Tranquility: Forex, Equities and Treasury Yields Drama-Free

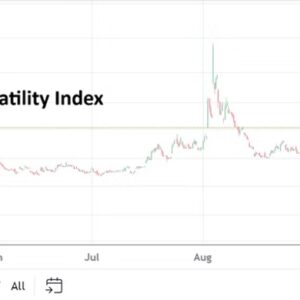

Sometimes no news is welcome. The markets though not devoid of drama, have been relatively tranquil. It is obviously summer in the northern hemisphere which helps bring about quiet, this since many ‘active’ market participants are off vacationing having been allowed to go on holiday. The implosion in the markets on the 5th of August after the dangerous riptides created by the combination of the Federal Reserve and Bank of Japan have certainly eased and evidence of the chaos is fading. Retail traders who are always looking at charts and for opportunities may have even been able to rest too the past week and a half.

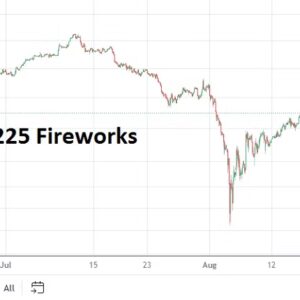

The USD/JPY as of this moment is near 147.185. The Nikkei 225 has recovered lost ground from over-reactive selling on the 5th of August. The value of the Japanese equity index is within extremely intriguing territory as financial institutions are clearly taking a wait and see approach regarding more BoJ and Fed rhetoric, combined with fundamental analysis of Japan’s economy and their companies in consideration. It is a healthy market dynamic, particularly via a notion the Nikkei 225 having reached an early August equilibrium is a solid result, this if you have a long-term viewpoint.

The GBP/USD, EUR/USD, USD/SGD have all seen better results for traders who have been wagering on USD centric weakness. Even the USD/ZAR has produced a solid trajectory. U.S Treasuries yields are falling.

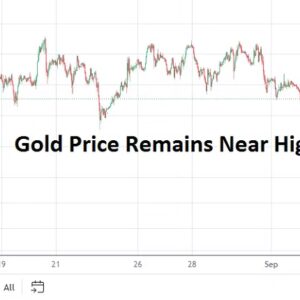

Yes, day traders definitely have different approaches compared to long-term investors, but if a speculator who is accustomed to quick trades synthesizes an outlook using the behavioral sentiment of long-term institutional players, they might find it helps build some foundations which help perceptions when deciding what to pursue. The use of barometers is always good too, this often gives a trader insights regarding market mood even if it is not an asset class they want to pursue. Gold is within record territory as it hovers around 2,500.00 USD per ounce.

Investors can argue all day and night about interpretations regarding results. The trading within gold the past six months, even since November of 2022 opens doors to a vast amount of complex explanations and narratives. They are too numerous to argue here, but the ability of the precious metal to march higher should continue to be watched. The recent surge higher since the end of June suggests – but it is again, only an explanation after the results have been seen – that gold traders believed the Federal Reserve would have to eventually capitulate and stop behaving hawkish about interest rates.

And this brings us squarely to this weeks events. Yes, the DNC is underway in Chicago and hopefully it provides a rather calm atmosphere free of political chaos via unwanted demonstrators. If investors can focus on the Fed’s FOMC Meeting Minutes report which will be published on Wednesday this would be good.

Because the Fed refused to sound dovish in their last FOMC Statement this created the potential for massive retaliation by institutional traders, and when coupled with the BoJ hike and their rhetoric, market turmoil in Japan and globally promptly ensued for a few days. However, because of recent inflation data again highlighting U.S prices via Producer Price Index are stable and decreasing in some sectors, and CPI has continued to come in below anticipated results, investors again firmly believe the Federal Reserve will definitely cut the Fed Funds Rate by at least 0.25% in September, and may be in a position to cut in November. Thus, the weakness and volatility of the USD which is clear to see via the USD Cash Index results.

Yet and potentially amusing tomorrow, the Fed’s FOMC Meeting Minutes may simply restate the cautious and very passive rhetoric from the last FOMC Statement. This because the Meeting Minutes are a reflection on thoughts shared at the Fed meeting, and we know what that outcome was already. Meaning tomorrow’s publication may scare some investors, but it shouldn’t. Tomorrow’s Fed paper may prove to be a non-event.

This sets the table for the Jackson Hole Symposium in Wyoming which starts on Thursday to produce a myriad of central banker statements led by Jerome Powell and his counterparts from the European Central Bank, Bank of Japan and Bank of England. The event is likely going to be important, but much of the talk which occurs in closed meetings is unlikely going to be made public.