Nervous? Central Banks Cautious, FX and Asset Equilibrium

Sometimes when looking for ideas regarding a risk analysis article it is difficult to find a timely subject. Exaggeration is often used to grab attention. This week and next will not be one of those times. Equities, Forex and commodities have produced nervous results since last Monday. The broad markets appear to be in search of equilibrium, but price velocity while higher than normal hasn’t produced a volcanic surge of pain. Financial institutions were presented less than inspiring jobs data this past Friday and day traders hopefully had their risk management working. Everyone will need to be paying attention this week too.

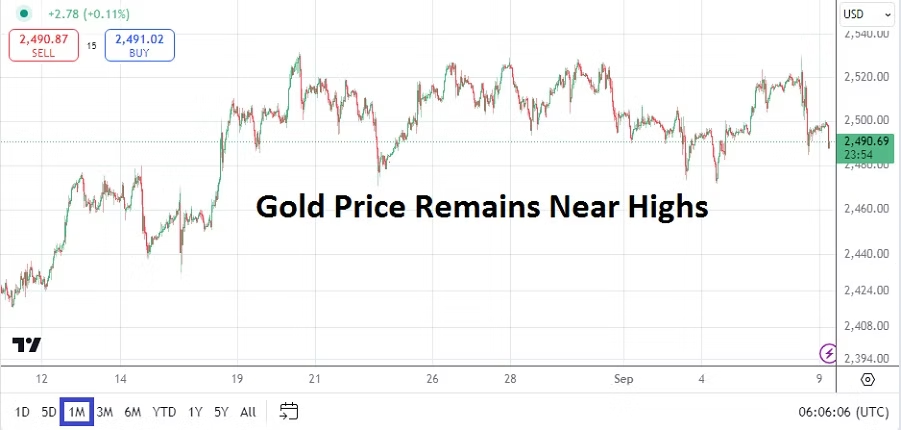

Gold has hovered around the 2,500.00 level and while it certainly is a short-term speculative asset for day traders, the precious metal also serves as distinct barometer of behavioral sentiment and long-term guidance regarding inflation. Recent economic data has created concerns in financial institutions about the potential for a stronger than anticipated U.S downturn. The volatility and sell off in equity indices last week is a clear sign investors would like the Federal Reserve to be more aggressively dovish.

This coming week is packed with a variety of risk events which will keep all market participants engaged. Long-term investors may feel calm as they rely on their outlooks which extend over a handful of years, but anyone who needs a firm grasp on short and mid-term viewpoints might not be comfortable. It is important not to cry wolf too often, but based on the trading results seen the past week it is worthwhile to point to the turbulent outcomes and issue a warning that more volatility could develop.

Some analysts may apply the thought that what we have seen was profit taking, and this can certainly be debated. The coming two weeks have plenty of noteworthy events on the calendar. Besides the listed risk highlights noted below, the Fed will release its FOMC Statement on Wednesday the 18th, the BoE will follow on the 19th and not to be outdone the Bank of Japan will step onto center stage on Friday the 20th of September.

While long-term investors likely believe all variables will return to known price realms and that central banks sooner or later will fall into their proper places regarding monetary policy, day traders who are gambling on short-term momentum must try to figure out where behavioral sentiment is leaning. One of the ways speculators without deep pockets can put the odds in their favor concerning potential profits, is to make sure they are practicing rock solid risk management and not stepping into Forex trades, equity indices via CFDs wagers, and commodities bets when they are displaying rough conditions without being prepared.

Monday, 9th of Sept., China Consumer and Producer Price Index – the inflation reports from China both came in below their estimates earlier today. While some may believe that less inflation than predicted is a good thing, it isn’t when the economy is suffering from deflationary pressures. Lackluster spending from consumers in China continues to highlight negative sentiment about prospects for growth. The USD/CNY is near the 7.1125 ratio as of this writing.

Tuesday, 10th of Sept., U.S Presidential Debate – while not an economic data event, investors might want to pay attention to the answers given by Vice President Kamala Harris and former President Donald Trump. The race for the White House appears to be close according to various polling. It could prove interesting for financial institutions if Harris is questioned about her ideas regarding taxing unrealized capital gains.

Wednesday, 11th of Sept., U.S Consumer Price Index data – the inflation reports will certainly get the attention of financial institutions. If the annual CPI report comes in weaker than the previous outcome, this could spark more USD centric weakness in Forex. All asset classes will react to the inflation numbers because they are likely to play a major part in the Fed’s FOMC decision in one week’s time. The USD Cash Index is still lingering near lows, but for it too resume a more bearish trajectory, financial institutions will need to believe the Federal Reserve is going to become increasingly dovish.

Thursday, 12th of Sept., European Central Bank Main Refinancing Rate – The ECB is definitely going to cut its prime borrowing interest rate, the question is how much of a haircut they are going to provide. A 0.25% cut has certainly been traded into the EUR/USD, but many financial institutions believe there is a possibility to see a 0.50% basis cut. Can the ECB and Christine Legarde be aggressive? The European Union remains under recessionary pressures and inflation data is starting to show signs of erosion. The amount of the interest rate cut from the ECB will also be a telltale sign regarding what will happen via the Federal Reserve on the 18th of September. The EUR/USD will react to the European Central Bank’s decision, and global assets in far off places may react too because behavioral sentiment among investors may shift according to the rhetoric provided. Prediction: The ECB will stay cautious and cut by 0.25%, while saying a November rate cut is likely if economic data remains under pressure. Having said the above, the ECB should cut by 0.50% this Thursday, if they do not – financial institutions will not be pleased unless ECB President Legarde sounds very dovish during her Press Conference.

Thursday, 12th of Sept., U.S Producer Price Index – more inflation data from the U.S will provide investors an other opportunity to glance into the Fed’s looking glass. But if these PPI numbers meet or are near the anticipated results, financial institutions may be reacting to the ECB’s rate decision more because they might believe it is a better clue regarding the Fed’s Federal Funds Rate decision which will come in a handful of days.

Friday, 13th of Sept., Japan Revised Industrial Production – this number may not get much attention, but because the Bank of Japan will release its Policy Rate on the 20th, the outcome could impact existing sentiment in the USD/JPY. The Japanese Yen has continued its bearish trajectory and traders who are wagering on more downside should not bet blindly on selling positions because intraday trading remains very choppy. The USD/JPY is now touching values last seen in a sustained manner in early January of 2024, lower values were seen in December 2023, and lower ratios that traversed the 138.000 realm and proved choppy occurred in the spring of 2023.

Saturday, 14th of Sept., China New Home Prices, Retail Sales, Industrial Production – this parade of data from the nation will be important. Foreign investors remain concerned about China’s economic prospects. The deflationary winds that have been blowing in the Asian giant have been well documented. The results from these three reports are expected to be lackluster.