India Insider: K-Shaped Economy via Growth and Inequality

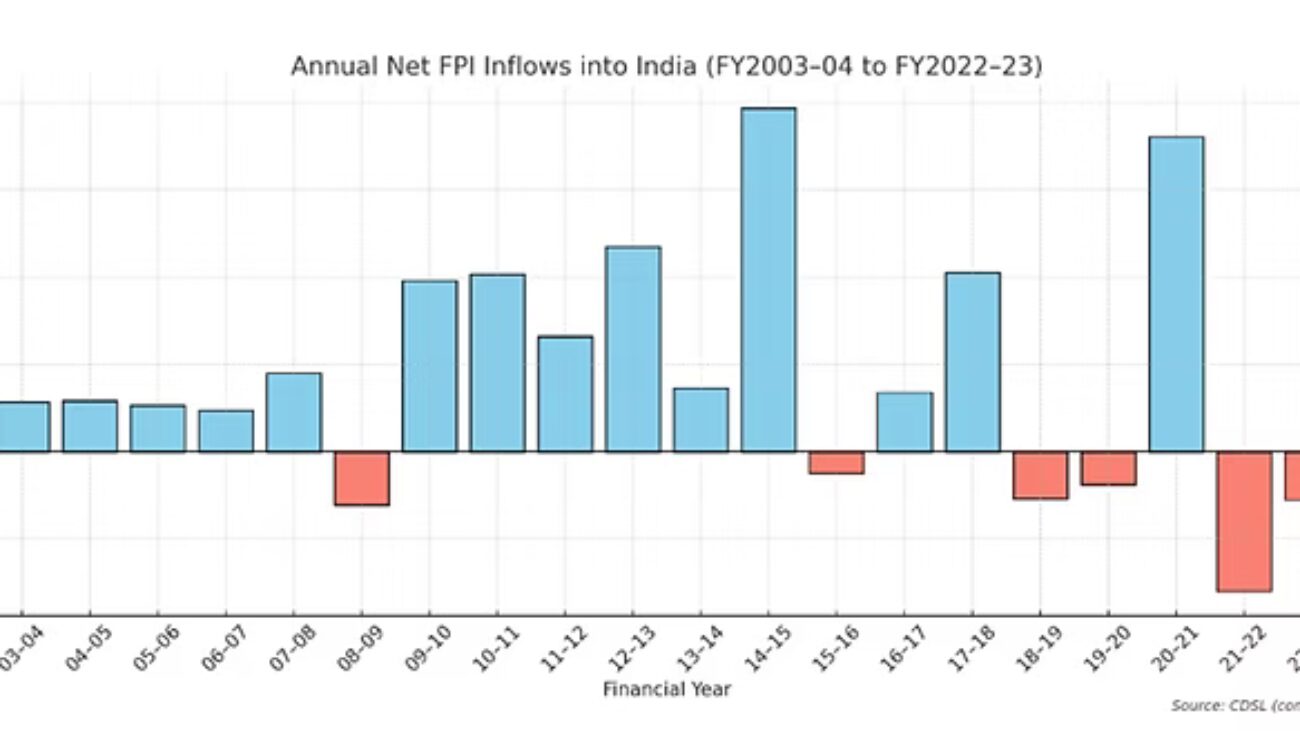

ndia’s growth story remains inspiring, supported by the National Democratic Alliance (NDA) government’s policies that attract foreign capital into infrastructure projects. The last decade has seen improvements in railways, ports, bridges and highways. In Financial Year 2025 (1st April 2024 to 31st March 2025), gross Foreign Direct Investment inflows reached USD 81.04 billion, a 14% rise from the previous year, reflecting global investor confidence under the China+ strategy. However, net FDI shrank to just USD 353 million, its lowest on record, as significant divestments and profit repatriations offset the inflows.

India’s stock market has rallied recently, driven by strong corporate performance despite tariff-related jitters. Corporate capital expenditures by listed non-financial companies rose over 20% year-on-year to exceed 11 lakh crore ($125 billion USD) in FY25, surpassing the government’s capital expenditures of 10.5 lakh crore ($120 billion USD). This signals robust investment by large firms.

In contrast, the unlisted corporate sector, contributing two-thirds of corporate value added and holding most corporate debt, remains weak with falling profits and tax payments. The divergence comes from the markets they serve: listed firms cater to higher-income households, while unlisted firms rely on low and middle income consumers, where progress and recovery is slower. Corporate tax receipts remain healthy, but are largely driven by listed firms. Collections in FY25 reached 12.72 lakh crore ($145 billion USD), while net direct tax collections climbed to 22.26 lakh crore ($254.97 billion USD).

