10. France Falls: President Macron’s leadership is in peril after his anointed Prime Minister, Michael Bernier, suffered a no confidence vote outcome. French politics and finances are in shambles. Life for French citizens goes on as their politicians battle for their jobs, supremacy of voice and egos. With the restoration and presentation publicly of Notre Dame Cathedral yesterday, Macron now has to find something else to divert attention away from his misappropriation of power.

9. 100,000: Bitcoin came within sight of the 104,000 USD vicinity this Thursday, then sunk with a rapid pace and challenged 92,000. Once again traversing near 100 grand, large BTC whales and MicroStrategy’s Michael Saylor and his cult of followers are likely celebrating. However, if the wind changes direction what kind of damage will the low tides create this time for Bitcoin and speculative leveraged positions? The price of BTC/USD as of this writing is near 99,500.

8. Al-Assad: The Syrian regime is apparently coming to an end after 50 plus years in power. Bashar al-Assad’s whereabouts are unknown. Russia, Iran and Hezbollah appear for the moment to be big losers in this power play. The many factions will now have to see if they can create a semblance of government, but that remains doubtful. Syria will be a quagmire in the coming months as its cauldron stirs.

7. Martial Law: South Korean President Yoon Suk Yeol startled Asia and foreign investors by declaring martial law this past week, making one of the worst political miscalculations in recent memory. Yoon was quickly forced to rescind the decision. The USD/KRW spiked and KOSPI Composite sank via the instability. However, the South Korean National Assembly has shown the ability to provide leadership and display power of law prevails, this as they try to calm their citizens concerns and investor sentiment.

6. Roasted: Coffee Arabica has boiled again and commodity’s price is fighting within apex levels. Like Cocoa, both Arabica and Robusta Coffee have surged the past year as large players have created a strangulated grip which suggests the markets may be ‘cornered’. While some analysts are quick to point out weather conditions as a reason for the higher prices, the tenacity of Coffee and Cocoa to sustain upwards momentum is intriguing but also suspicious.

