MicroStrategy and Bitcoin: Will They Turn into Smithereens?

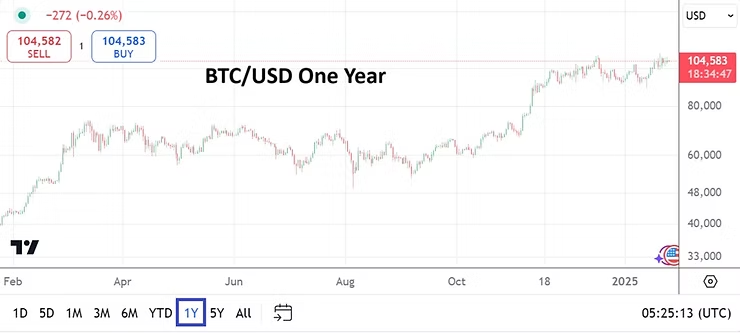

MicroStrategy near 353.67 per yesterday’s close. Bitcoin around $104,625 this morning. Will the balloons keep inflating or become smithereens? The combo of MSTR and BTC/USD are combustible.

MarketWatch has published an excellent article on the borrowing via bonds that MicroStrategy is undertaking with investors. https://www.marketwatch.com/story/why-investors-are-lending-microstrategy-billions-of-dollars-at-0-interest-so-it-can-buy-bitcoin-03f7cacf The article highlights the red hot glow that some investors are pursuing via bets on MicroStrategy and Bitcoin.

MSTR has turned from a data driven company that produces revenue into a proxy bet on Bitcoin. Not everyone is a fan. As of late November 2024 Citron Capital has been reported to be ‘shorting’ MicroStrategy.

Students intrigued by the art of speculation, finance and business outlook have an active case study via MicroStrategy. This is a saga which will continue to grow in stature as investors and speculators seek profits. While the potential for disaster remains high, Michael Saylor of MicroStrategy and his cult like leadership capabilities has led his flock of believers into a golden land for now, but what storms await?

Naysayers of MicroStrategy’s foray into Bitcoin have thus far been proven wrong. Michael Saylor and his legions will continue singing praises about Bitcoin and its ability to turn into the modern version of gold, but perhaps it will turn into a digital asset nightmare. However, there is no denying the strength of the trend which has manifested the past year in both MSTR and BTC/USD. With the advent of President Trump and his seemingly pro digital asset stance being taken; and the growing desire by some crowds to turn fiat currencies which have been paper based into Central Bank Digital Currencies (CBDC) there are likely years left in this saga to unfold.

There has been a growing clamor for central banks to start holding some of their reserves in Bitcoin instead of gold, but for the moment this seems like too wild a thought and a purely speculative notion. Wagering on the confidence generated by digital hype with little intrinsic value, except the ability to create hot air via rhetoric and lofty visions of grandeur still appears to a step too far for most central bankers. Speculating on MicroStrategy and Bitcoin is one of the ultimate bets looking to take advantage of behavioral sentiment in the digital asset realm. MSTR and BTC/USD are highly volatile and have certainly created profits, but the combination could also turn into a horror if things go wrong.