresh credit decision.

This discipline is missing when loans remain locked within banks. A vibrant corporate bond market which is supported by securitization, secondary-market liquidity, and institutional investors would allow credit risk to be priced, transferred, and monitored continuously. It would expose stress early, rather than after losses have already been socialized.

Today, banks account for nearly 70 percent of financial intermediation in India. Fintech has begun to challenge this dominance, but largely in consumer and personal finance. For corporate and MSME (Micro, Small and Medium Enterprises) financing, long-term capital cannot come from apps or short duration loans, it must come from markets designed to price risk over time.

India’s corporate bond market will not look like America’s, nor does it need to. But without deeper liquidity, institutional participation, and price discovery, India will continue to build long term businesses on short-term money ,and bear the consequences when cycles turn.

(Notes: 1 USD = 90.58)