India Insider: Concern IT Empire is at Risk in Age of AI

When China’s DeepSeek announced its Generative AI program as a rival to U.S based ChatGPT, the world paid close attention. In fact, Nasdaq bellwether stock Nvidia, the world’s most valuable company, took a hit because the DeepSeek product was made with less expensive chip processors compared to ChatGPT’s infrastructure, which uses Nvidia’s GPU technology.

In North America and Europe, DeepSeek’s rollout was met with much surprise and intrigue. And the true ‘poster child’ of India’s post-liberalization era, the IT (Information Technology) sector has been facing its own challenges and was also caught off guard. India’s IT sector employs some 5.3 million people and helps maintain its current account balance sheet by earning crucial foreign exchange reserves. The top four major IT companies have a combined market cap of $300 billion USD, larger than India’s richest man Mukesh Ambani’s Reliance Industries, which stands around $238 billion USD.

India’s IT Business Model and Artificial Intelligence

Indian IT companies operate on a model of software servicing for offshore clients, typically via medium to long-term contracts. Their business operations are embedded across the globe thanks to affordable pricing and the quality of services provided by Indian software engineers. Now, this model is being threatened by the rise of Generative AI and taking it lightly would be a serious mistake by India.

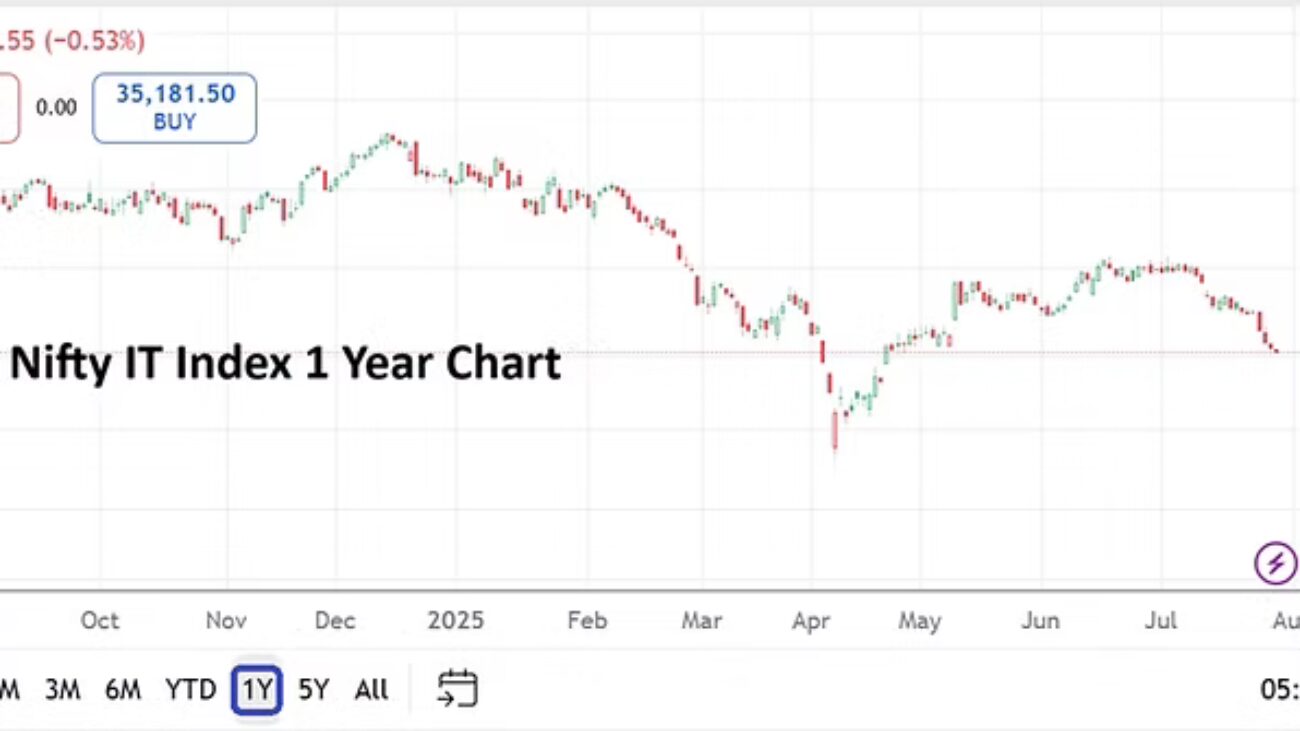

Shares of major IT companies - TCS, Infosys, Wipro, and HCL have delivered lackluster returns since their post pandemic rally. Since Covid high valuations amid deal pessimism were a concern. Now those worries are amplified by AI and the disruption it brings to their business models. Software exporters remain the worst performers, the Nifty IT index is down 18% year-to-date, underperforming the broader index consequentially.

