India Insider: Labor Productivity and Rising Household Debt

The desire for India to become a fast growing economy can be alluring, but without proper distribution of income and improved labor codes, this remains a major challenge to achieve. During coronavirus, acute problems were faced by those working in private enterprises. While some businesses and institutions supported their employees, many people were left behind without social protective measures.

According to Business Line newspaper analysis, from July 2022 to June 2023, an average salaried Indian male made 20,666 Rupees ($236 USD) and a woman made 15,722 Rupees ( $180 USD) per month.

Experience tells us that lower salaries in the rural areas are pervasive. Many private sector nurses, schoolteachers, and other service workers earn less than the international poverty line of $3 per day (around 250 Rupees per current Forex). Sometimes due to extensive workforce supply, some educated people must work blue collar service jobs additionally to make their ends meet.

Agriculture and Low Productivity:

Wage disparity and underemployment exists rampantly. Half of India’s labor force works in agriculture, where productivity is poor. In agriculture, farmers are both producers and consumers. There are barriers in food supply and demand for agricultural products. Farmers need access to local markets where their buyers can afford to purchase their produce. Without solid markets or better road infrastructure to reach them, many rural areas have less incentive to improve productivity.

As a result, many farmers produce low volumes. This is also one of the reasons why New Delhi is reluctant to permit U.S imports of agricultural and dairy products. Smaller farmers cannot afford to invest in education, which hinders their efforts to move into industries with higher wages. Without increasing labor productivity and better opportunities, most of the population will continue to work in agriculture.

Stagnant Wages, Informal Work and Problems in Micro-Finance:

A large portion of the workforce is employed via informal and low-paying jobs. If wage growth does not keep pace with increased productivity, domestic consumption will remain weak, making the economy more fragile during global downturns. Drivers and gig workers provide some insights because of their inability to make ends meet. Minimum wage policies are lacking for many gig workers. Employees work higher hours in these enterprises. Yet another reason why Indian households prefer to prepare their children for government jobs.

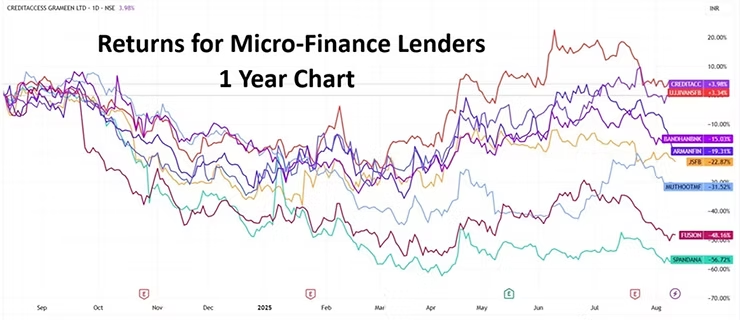

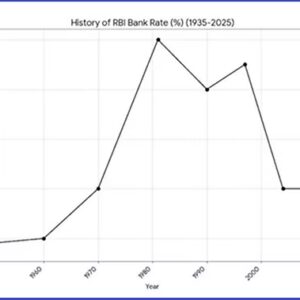

India’s micro lending industry is under stress as delinquencies rise at an alarming pace. This has prompted the Reserve Bank of India to intervene and impose fines on lenders charging excessive interest rates. Loan disbursements shrank 13.5% year-on-year, and shares of some small finance banks have fallen, this as they have been forced to set aside higher provisions for bad loans.

Total loans outstanding in the industry are around 3.75 lakh crore rupees ($43 billion USD) in financial year 2025, with non-housing retail loans accounting for nearly 55% of total household debt. Small ticket loans were meant to ensure financial inclusion in underserved areas. The RBI defines microfinance as collateral-free loans to households with annual incomes of up to 3 lakh Rupees (approximately $3,400 USD).

But when wages do not rise in line with inflation, households begin to borrow to cover deficits, often at high interest rates. This creates risk for small finance banks when borrowers default, besides many consumers who are clearly struggling. A bank employee in Tamil Nadu has said loan disbursements are now scrutinized more closely, and applicants with monthly EMIs – equated monthly installments – above 10,000 Rupees ($115 USD) are no longer eligible for micro-loans.

Job creation in the Manufacturing:

Despite media portrayals of India’s manufacturing ascent, Harvard economist Dani Rodrik offered a compelling remark paraphrased here which points out obstacles ahead, ‘what made manufacturing a vehicle for transformational growth was its ability to generate productivity while drawing unskilled labor from traditional farming’. Rodrik seems to believe manufacturing remains a lower income sector in India due to its large work force and inability to transform efficiently, while also facing globalization problems from other Asian competitors.

The reason why manufacturing companies in India can pay lower salaries is because of high unemployment ratios and a steady supply of new graduates every year, making it easy to find new employees. Wages don’t see much improvement because workers are replaced easily. Many employees working in manufacturing actually have engineering and Masters’ degree backgrounds. Their average salary is around 15,000 Rupees a month ($170 USD), the same amount paid to low skilled employees who have technician diplomas.

India needs to work on improving core manufacturing capabilities, creating better infrastructure via land reforms and logistical capabilities. Implementing a fair minimum wage policy would also influence the economy via better household wages. Yes, inflation is a concern, but India’s aspiration to become a $10 trillion economy will remain hard to attain unless coordinated policy changes occur.

Notes: 1 USD = 87.5 Rupees