USD: Hidden Jobs Data Shows Potentially Intriguing Weakness

Forex traders like many market participants react to the ‘noise’ of U.S headline data results. The recent U.S jobs numbers published last Friday is certainly an example. The USD surged in strength on the backbone of more hiring via the Non-Farm Employment Change numbers. Also the Average Hourly Earnings beat expectations showing the cost of labor had become more expensive.

The U.S Federal Reserve stood in place last Wednesday before the jobs report. Pointing towards some troubling inflation, and mentioning the labor market was tight, the Fed refused to give a timetable regarding potential Federal Funds Rate cuts. The U.S central bank is showing more patience about coming interest rate cuts than many hoped on and had wagered.

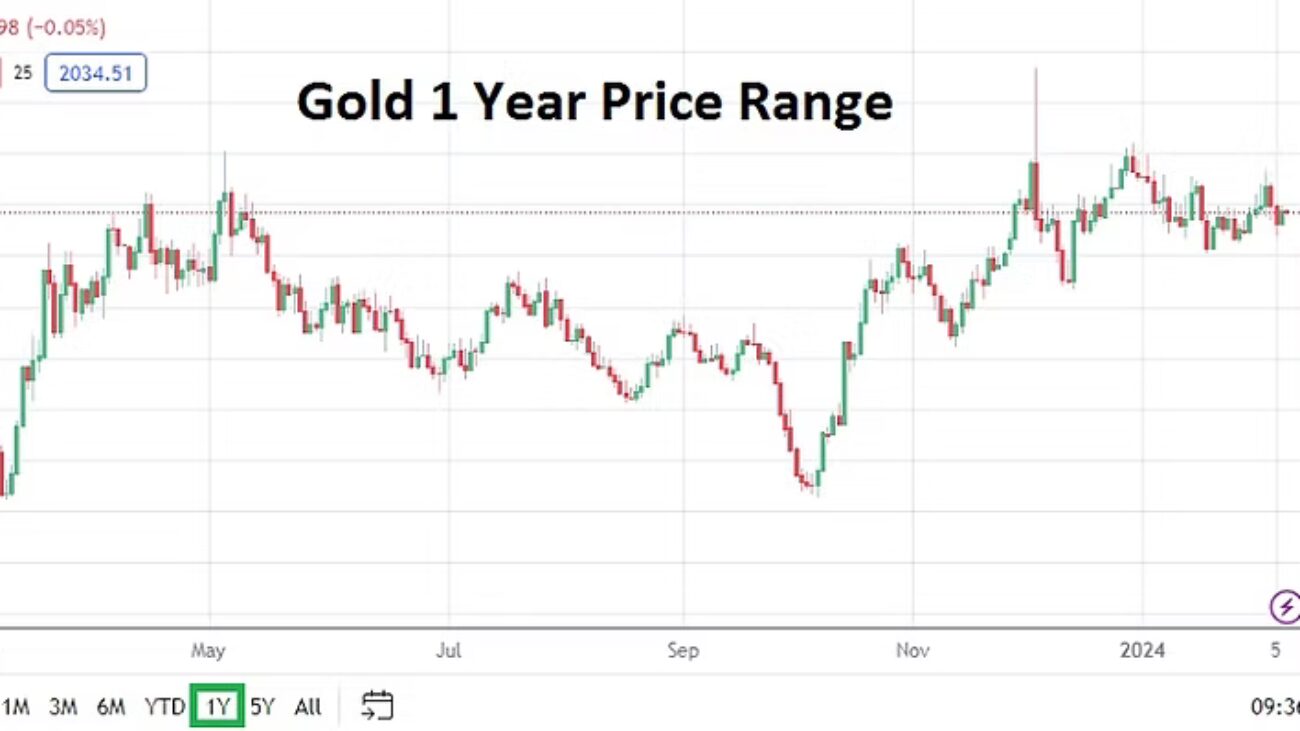

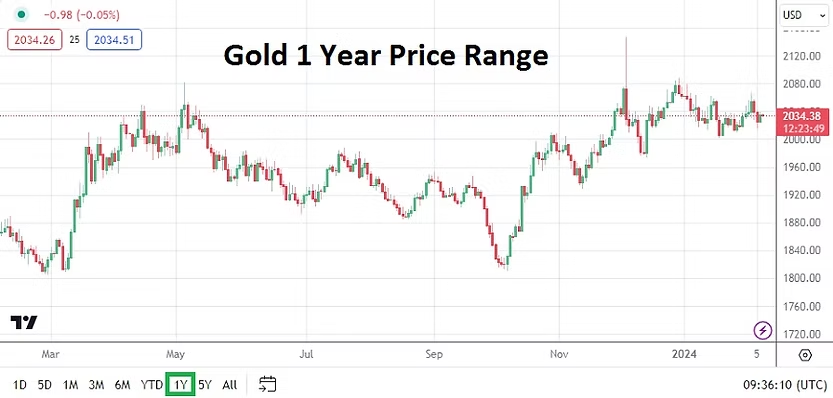

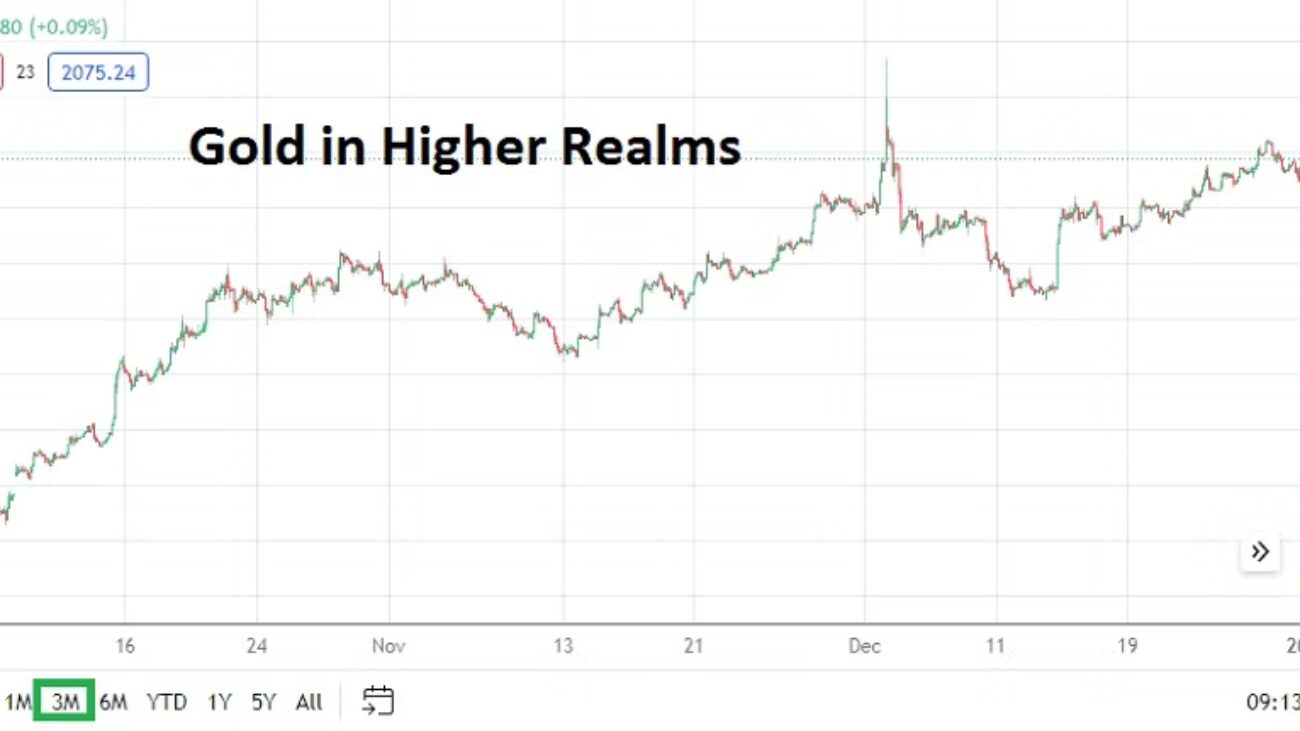

