Concerns Ahead and a Potentially Noisy Week for Day Traders

In the wake of last week’s central banks follies, day traders have what may appear on the surface a rather comfortable week of economic data to consider as they make their wagers. However, there are outside risk events looming which will likely stir the emotions and positions of financial institutions, and cause knock on tremors that speculators feel caused by a noisy storm of experts and media pundits.

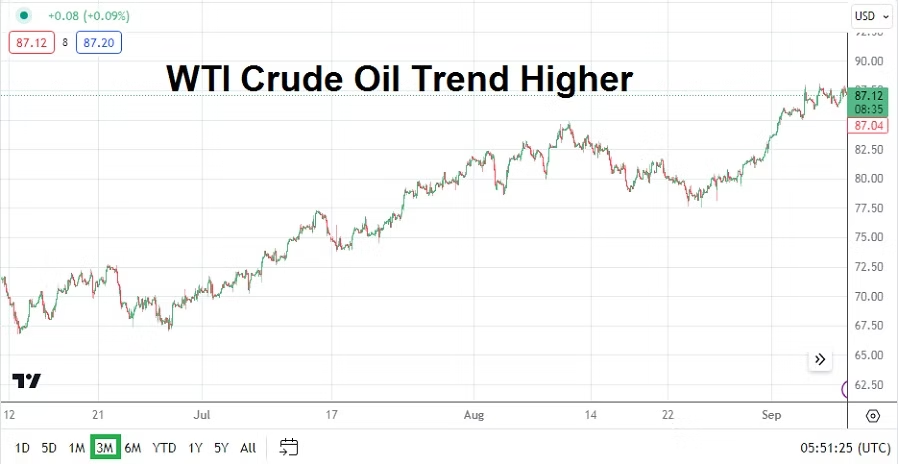

U.S equity indices have struggled recently and this should be viewed as a barometer of current behavioral sentiment. Concerns regarding higher Crude Oil prices, and talk of a growing U.S political crisis as a government shutdown is threatened (remember next year’s election is shadowing all spectacles in Washington D.C presently) highlight the nervous state of affairs. The USD has been stronger and gold has remained under pressure in recent trading. Risk adverse trading is proving rather flavorful for the moment.

The ongoing strong rhetoric from the U.S Federal Reserve and what appears to be an almost certain interest rate hike in November is causing market sentiment to remain anxious. Financial institutions are not only lining up to buy U.S Treasuries, but money market funds are also being sought too which offer the ability to accumulate returns from higher interest rates. While cash is being parked in ‘sure things’ because financial institutions and large investors are keen on locking in ‘known’ returns (profits), this creates potentially less money supply for buying of U.S and global equities momentarily.

Troubling economic data continues to mire the terrain also for financial institutions, and the heightened fear is causing a reaction which day traders need to deal with as short-term volatility mounts creating dangerous speculative conditions. Consumers face a rather large bag of ‘troubles’ via higher mortgages, debt obligations on credit cards and student loans, and inflation costs. Yet, intriguingly the U.S economy has shown resilience which is almost perplexing.

Current behavioral sentiment appears fragile and ready to crack open into a chaotic storm if too much pressure is exerted. Day traders should be cautious this week because plenty of diatribes and warnings are sure to be heard. Unfortunately the warnings being heard now for this coming week could prove correct.

Monday, 25th September, Germany Business Climate via Ifo – investors will keep their eyes on the sentiment reading from Germany which is expected to be worse than last month’s results. The EUR/USD is trading at six month lows.

Tuesday, 26th September, U.S CB Consumer Confidence – the result is anticipated to be slightly negative compared to last month’s outcome. U.S consumers have remained strong and financial institutions will want to see if they remain optimistic regarding their outlooks. The outcome could affect the USD, particularly if the number is weaker than expected.

Wednesday, 27th September, U.S Durable Goods Orders – this report could prove noteworthy via the broad and core reports. Durable Goods Orders are a relatively important barometer on U.S big ticket spending and demand. The numbers are likely to cause a rumble in U.S equity markets.

Thursday, 28th September, Germany CPI – the inflation results will be watched carefully by EUR/USD speculators. Higher prices in Germany are not welcome and a larger number than anticipated would be troubling.

Thursday, 28th September, U.S GDP – the Gross Domestic Product data from the States on Thursday will be closely monitored and likely provide impetus for Forex and major indices. If the growth numbers are stronger than expected this will serve as another nail for the U.S Federal Reserve to hit when it makes its case for another interest rate hike. While it is good the U.S economic growth numbers have been relatively strong, better than expected data could play into U.S Treasury yields remaining high and spark additional complex considerations for investors.

Friday, 29th September, Canada GDP – the data from Canada is expecting a negative ‘growth’ result which would have an affect on the USD/CAD.

Friday, 29th September, U.S University of Michigan Consumer Sentiment – the revised numbers will give insights into American spending habits. The previous two months have been more lower than anticipated, this outcome is expected to produce a reading of 67.7.

Saturday, 30th September, China Manufacturing PMI – while the Purchasing Managers Index reports from China are forecast to show slight improvements, analysts remain worried about economic conditions in the nation. Transparency remains a focal point for investors who want to make sure the results they are being given are accurate.