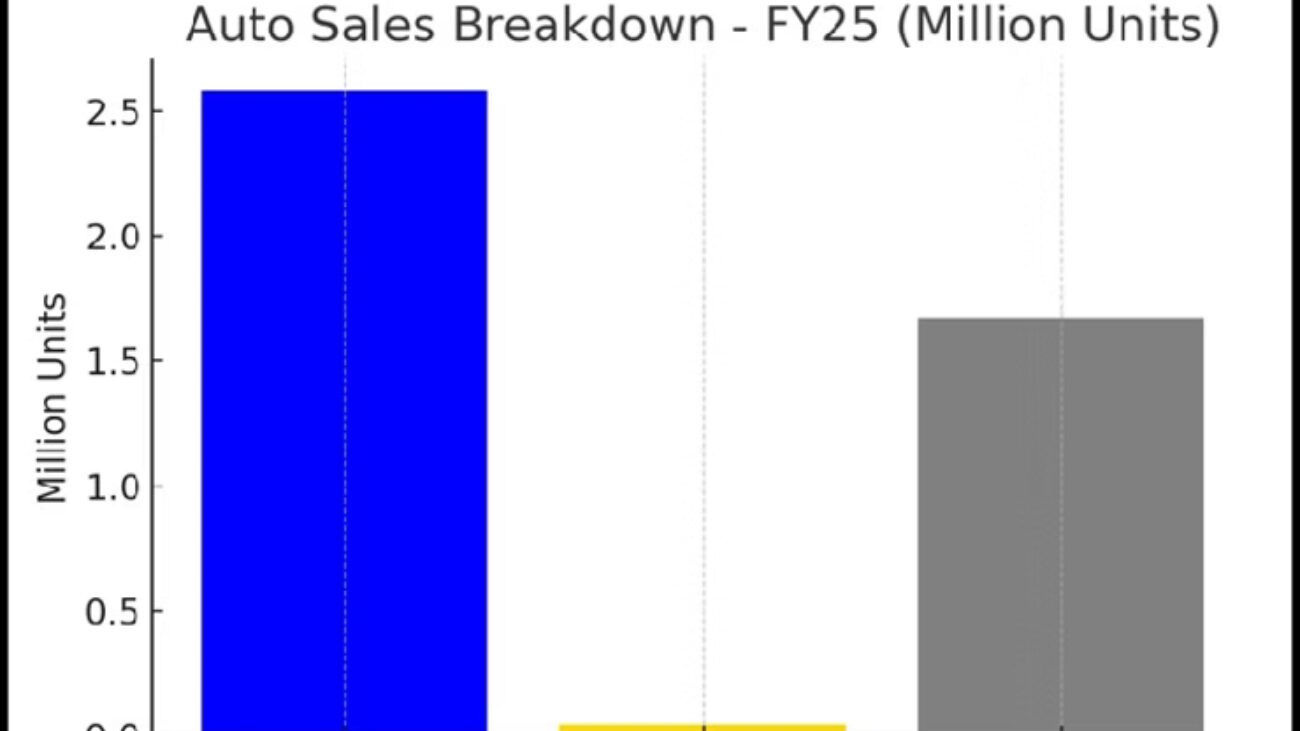

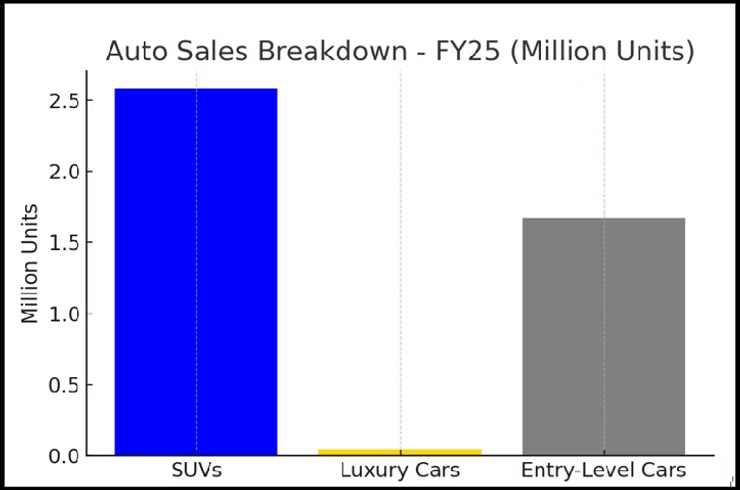

Consumer trends mirror this imbalance. Passenger vehicle sales hit a record 4.3 million units, led by SUVs and luxury cars, while entry level cars and two-wheelers saw subdued demand. The aspirational middle class, especially tech professionals in their late 20s and 30s, drives premium demand, leaving the mass market segments of the population behind.

Nearly half of the nation’s workforce remains in low productivity sectors contributing only a fifth of national income. Wage growth is stagnant in several States. Micro, medium and small enterprises struggle with credit, policy bottlenecks, and institutional constraints. This is India’s K-shaped economy as large corporates and affluent consumers thrive, while smaller businesses and lower-income groups lag. India’s booming economy hasn’t delivered progress for all quite yet.

The country remains the fastest-growing major economy in the world, above 6%. A crucial question is whether this astonishing growth will create mass employment and better equality. Unfortunately, without updated consumer expenditures data since 2011–12 due to the lack of a recent census, policymakers rely on capital expenditure and earnings trends to gauge consumption patterns which deliver incomplete insights. The next census for India is scheduled to be conducted in 2027. More transparency is needed statistically to help alleviate the K-shaped results via the Indian economy.