India Insider: Why is Gold Frequently Accumulated by Indians?

In a society like India in which I live gold hoarding is a fact of life. According to a recent report by the World Gold Council, Indian households are believed to hold around 25,000 tonnes of gold with a combined value of around $3 trillion USD.

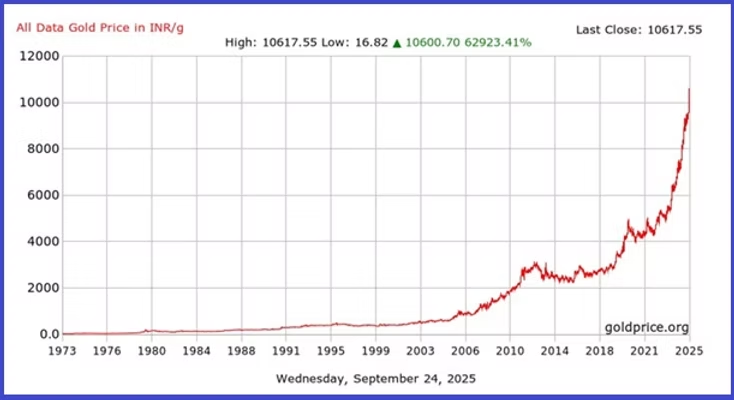

Billionaire banker Uday Kotak applauded Indian women when he said they are ”the smartest fund managers in the world”. The precious metal has gained 42% in 2025 alone, and returned 700% in the last 20 years in Indian Rupee terms. In India consumers have a habit of monitoring daily gold prices. There is a gold festival in India called Aksayatritiyai, when gold is bought frequently in small grams but often also includes large purchases for religious sentiments. In Northern India, gold is bought during festival times like Dhanteras and believed to bring prosperity and good fortune.

Adam Smith’s Case Against Gold:

Smith lashed out at gold for its lack of productiveness. He wrote in the The Wealth of Nations, “labour was the first price, the original purchase-money that was paid for all things. It was not by gold or by silver, but by labour, that all the wealth of the world was originally purchased; and its value, to those who possess it, and who want to exchange it for some few productions, is precisely equal to the quantity of labour which it can enable them to purchase or command.”

The act of hoarding, whether it is money or gold, depresses economic activity, as demonstrated by John Maynard Keynes in his ‘paradox of thrift’. Indeed, it was the Europeans by spending all the precious metals taken from the Americas which boosted economic activity, and ultimately sparked the rise of modern capitalism whereas Asians by hoarding ended up falling behind.

Ancient China Example:

In the past, China’s reliance on silver gave short-term stability but stunted long term growth. With no domestic silver, it depended on inflows from Spain and Japan, making its money supply hostage to global trade. Wars or disruptions cut silver inflows, draining liquidity while crippling tax collection. Unlike Europe, China clung to silver as ‘real’ money, while neglecting credit, banking and bonds. This rigid system weakened the nation’s fiscal capacity, leaving China unable to mobilize resources or industrialize effectively. In the end, silver ensured stability, but strangled flexibility and growth. Indian growth has been strangled too often because of an over-obsession towards gold.

Why Gold Prices are Moving Up?

The price of gold was relatively stable until the 2008 financial crisis and it’s been rising steadily ever since, doubling in 3 years from 2009 to 2012. After some broad consolidation, gold has been in a higher value band if you scrupulously study charts. Arguably, it is an influence due to lower interest rates that have helped gold prices move up for 15 years as inflation has been attempted to be camouflaged by Central Banks.

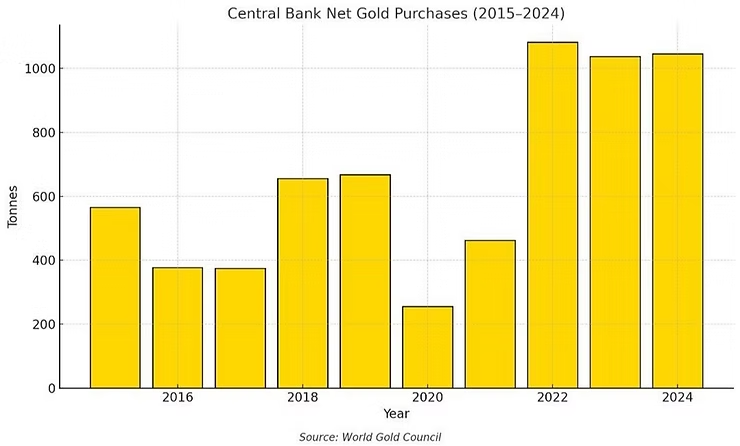

Central Banks also accumulate gold for many reasons. One reason for this are rising bond yields that make existing fiscal obligations underperform for governments. Central Banks buy gold to diversify and hedge against risk. As the Official Monetary and Financial Institutions Forum – an independent body – noted recently, many European national bank systems endure massive losses because of quantitative easing. When the institutions try to undertake quantitative tightening, they are forced to sell at market prices, which deepen their balance sheets losses. Thus, Central Banks diversify into gold as a sacrosanct hedge against losses incurred and allows them to offset many liabilities. Gold has a long historical track record of working as a safeguard against inflation.

It’s also true that gold is often accumulated by Central Banks when hedging against geopolitical uncertainty. The Russia and Ukraine war offers intrigue regarding the nation of Kyrgyzstan, which China uses as a route for its exports to Russia, this due to Kyrgyzstan’s inherent ability to conduct trade via accessible routes. There is high plausibility that Kyrgyzstan might be converting Russian Ruble surpluses into gold.

Monetary Policy Matters for Gold:

Gold will remain vital for many years to come as a store of value and a safe haven. Buying the precious metal delivers investors and businesses a needed hedge against inflation. Protections against the lose of purchasing power within their own fiat currencies remains important for all people.

The Indian public and other societies need to remember, the value of gold within their own currencies often lies within the interest rate valuations sparked by Central Banks mechanisms which sometimes amount to magic shows and influence demand. While public buying of gold is important, it sometimes equates into mere speculation and does not always help economic activity.