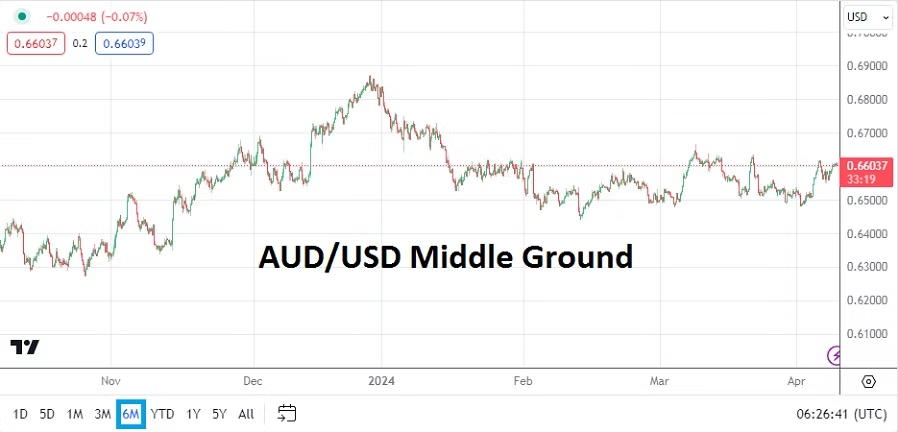

New Year's Thought on AUD/USD Potential Intervention by RBA

AUD/USD One Year Chart as of 1st January 2025

1 year chart of AUDUSD showing decline and lows as rumors swirl about the Reserve Bank of Australia contemplating intervention due to weak Australian Dollar.

AUD/USD and AMT thoughts: Australia’s govt is led by the Labor party which is socialist based, so it would be no surprise if they and the Reserve Bank of Australia believe (wrongly) they can intervene to help the strength of the AUD, when actually they should work on improving the fundamentals of their economy with solid fiscal policy. But being socialists they don’t know how to do that. Labor is going to lose big in the next Australian federal government election.