Opinion: The following article is commentary and its views are solely those of the author.

We wrote a few weeks ago in response to Nassim Taleb’s claim that Israel was fragile due to its over-dependence on the United States, and we came to the conclusion that in general he was correct although not in every aspect Is Israel a Fragile Country?.

Also, we compared Israel’s fragility with that of other free or status-quo countries (as opposed to revolutionary countries like Russia, Iran and China) and thought that Israel was certainly not more fragile than other free countries in difficult neighborhoods. We then gave a general outline of how the free-status-quo world might look should we actually see the end of America’s commitment to global freedom The Day After Pax Americana.

I would like to examine in a more detailed way about Israel and India and how their potential relationship could be a model for this world. With the U.S reluctantly and belatedly responding to attacks from Iranian backed groups in Syria, Iraq and Yemen and their stubborn resistance to attacking Iran itself each free or status-quo country needs to look into its own defense. The U.S also needs to see how it can help midwife these alliances so as to guarantee a free world after their voluntary end to the Pax Americana.

Israel will need to expand its reach and move towards a more anti-fragile existence without damaging the all important U.S relationship. We can’t underestimate the importance of the U.S relationship to Israel and how important it is to maintain and even expand it – but as the U.S political landscape is changing and as the elite part of the younger generation is, for some reason, excusing violence against Jews in general and Israel in particular, Israel needs new strategic partners if it is to thrive and move at least part of the way towards anti-fragility.

Israel’s relationships with the Arab world, the Abraham Accords along with its older peace treaties with Jordan and Egypt are dependent upon dictators remaining in power. The most vocal and belligerent voice against Israel by a government in the (non-Iranian influenced) Arab comes from Jordan and the most vocal and belligerent non-governmental voice in the (non-Iranian influenced) Arab world probably comes from Egypt. These treaties are all important and they are based upon the self interest of the current rulers of the countries (which is a good thing), but no one can know how long they can last and how firm they really are.

Israel also has a strong and growing relationship with Greece and Cyprus in the eastern Mediterranean and have joint military exercises together. Their navies and air forces train together and even their ground forces have joint exercises but neither of those two countries have the economic, military or diplomatic heft that Israel needs.

