AMT Top Ten Miscellaneous Raindrops for the 2nd of February

10. Risk Appetite: WTI Crude Oil almost serene around 74.00 USD, as bombastic rhetoric remains loud involving the Middle East.

9. South Africa: President Cyril Ramaphosa expected to announce the country’s election date when delivering the State of the Nation Address on 8th of February.

8. Tesla: Negative media coverage and an always defiant Elon Musk gravitate towards each other, share price is around 188.88 USD.

7. China: Shanghai Composite Index (SSE) hovering near 2,730 as of this moment.

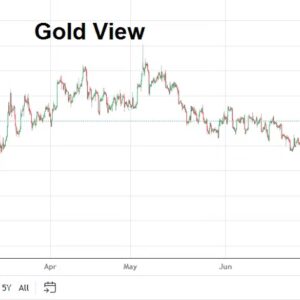

6. Gold: After near-term lows a challenge of highs as USD has gotten slightly weaker.

5. Central Banks: All bark and no bite yet, as financial institutions desire interest rate cuts from Federal Reserve, European Central Bank and Bank of England.

4. India: Nifty 50 Index near 21,865 as of this writing, it has gained more than 101% over the last five years – yes, plus one-hundred and one percent.

3. Forex Reactions: Recent short-term volatility and reversals seen as expected, patience still needed as USD mid-term outlook remains weaker.

2. U.S Equities: S&P 500, Nasdaq 100 and Dow Jones 30 have produced nervous results but still near record highs, as U.S Treasury yields have edged lower this week.

1. Data: U.S Non Farm Employment Change and Average Hourly Earnings today, this as some major corporations shed employees but labor market remains rather tight. Broad markets will react to the outcomes.