The recent release of Q1 fiscal year 2026 numbers from these four IT companies have been met with skepticism regarding forecasted outlook. Analysts noted that Indian IT firms are grappling with margin pressures amid persistent macroeconomic headwinds and rising threats from AI-driven productivity improvements. In response, companies have started to protect their margins with layoffs, TCS (Tata Consultancy Services) shed around 2% of its workforce this past weekend which could affect more than 12,000 jobs.

Time For India’s IT Sector to Become Proactive

Pricing models that IT companies charge customers are changing from long to short-term flexible contracts like ‘pay as you go’ over traditional fixed annual licensing models. Despite changing CEOs in several of these companies over the last few years, animal spirits are failing thus far to innovate AI products that can enhance the bottom line. Instead, companies prefer share buybacks and paying stellar dividends to appease the shareholders rather than to invest in R&D especially when their core model is under threat.

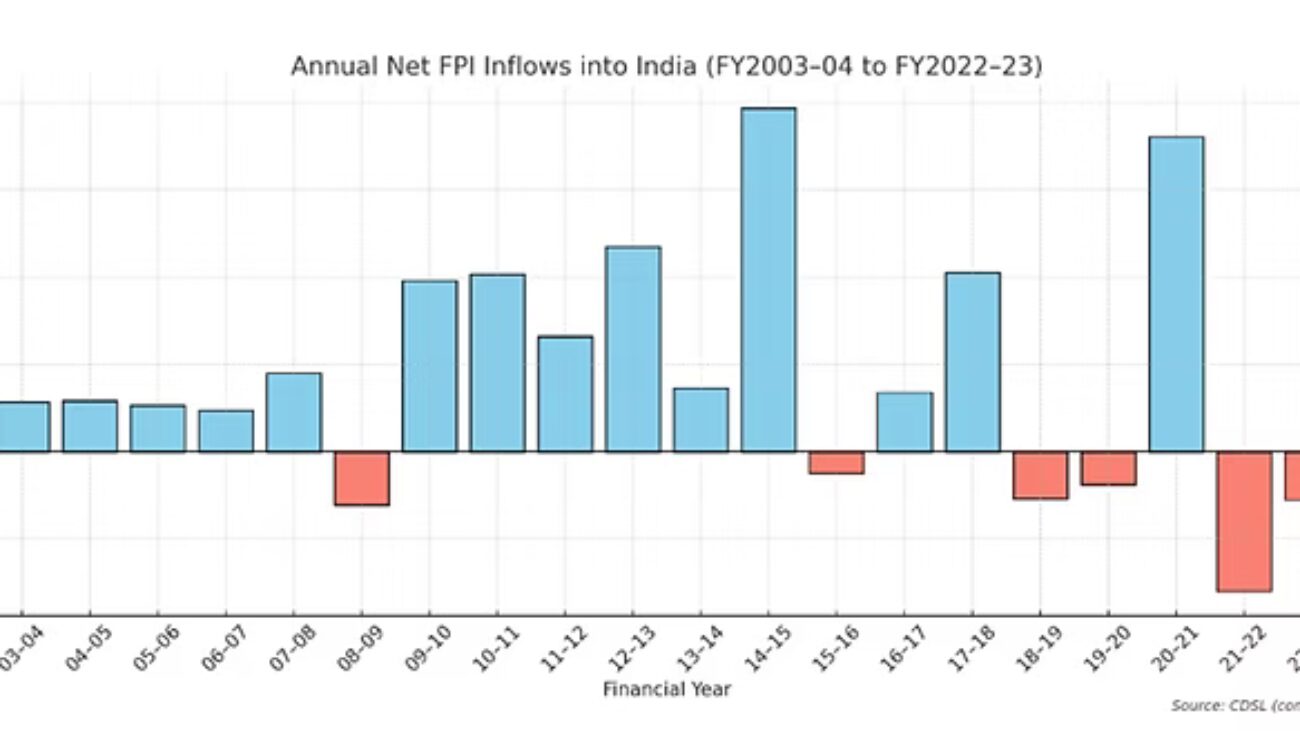

The euphoria surrounding India’s $5.4 trillion equity market is cooling in 2025, amid concerns over slowing earnings growth, elevated valuations, and tariff related uncertainty. At the same time, sentiment towards Hong Kong’s listed Chinese shares are improving with global fund managers rapidly reallocating capital to that market. The Hang Seng Index has delivered an impressive 27% return year-to-date. Meanwhile, India’s stock market still lacks depth for investors seeking meaningful exposure to the booming Artificial Intelligence theme.

Indian IT companies excel at scaling and delivering AI solutions for global clients, but they do not own the core models, platforms, or consumer data needed to become true AI disruptors like China’s tech giants. The industry contributes approximately 7.5% to India’s GDP and remains the primary employment avenue for engineering graduates. It’s time for India’s IT sector to proactively address the growing AI threat posed by global competitors.