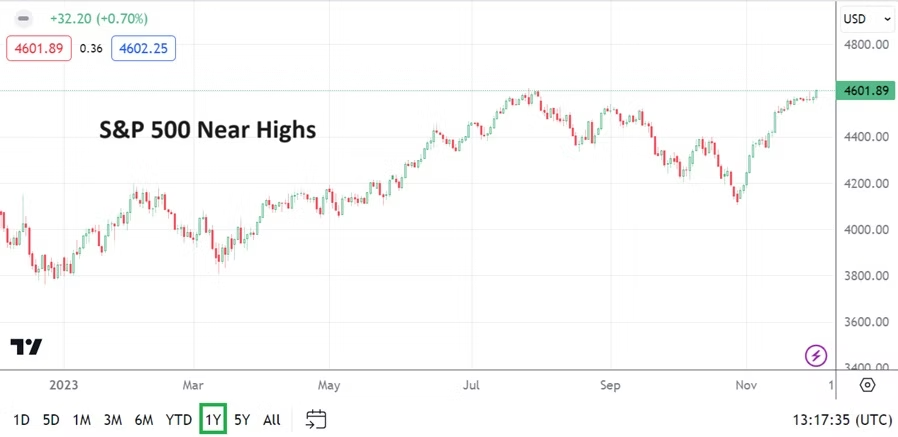

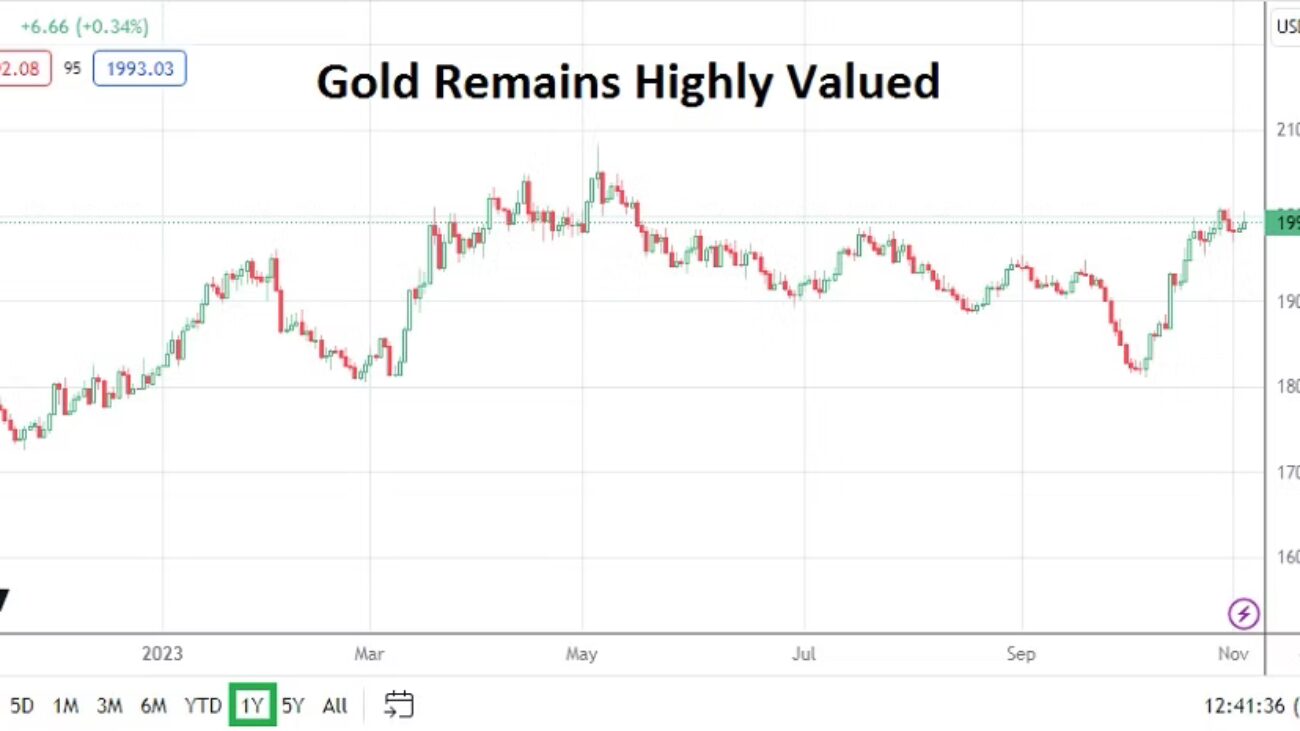

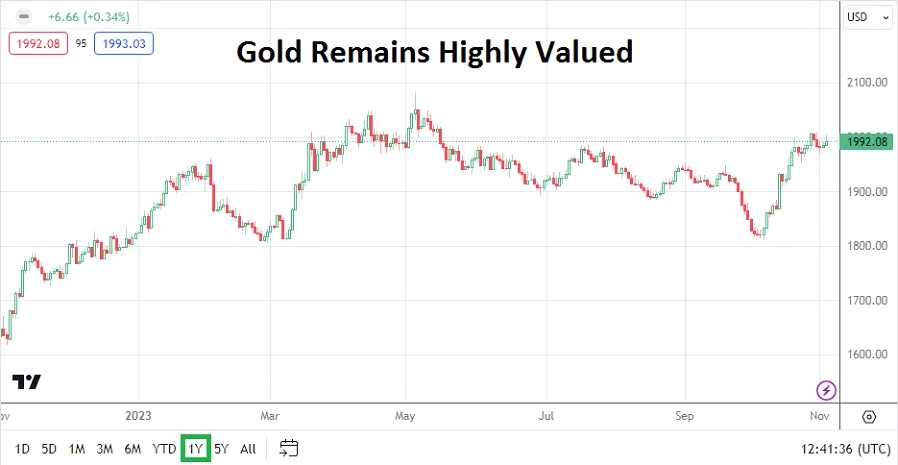

Yet, there continues to be signs of anticipation for a weaker USD in the mid-term. The price of Gold remains within its higher elements, and U.S Treasury yields remain lower (although it must be said the past two weeks have seen an incremental move higher). And as a sign of potential inflation erosion, energy prices continue to be polite, which means the costs of logistics may continue to ease (except to say concerns about Suez Canal availability and chaos in the Red Sea are certainly risks).

The fact that gold remains solid in value, and energy prices remain relatively low, and that support levels in Forex via the USD continue to drift near realms seen on the 13th and 14th of December is an intriguing behavioral sentiment clue. Perhaps it is a sign large institutional players believe they know something others are not considering regarding the future direction of the USD fundamentally.

