India and the U.S Govt Shutdown: Quick Market Thoughts

President Trump has been ramping up his claims that India is no longer going to buy Russian oil, he made a statement regarding this belief yesterday once again. As the White House threatened to initiate tougher sanctions against India, there seems to have been some movement towards a reconciliation between the two powerful nations.

The Trump administration is clearly trying to limit the amount of purchases of Russian oil by India to increase economic pressures on Russia, and reportedly India may be starting to actually buy less oil. India has certainly not stopped buying Russian oil in a maximum ‘fait accompli’, but if the nation continues to show a willingness to purchase less energy resources from Russia, this will go a long way in preserving a good U.S and India association. A stronger relationship between the U.S and India can achieve a vital economic and military correlation for the both nations. Improved friendlier tones from New Delhi and Washington D.C appear to have reassured investors in the Indian equity markets via highs currently being seen on Nifty 50, which are now within sight of apex values from late September last year.

India is a vital and important part of U.S policy as it attempts to also create pressure on China too. By maintaining political and business dealings with India, the U.S can and should look upon this joint relationship as a vast long-term strategic interest. India understands this as well. The ability of India and the U.S to remain ‘friendly’ allies, and the prospect of creating a vigorous economic and military partnership should be one of the U.S government’s essential missions.

India does have strong connections to Russia the past handful of decades politically and economically via its non-aligned status. India will certainly maintain its dialogue and sometimes cooperative dealings with Russia. However, if India and the U.S maintain a solid relationship with the prospect of increasing their economic and political ties this could substantially change dynamics on the Asian continent.

U.S Government Shutdown Since the 1st of October

The U.S government has now been shutdown for over three weeks as Republicans and Democrats remain stubborn about compromise. Both sides have made the shutdown a political game. While each party claims they are doing what is best for the nation and preach to their collective voting bases, the stalemate could start to have uglier effects regarding wages not paid for many U.S employees on the 1st of November.

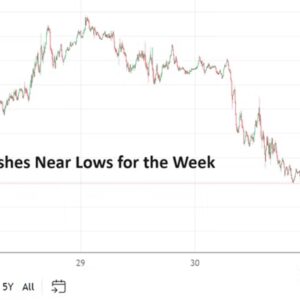

A lack of government salaries not being dispersed will cause an economic hit via consumer spending and create at a minimum some temporary damage for GDP numbers. Remarkably, and to be clear about this potential impact, Wall Street hasn’t seemed to care yet, but this could start to change. As the U.S economy rumbles powerfully forward without a major downturn in the major equity indices, politicians appear to be comfortable acting like spoiled children on both sides of the aisles engaged in accusing the other side of misdeeds.

Likely to start changing attitudes among Republicans and Democrats in the next two weeks are the coming Federal Reserve’s FOMC Statement during the end of October, and voting results via key political races in the first week of November.

Wall Street wants clarity regarding interest rate outlooks for November, December and early next year. Investors might not get a clear picture from the Fed next week, taking into consideration the Federal Reserve will not have up to date official U.S economic data because of the government shutdown. Meaning the Fed will likely issue a 25 basis point rate cut on the 29th of October and say it is uncertain about the coming few months because it does not have enough inflation, employment and GDP information to form a concrete opinion. The joke of coarse being the Fed seldom seems to have a strong opinion, but now can use the government shutdown as an excuse.

And now for contemplation, let’s look at the election in NYC for Mayor. A bona fide socialist may get elected in New York City who carries the historically misguided and dangerous wisdom of a Marxist. The economic and social practices of Marxism have proven utter failures for over one hundred years consistently. If NYC suffers a victory from the socialist candidate running as a Democrat, Wall Street and many financial institutions based in the city will not react favorably.