AMT Top Ten Miscellaneous Votes for the 4th of November

10. Priorities: Not to dismiss the execution of beloved Peanut the Squirrel by New York authorities recently, but lets reflect on the fact that this little fellow made international news while wars are raging, and nearly 300 people in the U.S are dying from drug overdoses per day. Social media is rather powerful.

9. NBC: Kamala Harris appeared on Saturday Night Live for roughly 90 seconds this weekend, this created criticism and questions about unfair airtime for the Vice President. SNL is lucky to get more than 5 million viewers per episode on average. To try and apologize for the potential trouble, NBC then gave Donald Trump free commercial airtime twice yesterday, once during a NASCAR race which on average attracts over 3 million viewers, and on a Sunday night NFL broadcast which averages sometimes up to 22 million viewers.

8. Saber-Rattling: There is a potential Iran is waiting on the outcome of the U.S vote for President before undertaking more military actions. Deciding if and how they are going to launch another attack on Israel, depending on who wins the U.S election because of the potential ramifications is likely part of their military strategy.

7. BTC/USD: Bitcoin as of this writing is trading near 68,500 USD. The digital asset continues to bounce around rather intriguing resistance. On Tuesday of last week Bitcoin traded near 73,500 momentarily, while the highs are certainly noteworthy, support for the speculative asset has been around 66,000 since the middle of October. There are reasons to suspect Bitcoin will display a large amount of volatility this week, particularly when the new U.S President is known.

6. Forex: As of this writing the USD/JPY is slightly below 152.000, the EUR/USD is around 1.09000, the GBP/USD is near 1.29650. The question is where these currency pairs and other major FX assets will be in three nights. Day traders dreaming of riding momentum via financial institutions need to understand the equilibrium of risk and reward. In other words, the same amount of money you can make, is likely the same amount of money you can lose. Risk management will be a life preserver for many speculators this week.

5. U.S. Data: This past Friday the Non-Farm Employment Change numbers came in wildly below the 106,000 jobs added estimate, the result of only 12,000 hired was rather shocking, but met with almost muted bewilderment. Also, the jobs numbers showed another revision lower from the previous month. Advanced GDP quarterly numbers, on Wednesday the 30th of October, also missed their estimate coming in with a 2.8% gain compared to anticipated growth of 3.0%. The U.S economy is still under stress.

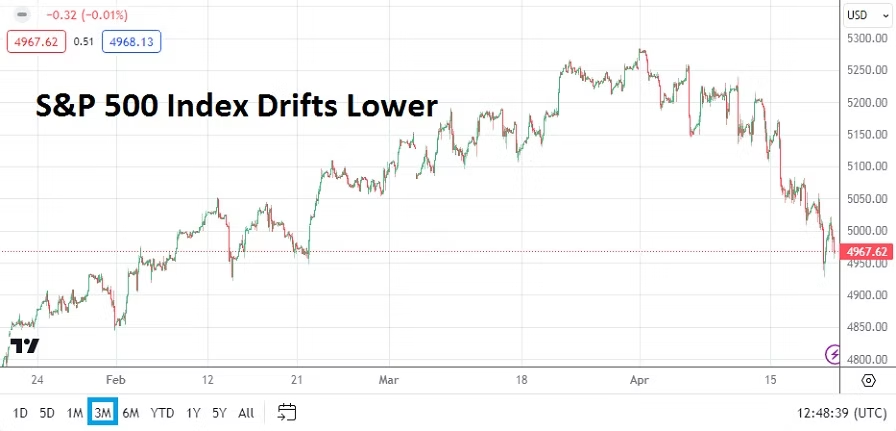

4. Barometers: Risk adverse trading has been widespread the past handful of weeks. While gold has reached new highs and is slightly below the 2,750.00 mark for the moment, one month from now will be a telltale for gold and many assets. Since the end of September a number of narratives have been heard trying to explain the results seen across the board, but the simple answer is caution has entered the markets. U.S equity indices are still flirting with highs, even as they have suffered downturns in recent trading. WTI Crude Oil is near 71.50 USD per barrel. Gold, U.S equities and WTI Crude Oil will react to the outcome of the U.S election and serve as solid behavioral sentiment indicators in one month when compared to current prices.

3. Federal Reserve: If last week’s U.S economic data had been delivered without the fanfare of the U.S election approaching, Fed observers would likely be anticipating a dovish sounding FOMC Statement coming on the 7th of November. Instead, the USD has remained rather strong as risk adverse trading has been demonstrated in the broad markets. The Fed is certainly in a position to cut the Federal Funds Rate by another 0.25 basis points, some could even argue for another 0.50% cut. However, the Fed is likely to cut interest rates by a quarter of a point and sound rather cautious as they too read the landscape in the wake of the U.S voting results. Mid-term outlook from the Fed will be scrutinized this Thursday.

2: Nervousness: Day traders who decide to participate in the broad markets near-term may also enjoy walking outside and looking at approaching storms and dreaming about the fury about to come. Being anxious before and during large risk events when outcomes are unknown is a survival instinct. Speculators need to protect themselves over the next couple of days. Tranquil trading in all major assets may appear, but as tomorrow grows long assets will begin to percolate and by Wednesday almost all financial markets will be boiling. While this is certainly being hailed as the most important week of the year because of the U.S election and the Federal Reserve, it is also a very dangerous time to be trading. Those with limited funds may want to hunker down in a safe place and watch the markets create bedlam over the next 48 hours.

1. U.S Election: The vote is less than one day away when old standards are considered. However, more than 72 million votes have been cast early in the U.S already. That’s more than 45% of the total U.S vote during 2020, when 158,434,567 votes were counted. While the media bangs the drum regarding the incoming results tomorrow, it is important to note that many Americans and global observers are merely waiting for the final results to be announced. The end of the election campaign is nearly upon us, now financial institutions and traders await clarity. Wednesday the 6th of November is going to be an interesting day for the markets.