There are always risks for day traders. Having solid information which is correct and can affect values in Forex, commodities and even equities is important for speculators, but is also hard to find when there are limited resources regarding market intelligence.

U.S Jobs Numbers Headline may be Misleading

Importantly, while last week’s jobs numbers on the ‘surface’ scared many large players who believed the USD will get weaker, thus causing the significant reactions via reversals in many major currency pairs teamed against the USD; there is some evidence from the U.S jobs statistics that needs consideration which was not widely reported. It is important to read beyond the headlines.

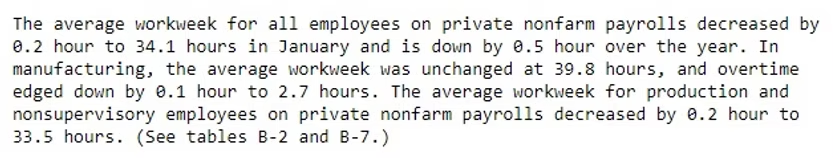

The amount of hours worked in the U.S on a weekly basis has eroded. Added to this consideration is that the stronger hiring numbers may still have been affected from seasonal needs due to the holiday season. This sets the table for the next U.S jobs numbers as a significant report on the 8th of March, and one that will have a big impetus on Federal Reserve’s monetary policy outlook and USD.

The U.S Bureau of Labor Statistics Employment Situation News Release on the 2nd of February (https://www.bls.gov/news.release/archives/empsit_02022024.htm) reported the following:

Perhaps it is conjecture to speculate the average workweek for employees decreasing is a telltale sign of weakening employment numbers to come, but it might prove to be a useful insight. Layoffs via U.S corporations continue to make news as companies seem to be bracing for a downturn in U.S economic health in the coming months. If the layoff theme remains noisy it will create the need for action from the Federal Reserve regarding monetary policy.

