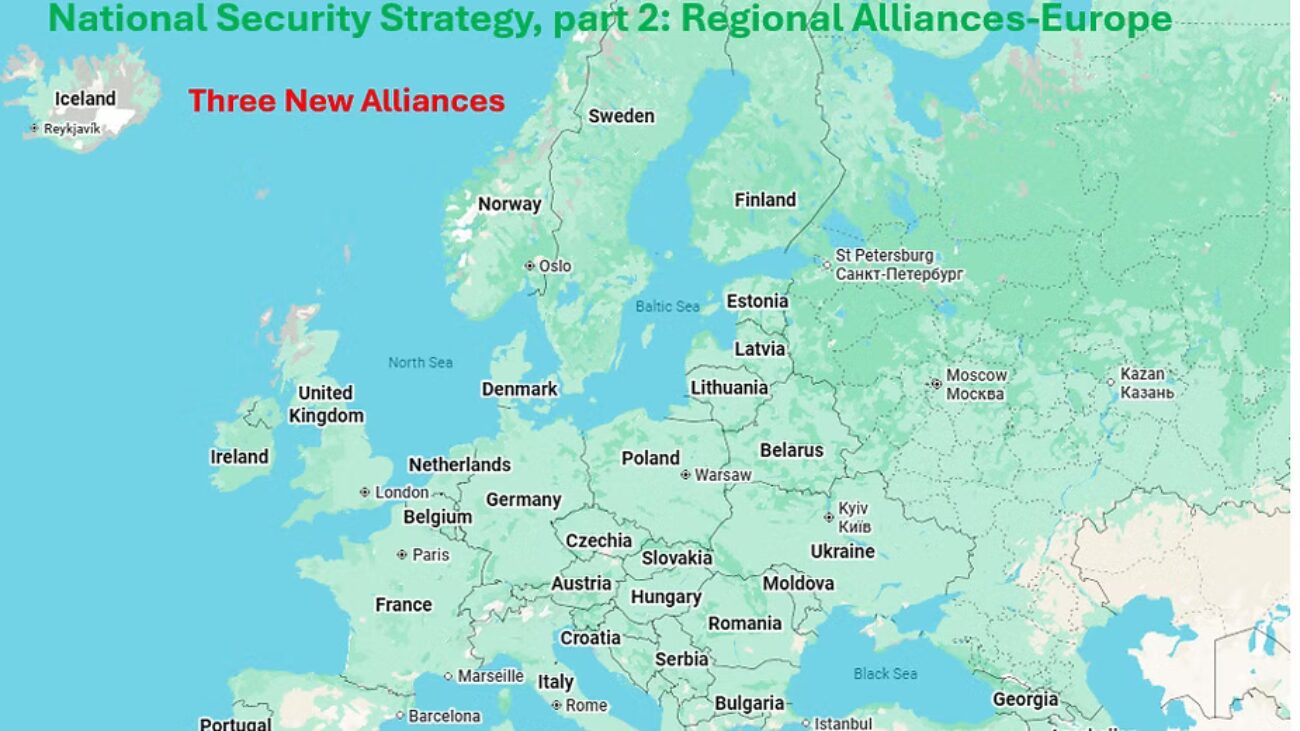

U.S National Security, Part 2: Regional Alliances - Europe

Opinion: The following article is commentary and its views are solely those of the author. This article was first published the 25th of December via The Angry Demagogue.

As we continue our tour of the administration’s National Security Strategy we will stay with “part III: What Are America’s Available Means to Get What We Want?” and move to the sixth bullet point: “A broad network of alliances, with treaty allies and partners in the world’s most strategically important regions” and work through the important regions that the strategy documents – Asia, Europe, the Mideast and Africa. For good or for bad we will need to split these regions up since the key point is forming coalitions that can handle their actual region. Sweden can’t be part of a coalition to protect Italy’s interests in the Mediterranean and Japan won’t be protecting Singapore.

Some U.S allied countries, like Australia, Israel and India will be involved in multiple regions helping lead alliances in all areas important to them. With that in mind we will point out the first mistake of the discussion on regions and that is Europe. We will suggest something here that would not usually come from the mouth of a hawk and pessimist and that is that NATO has no real mission and needs to be replaced by a series of alliances that make more sense. While the fear during the Cold War was a Warsaw Pact ground invasion into Germany and beyond which would have required the totality of American and European forces, Europe now is facing a Russia that could not conquer Ukraine in nearly four years of war. That is not to say that Russia is not to be feared only that each part of Europe needs to ally to face a Russian onslaught in its own theatre.

Italy is not going to send troops to Sweden to prevent an attack and Norway won’t be helping Greece in any fight. Turkey is a country that other NATO countries fear more than trust, especially regarding Russia.