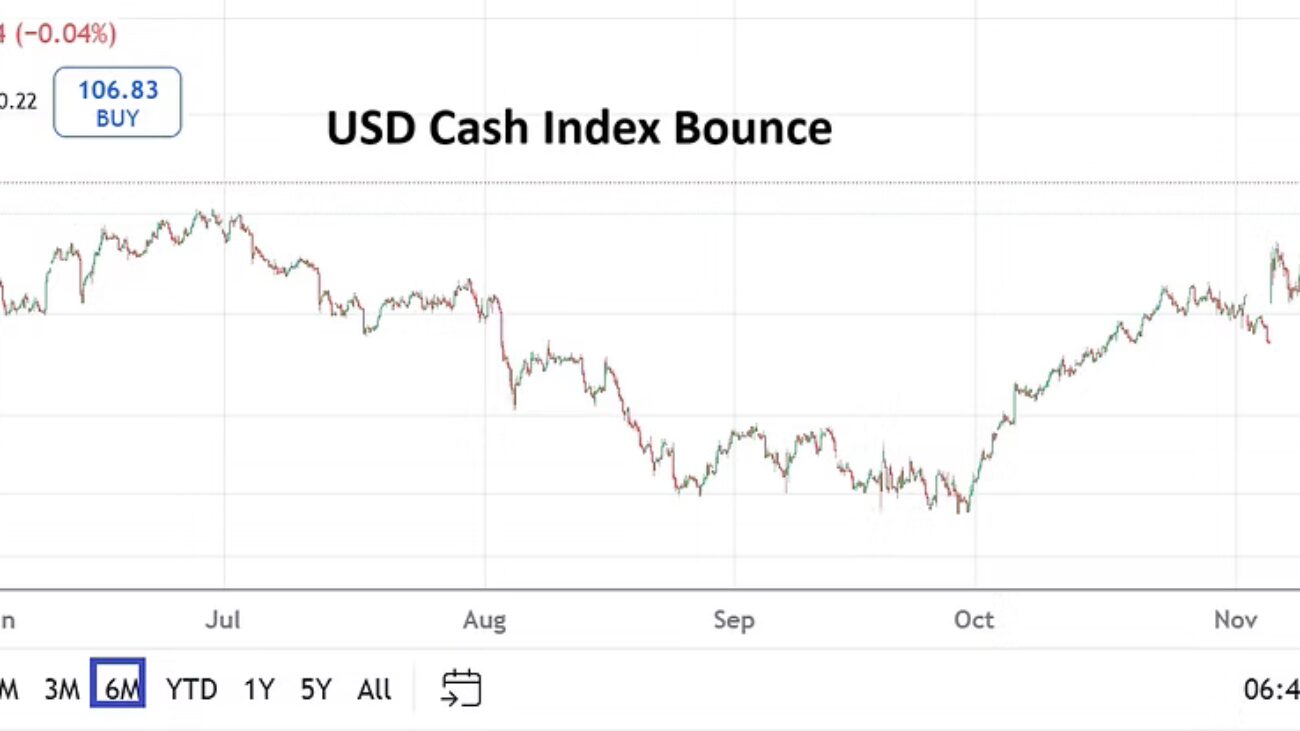

5. FX and Data: U.S jobs numbers this Friday were marginally better than anticipated and the Average Hourly Earnings came in slightly above expectations. Economists from different schools of thought are debating the potential of recession and inflation concerns, versus those who believe growth, greater transparency of U.S fiscal mandates and elimination of a bloated budget will be achieved when Trump’s economic policies takeover. Globally Forex conditions are showing signs of fragility because of the threat of tariffs and trade concessions by nations which may need to be made. Yet, it is quite possible the ‘bad news’ consisting of accusations of unfair trade agreements by Trump, and the reactions which have been cooked into the EUR, GBP, JPY, ZAR, MXN, CAD, NZD and others is overdone. While there could certainly be more weakness in major global currencies paired against the USD, upside potential mid-term may be more positive compared to near-term drawdowns. Retail traders still face difficult technical perceptions in the days ahead because financial institutions also remain shaky regarding their outlooks.

4. Pardon Me Joe: President Biden has forgiven his son, Hunter Biden, for crimes known and unknown for an eleven year period – that is not a round number ladies and gentlemen, with a Presidential Pardon. Why 11 years? Why not 10 or 15? There is conjecture that Joe Biden is also considering preemptive pardons for people his administration feels may face the wrath of the incoming Trump White House. However, if pardons are given to the likes of Anthony Fauci, won’t the pardons awarded to those who have not been charged with a crime yet look like an admission of guilt?

3. Central Banks: The ECB will deliver their interest rate decision on the 12th and the Federal Reserve will announce their Fed Funds Rate on the 18th. Behavioral sentiment however is seemingly more focused on the threat of potential storms that could suddenly appear due to the Trump effect. The ECB and Fed are both expected to cut their interest rates by a quarter of a point, while it appears many financial institutions no longer believe the Fed will cut again in January.

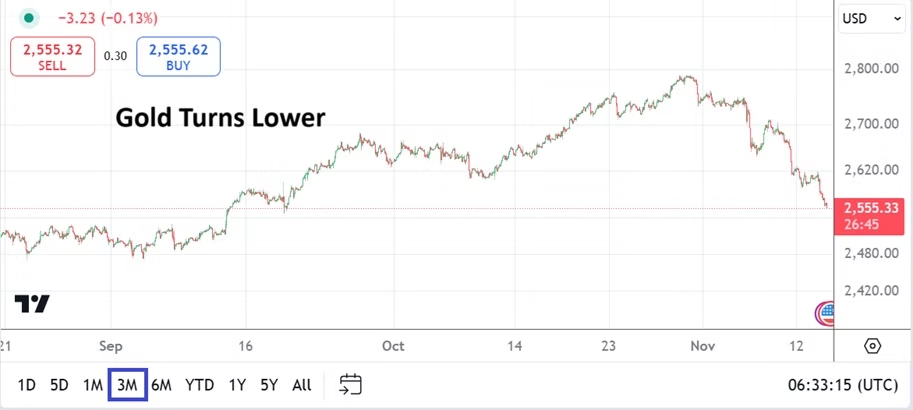

2. Chinese Gold: Tucked away in the quiet corners of the business news has been the discovery of a massive gold ore deposit in China. Some geologists claim the Wangu gold field could have up to 1,100 tons of the precious metal. If correct and the amount of gold meets or exceeds the expectations of the experts, the question about this becoming a deflationary event for gold is intriguing but likely wrong. Importantly, the gold will be a long-term benefit for China and potentially create a stronger national currency via the Renminbi (China Yuan). Perhaps also solidifying the idea of using the reserve as part of the backbone for a potential BRICS ‘Unit’ currency if and when that day ever arrives. Gold closed at nearly 2633.00 USD per ounce before going into this weekend.

1. Trump Effect: WTI Crude Oil is around 66.78 USD as the promise of easier energy production for U.S companies has created the conviction of steady and less expensive supply. The USD remains in the stronger elements of its long-term Forex range, and folks betting against the strength of the USD need to remain cautious. BRICS has been warned about not infringing on the USD by Donald Trump, and some member nations of the organization have affirmed they do not seek a BRICS currency (yet). Tariffs have been threatened, but China has responded by showing it has the ability to create potential hinderances this week via a tough negotiation stance by threatening to stop export of rare earth metals to the U.S. Mexico and Canada have felt the verbal wrath of the President-elect already and started to react. All of this while Donald Trump still has six full weeks before taking power.