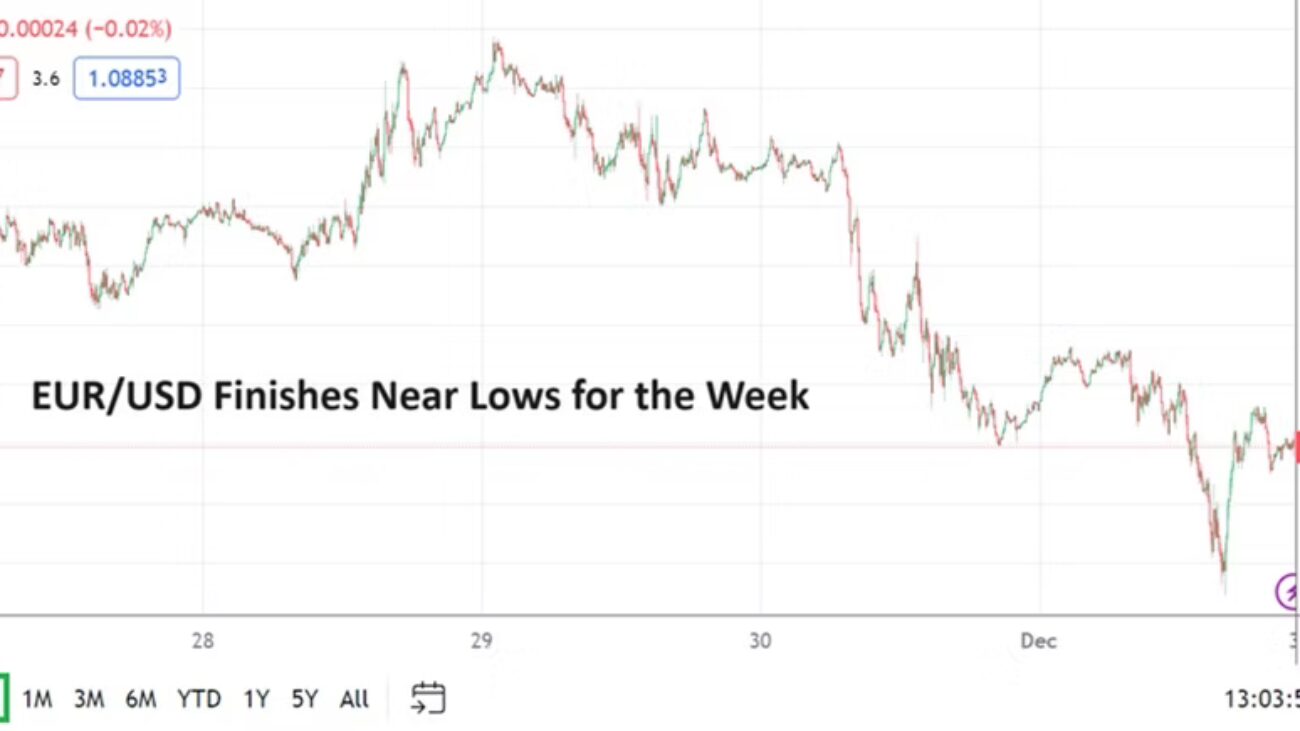

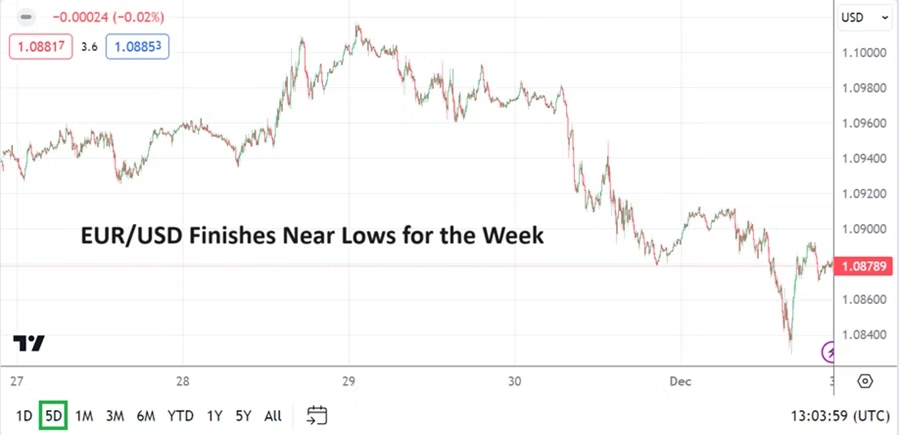

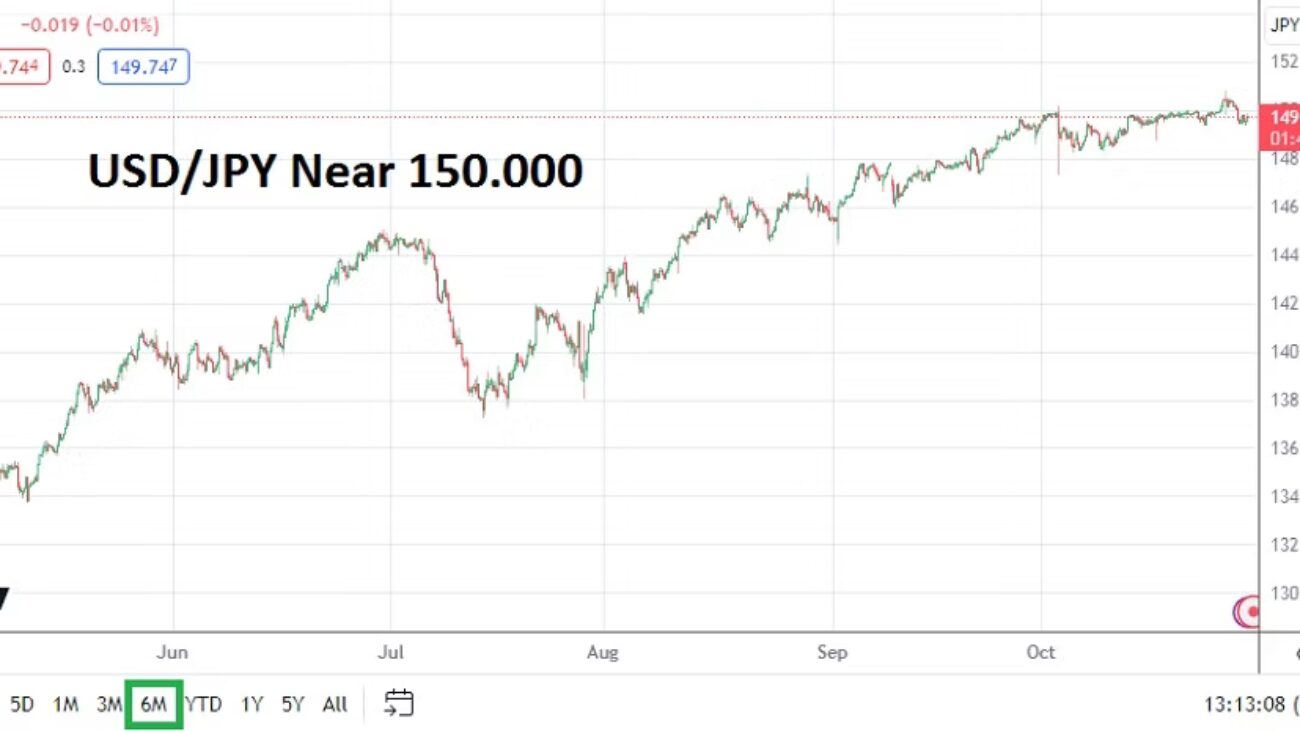

What does it mean for day traders? There are absolutely no guarantees, but the major currency pairs ability to stay within their mid-December prices is a likely sign that financial institutions have analysts which are looking beyond the headline numbers from the recent U.S jobs report, and have also seen the hourly workweek data. In other words support levels in many of the major currency pairs could prove durable. There is no doubt reversals and outliers will be demonstrated, and choppy Forex conditions will happen, but perhaps the current lows in many major currency pairs will start to exhibit resilience.

Trying to time short-term moves via behavioral sentiment that is generated by statistics found ‘hidden’ away in the jobs numbers is speculative. But if traders want to consider the potential of technical support, it might be worth a consideration to think the U.S employment picture isn’t as strong as the headline ‘noise’ is projecting.