In short, NATO needs to be broken up into different alliances where each country will be allied with countries whose fall would affect its national security. The United States can either be a signatory to these alliances or it can decide how involved it wants to get in any conflagration depending on its own interests at that time. It can decide to position ground troops in the countries, supply air cover or, as in the 12-day war between Israel and Iran, help with missile defense and in providing the final blow with weapons only America has. Or – it can decide that it will never participate. One hopes that that won’t happen, but each alliance will need to be ready to fight on its own.

We can include France and the U.K as large countries with advanced armed forces as allies to all of these alliances. France certainly can contribute air power to each of the alliances that are faced against Russia. As for the U.K, it is difficult to know where that country is going but its navy and air force are still powerful.

Today we will deal with north, central and western Europe.

The Baltic Alliance

This would be an alliance that includes Poland, Germany, Sweden, Finland, Norway, Denmark, Latvia, Lithuania and Estonia and would provide cover for land, air and naval battles. Each of these countries, with the exception of Germany, has a border with Russia and all are on the Baltic Sea – a key waterway for them and for Russia.

An alliance of these countries would force them to concentrate on those areas necessary for their defense. An incursion, for example into Finland would force Poland to mass forces on its border with Russia and Belarus (Poland borders Russia in Kaliningrad which is separated from Russia proper by Lithuania) and Germany to move forces to Poland. All countries could also contribute ground forces to Finland as well as naval and air power.

The only thing missing is the lack of a nuclear umbrella. That is no small issue but can be dealt with by support or threats from France or the U.K.

The Atlantic Alliance

Aside from helping the Baltic Alliance, France and the U.K will have major responsibility along with the Netherlands for patrolling the North Atlantic and, with help from Portugal, and Spain the South Atlantic. As the Atlantic Ocean can be considered one of America’s seas, this alliance will need to have the close cooperation if not outright membership of the United States. Canada too, will need to be part of this alliance. We can include the increasingly important Arctic Ocean into this alliance’s responsibilities.

As we move towards the south Atlantic countries such as Morocco, can be included as well as other western African allies of the west. An alliance like that could encourage western African countries to abandon close security and economic ties with China and Russia. The “border” of this alliance would be that squiggly line in the middle of the Atlantic that separates the Eastern and Western hemispheres.

The Central European Alliance

We can look at the smaller central European countries that formed the heart of what was the Hapsburg Empire but are not front line countries bordering Russia – Romania, Hungary, Slovakia, Czech Republic, Austria, Serbia and Bulgaria – and we have an alliance that, backed by Germany, Poland and the United States, would create a further deterrence to Russian encroachment into Europe proper.

Where, do you ask does Ukraine fall in this European alliance structure? That answer will have to come from the major European powers in concert with the United States. Adding Ukraine to the Baltic alliance might be viewed as another attempt to NATO-ize them by the Russians. However, attaching them to the less threatening Central European Alliance of smaller countries might be the excuse and “victory” that Putin would need to end the war. But we are getting ahead of ourselves here. Ukraine is a problem that can only be solved if the West decides to actively join the fight against Russia (unlikely) or when Putin and Russia get tired of the fight and look for a way out that could allow them to claim victory (more likely than the former, but sadly, a long way off).

The Administration’s concentration on regions and how certain countries can become leaders in support of western and American interests is correct – but the breakdown of the regions has to go beyond the post WWII world. The place of America in the post-cold war world, with a China that wants to challenge America’s economic and military interests and leadership needs to break down old alliances into more manageable and logical pieces.

The wild card in all of this is, of course, the will of the European powers to take their own defense seriously. The Baltic Alliance we spoke about seems to be filled with countries that understand the threat from Russia, but do they recognize the threat to them from the alignment, the Axis if you will, of Russia, Iran, North Korea and China? And of more importance have they yet come to understand the threat to their countries, as they know them, from open immigration and from their own abhorrence of families? The former is something only the governments can handle, the latter though, must come from the people themselves.

A whole generation (or two in many instances) of Europeans have grown up not only as “only children” but in families that have no aunts and no uncles, no cousins and only very elderly grandparents, if that. They have grown up in other words without families. Will the young generation see the importance of families to themselves and their countries or will they continue the nihilistic lives that they parents have “sanctified”? Religious institutions, too will have a major role in this challenge. No amount of “parental leave” and childcare subsidies will convince the young to marry and have children – will only come from a change in the culture. Is Europe up to it?

Disclaimer: the views expressed in this opinion article are solely those of the author, and not necessarily the opinions reflected by angrymetatraders.com or its associated parties.

You can follow Ira Slomowitz via The Angry Demagogue on Substack https://iraslomowitz.substack.com/

Related article of interest by Ira Slomowitz https://www.angrymetatraders.com/post/u-s-national-security-usd-reserve-currency-importance