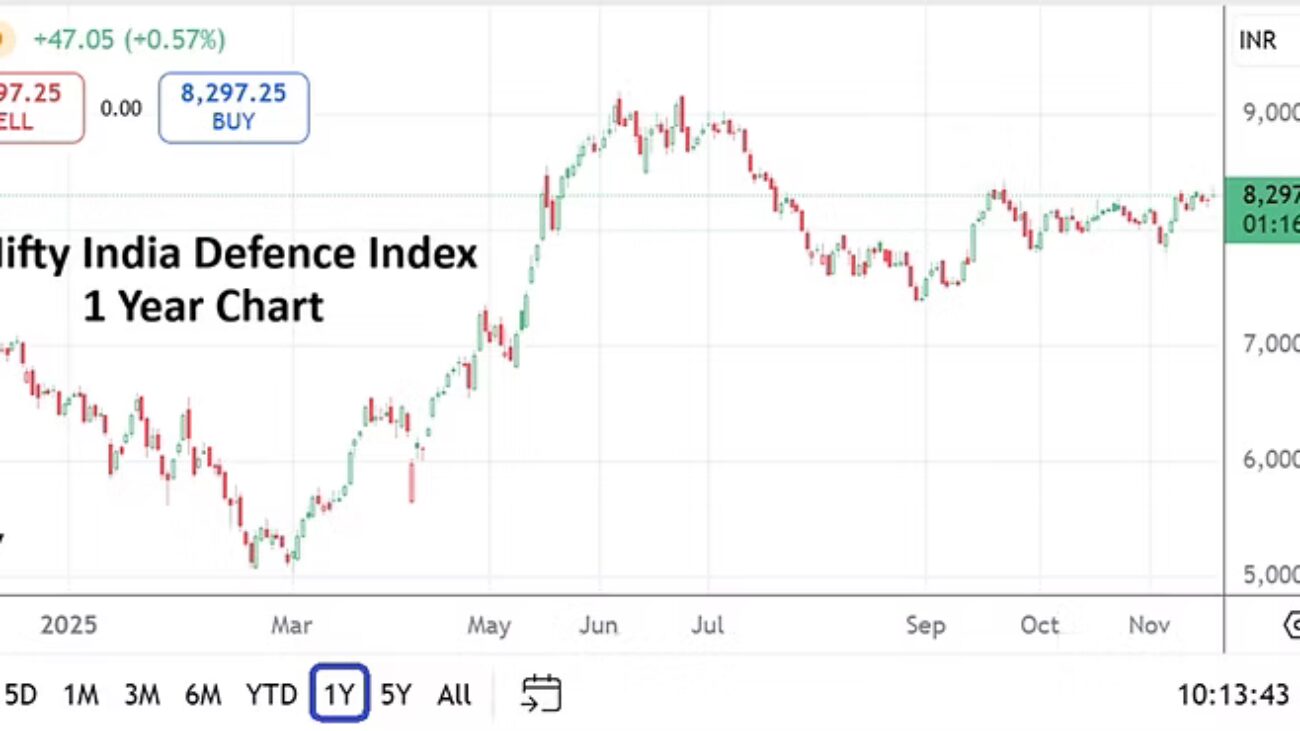

If Israel is looking for a second strong ally but one that itself lives in a dangerous neighborhood then the place to turn to is India. With the largest population in the world, a democratic government and a growing economy, India is the ideal strategic ally for Israel. Both are countries that live in dangerous neighborhoods, are working democracies and have experience dealing with terrorism. India, under with the premiership of Narendra Modi already has a strong relationship with the Israeli military. Israel has sold more than $600 million worth of military equipment to India (second only to Russia) and the two militaries have cooperated on anti-terror policy. The Israeli navy also reportedly has close ties to the Indian navy including submarine exercises in the Indian Ocean. Israel already has nearly $5 billion in trade with India (import and export) and it is time for Israel to start purchasing basic military supplies from India. India has five domestic manufacturers of the standard 155 mm artillery shells and it has large small arms industry – this should be an alternative to total dependence on the U.S for this standard equipment.

There is now a consensus in the country that Israel needs to broaden its military manufacturing and acquisition and the best way to do this would be to expand its relations with India. In order for this to make sense the time has come for Israel to say a very big “thank you very much” to the United States for the $3.9 billion in military aide it gets annually and instead purchase directly from the U.S and other sources. India could also help in building factories in Israel – which could even be operated by Indian nationals through Israel’s guest worker program.

The military cooperation should be expanded to the air-force as well as ground forces. There ought to be joint officer training, just as there is now with the U.S and some European countries. There should be a process in place that will eventually lead to a freedom of the seas treaty in the waters between India and Israel’s Gulf of Eilat. This should include cooperation between naval, air and anti-missile forces.

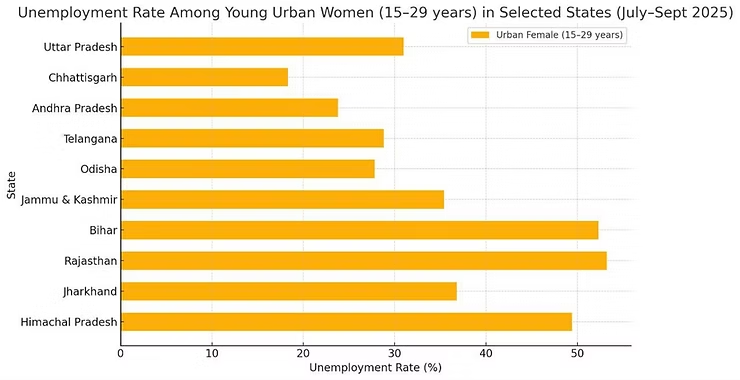

The foreign worker program should also be expanded. Israel is trying to free itself from dependence upon Palestinian labor – from both Gaza and the West Bank – and India and Israel have been talking about an expanded guest worker program. Currently there are Indian citizens working as aides to the elderly and disabled and that needs to be expanded to construction and agriculture.

