Federal Reserve Bank Decision and FOMC Statement Wednesday

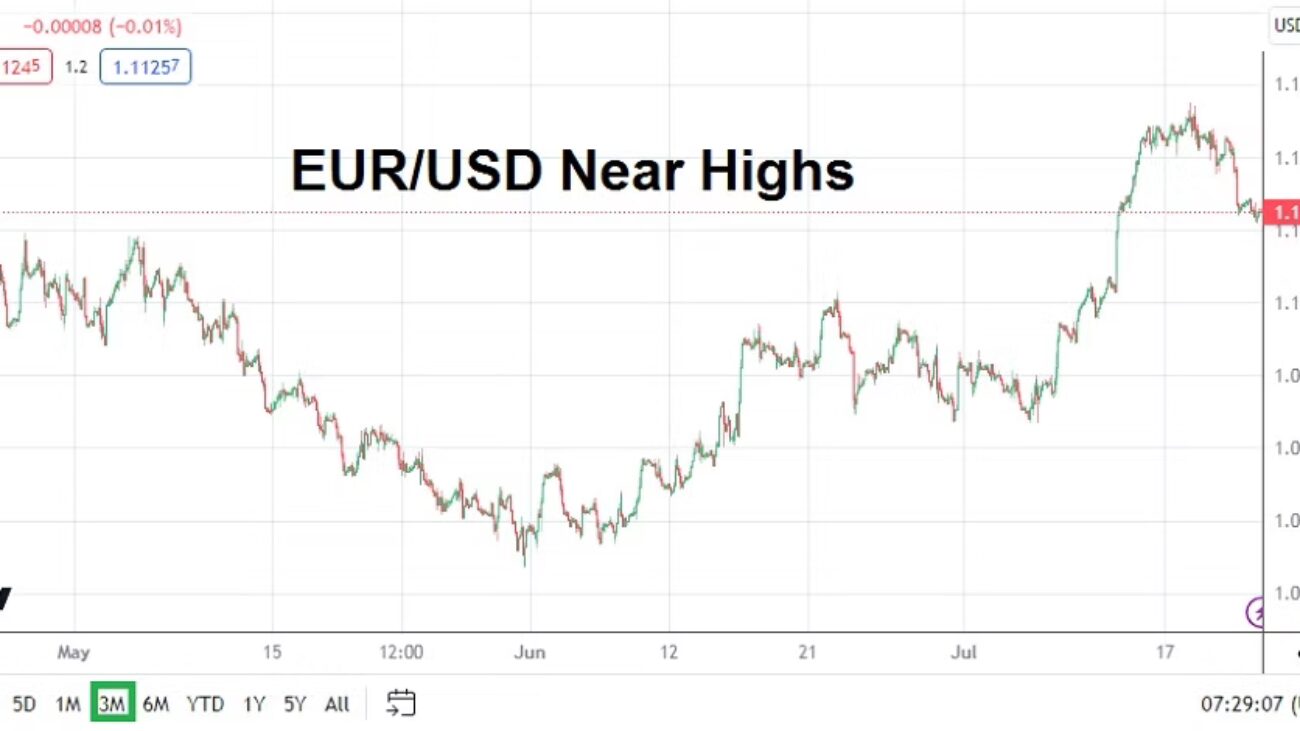

Monday, 24th July 2023, E.U Flash Manufacturing and Services PMI – a slew of Purchasing Managers Index readings will come from European Union nations including Germany and France. Projected outcomes are expected to show slight improvement in the Services readings and mixed results from the Manufacturing sector. The EUR/USD may get a momentary nudge from the published numbers.

Monday, 24th July 2023, U.K Flash Manufacturing and Services PMI – the British economic reports are anticipated to come in below last month’s readings. The U.K did report slightly better Retail Sales numbers last week, but a Consumer Confidence outcome was weaker than expected. The GBP/USD might react briefly to the U.K PMI data.

Monday, 24th July 2023, U.S Flash Manufacturing and Services PMI – the reports from the States are forecast to be below last month’s numbers. U.S data produced nervous and weaker economic insights last week from the Housing sector. The Federal Reserve will certainly give some attention to the PMI data as they try to gauge the strength of the U.S economy while likely preparing to hike the Federal Funds Rate on Wednesday. The PMI statistics could factor into the Fed’s outlook, which is the crucial ingredient that financial institutions want to understand and still have skepticism about while considering the Federal Reserve’s potential actions later this week.

Tuesday, 25th of July 2023, Germany ifo Business Climate – the results are expected to be slightly weaker than last month, showing businesses in Germany are not optimistic about current conditions and outlooks.

Tuesday, 25th of July 2023, U.S CB Consumer Confidence – the report is anticipated to show U.S consumers are feeling more confident about their spending habits. If this report is stronger than expected, it could be one final clue before the U.S Federal Reserve springs into action the next day.

Wednesday, 26th of July 2023, U.S Federal Funds Rate and FOMC Statement – most financial institutions are prepared for a hike of 0.25%, which would bring the key borrowing cost to 5.50%. This number has been anticipated for a handful of weeks and any deviation would cause volatility. Forex has largely priced in the rate hike. Speculators need to pay attention to the FOMC Statement regarding outlook regarding comments on inflation, growth and what the Fed is prepared to do moving forward.

Because U.S inflationary price pressures showed a decrease recently, many financial institutions are likely betting on a slightly more optimistic sounding FOMC Statement. The question is if the Federal Reserve will risk sounding dovish, or continue to voice disciplined rhetoric about its ability fight inflation as needed and keep a middle ground. For all the criticism of the U.S Federal Reserve if it can raise interest rates without causing a credit crunch on mid and small sized banks the remainder of the summer, that would be a victory – particularly if it is perceived the U.S central bank will not raise hike the Federal Funds Rate the remainder of the year. However, that remains to be seen.

Thursday, 27th of July, E.U European Central Bank’s Main Refinancing Rate and Monetary Policy Statement – the ECB is expected raise their key lending rate by 0.25% and back up their recent ‘tough’ and heightened rhetoric regarding inflation. Again, day traders should understand the interest rate hike to 4.25% has been anticipated and largely digested into Forex. The question is the ‘voiced’ concern from the ECB within its Monetary Policy Statement. Financial institutions will react to the ECB Press Conference led by Christine Legarde, which comes about half an hour after the release of the Monetary Policy Statement.

Friday, 28th of July, Japan BoJ Policy Rate and Outlook Report – the Bank of Japan is the one global central bank that marches to its owner drummer and this will not change in the near-term. The BoJ is expected to keep its policies of low interest rates in place, voice concern about inflation and likely say their ‘boat’ remains steady on the water. The USD/JPY will have reacted before to the rhetoric from the Federal Reserve in the middle of the week. Yes, the USD/JPY could see a flourish of volatility on Friday, but most of it will have likely been seen already on Wednesday and early Thursday.