Return to Normal Market Conditions and a Trump Outlook

Retail speculators can now expect a return to calm and clear financial market outlooks, knowing that potential influences from new U.S policies will start to be considered. With the U.S elections in the rear view mirror and a Trump mandate delivered by many U.S voters, global financial institutions and traders will again be able to focus on a combination of technical perspectives, current behavioral sentiment and outlook.

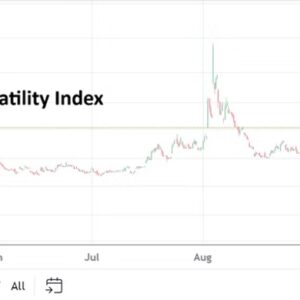

Some technical traders may believe behavioral sentiment has nothing to do with the long-term prospects of studying charts, but price action last week in FX and equities clearly showed why traders must be attuned to storms created by human emotions. Risk adverse trading has been prevalent since the end of September. A glance at the six month USD Cash Index demonstrates the extent of behavioral sentiment causing volatility the past handful of months. After believing the U.S Federal Reserve was going to become dovish which propelled the USD lower in many Forex pairs in early July, financial institutions expressed concerns about political outlook the past handful of weeks as a lack of clarity started to shroud their perspectives. USD centric positions have powered Forex.

And now that there is a Trump administration coming, and the U.S Fed has remained cautiously dovish this past Thursday, financial institutions may exhale with relief. The election on November the 5th has delivered a clear message regarding the potential for changes to U.S administration mandates regarding trade. Whether a stronger U.S economy is attained because of these hopes is not the question, it is the perception new policies will be initiated which try to deliver results which have been promised. Yes, promises can be broken.

However, the ability to believe changes are coming will affect behavioral sentiment. The Trump soundbites may prove to be rather weak in the future, but there is a chance he will also get things done regarding stronger trade agreements which protect U.S business enterprise and manufacturing. Folks can argue until they are blue in the face regarding the prospects of all things, but the U.S major equity indices rising like a rocket ride in the middle of last week is clear evidence that many believe the prospects for U.S corporations is better. No matter if it is only hopes about tax laws changing, less regulation, and better U.S trade agreements, investors are clearly betting on optimistic outlooks for the mid-term.

Improved attitudes are great for the prospect of financial institutions, but traders still have to certainly protect their positions against volatility developing. Markets should start to return to tranquil conditions in the days ahead. U.S data will come this week which will be important via the CPI numbers on Wednesday and PPI figures this Thursday – the combination of these inflation reports will be important. Friday will see Retail Sales from the States.

The return to data as a guideline for financial institutions teamed with the Fed’s rate cut this past Thursday may be an ointment for retail traders who seek a return to normal conditions. Nervous behavioral sentiment could remain a factor in the coming days as people adjust their outlooks to a Trump White House, but the coming week should be relatively quiet regarding surprises.

It isn’t a question of liking or disliking the outcome of the U.S election, it is a question about how behavioral sentiment will now be affected. While some bring up potential tariffs as a major risk for the U.S and global economy, we have been down this road before with Trump. The risk of inflation if trade disagreements flourish should be taken seriously, but Trump has dealt with China in the past and both sides did find a way to do business in many respects. China is probably worried about Trump being in the White House again, but they likely have a gameplan for the tough business discussions ahead. The experience of having dealt with President Trump before allows China and others to know what they may face this time and empower them to be prepared.

It should be noted that Trump has shown in the past a tendency to enter negotiations with a difficult offer and permitting the other side to counter. Trump then might turn down a proposal, but often shows he is open to discussing things further and reaching a compromise. And that is the crucial word – compromise. It is about business and geopolitics. Financial institutions have dealt with a Trump White House before. This time around there is a hope Trump’s naming of a White House cabinet will not be as messy an affair as it was the first time.

The naming of Susie Wiles as the White House Chief of Staff last week looks like a good first step, also having strong Republican leadership in the Senate and House of Representatives may make things easier. While some are worried about a slew of loud rhetorical stances by Trump, perhaps pragmaticism will be practiced. And based on that rather optimistic viewpoint, retail traders may also feel businesslike conditions are ahead and that the financial markets will be a safer place to pursue speculative wagers again in the near and mid-term.