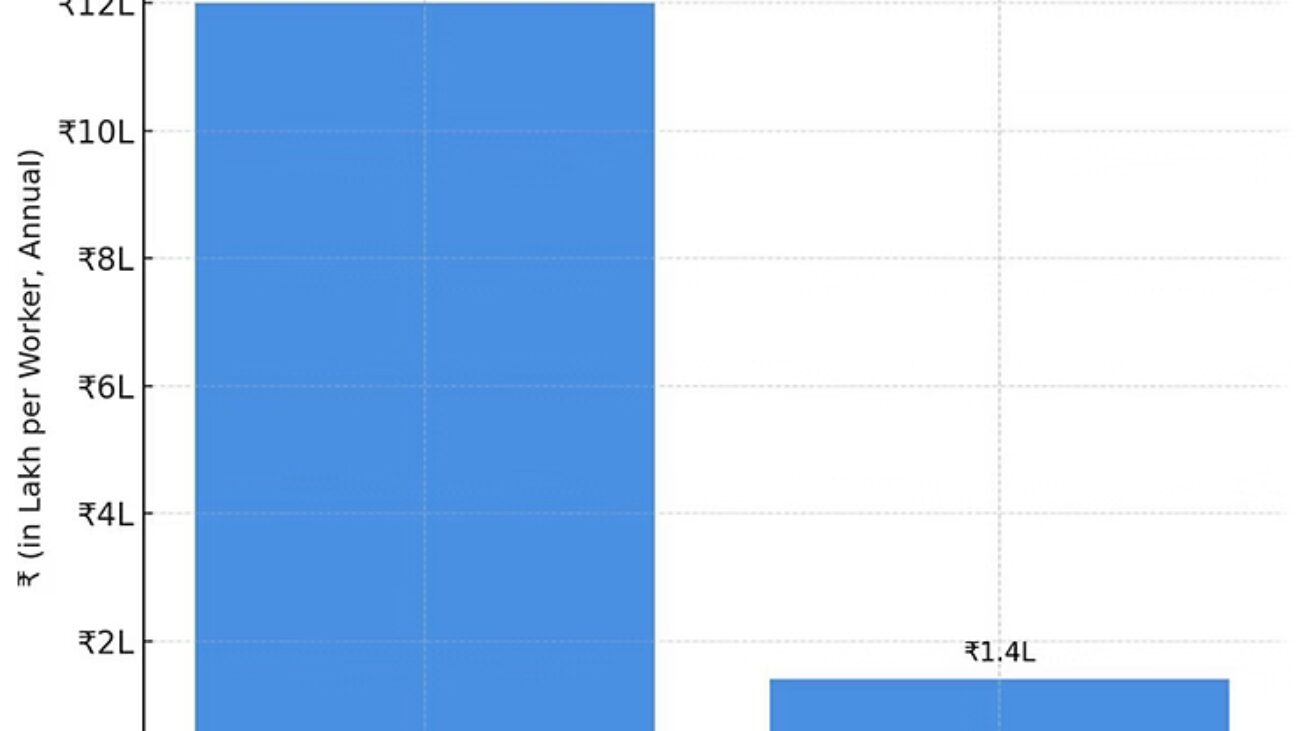

Israel is a small country with around 10 million people and due to its large birthrate and legal immigration there is a lack of new housing construction in the country. The guest worker program in place with countries like Philippines, Thailand, Sri Lanka and others allows workers to work for up to five years and earn much more than they can earn in their home countries. They are provided with the same health care as Israeli citizens (paid for by their employers) and are even given pension benefits which they take with them when they return to their home countries. Israel could probably host up to 100,000 Indian workers a year.

Scientific and student cooperation should be increased. This will not only help both countries develop important technology in areas such as healthcare and biotech, but will help India and Israel retain some of the scientists that would otherwise emigrate to the U.S and U.K. The exchange programs at university science and technology departments could lead to the creation of world class companies in the respective fields.

Finally, cooperation regarding the capital markets could help both countries develop world class markets. India has the potential to be a global financial center in the coming decades and Israel, while far from being a financial powerhouse could be a link to European markets and investors with the time zone 1-2 hours ahead and close connections with those markets.

The United States will be Israel’s main ally for the next few decades but it will be healthy for both countries if Israel was able to share interests – political, diplomatic, cultural and military with another major country. While France was that country until 1967 no European power has the position or the disposition to ally with Israel. India is democratic and attained its independence at the same period Israel did and from the same (then) major colonial power. Also, both countries have overcome their socialist beginnings to thrive on the global economic stage.

Now is the time for Israel and India to take the next step on the road to a true alliance. If we have truly reached the end of the Pax Americana, then this can be an example to the rest of the free-Status-quo world on how to manage without the vast power that is the United States. If somehow America shows the will to continue to lead the free world an Israel-India alliance will only contribute to the freedom that a continued Pax Americana protects. It would be helpful in any future conflict in the Pacific and the alliance could expand to the Gulf countries, East Africa and maybe even Egypt.

Economically and technologically the obvious expansion would be towards South Korea and Japan. Militarily, it could aide and potentially replace the U.S naval presence in the Persian Gulf and allow it to concentrate its forces more in the Pacific. We are not talking here of a relationship that will replace the U.S military tomorrow or even next year.

This is a long term process and requires the governments, corporations and individuals in both countries to be aggressive in turning a relationship into an alliance. And it will require the cooperation and encouragement of the United States which will have to agree to support this and similar alliances even if it does not agree with all the tactics used in a moment of crisis.

It is time to start looking forward and to stop depending on the goodwill of the American people as America, too faces major fiscal, strategic and military challenges of its own.

Disclaimer: the views expressed in this opinion article are solely those of the author, and not necessarily the opinions reflected by angrymetatraders.com or its associated parties.

You can follow Ira Slomowitz via The Angry Demagogue on Substack https://iraslomowitz.substack.com/