USD/ZAR Celebratory Parade Should be Put on Hold Awhile

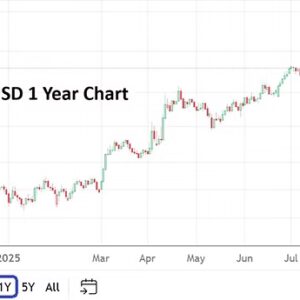

The USD/ZAR has produced a solid downward turn since the 1st of April when the currency pair was trading above 19.00000.

The value of the USD/ZAR as of this writing is near the 18.48000 mark as the currency pair fluctuates within Forex. The currency pair has produced a solid downturn since the start of April when it was above the 19.00000 level. The ability of the USD/ZAR to suddenly create a streak of bearish trading and make support levels look vulnerable is intriguing, particularly considering USD centric sentiment against many other major currencies the past week and a half has produced very choppy results in the broad Forex market.

The USD/ZAR is now trading at its monthly low via a technical perspective and the currency pair is testing values last seen at the start of January. The ability of the USD/ZAR to suddenly spark selling may be able to be explained because of the higher value of Gold which is trading at record prices while traversing near 2,360.00 USD currently. Mining makes up roughly 8% of the Gross Domestic Product value for South Africa.

However, before a party is launched to start celebrating the reemergence of the South Africa Rand, traders should note the USD/ZAR was trading within its current value range on the 14th of December. Thus the South African Rand is simply taking up residence like many other major currencies including the GBP and EUR within known prices they were valued, when the U.S Federal Reserve ‘changed’ its monetary policy stance on the 13th of December to a more dovish outlook.

The choppiness within the USD/ZAR has been rather extreme over the past few months. On the 28th of December the USD/ZAR was trading near the 18.26000 ratio briefly, on the 23rd of February the currency pair was near the 19.40000 mark and testing values which had been last seen in October of 2023. While the price of Gold is at record values now, the worth of the precious metal might be a false correlation to the USD/ZAR, and technical traders may want to watch the currency pair’s support levels below as a place that reversals higher could be sparked.

U.S Data and Concerns in South Africa Regarding the Election

The U.S will release important inflation data on Wednesday and Thursday. Last month’s Producer Price Index numbers from the States sparked a wave of volatility in Forex and the USD/ZAR was not immune. The bearish cycle in the USD/ZAR has been noteworthy, but fundamental doubt exists regarding its ability to sustain lower price momentum. The U.S Federal Reserve does not appear any closer to cutting its Federal Funds Rate.

There is also a political shadow regarding South Africa elections. The nation’s vote will take place on the 29th of May. The results potentially could create instability and the need for a coalition government which may be difficult to attain without signing off on more costly social policies which the South African government cannot easily afford fiscally.

USD/ZAR Short Term Thoughts:

· The 18.46000/18.47000 support levels in the short-term may cause reactions if challenged.

· Traders are urged not to be overly ambitious, particularly if they still want to pursue downside in the USD/ZAR, the use of take profit and stop loss orders is appropriate.

· Current price levels may spark volatility if financial institutions feel the price of the USD/ZAR has become unbalanced.