Gold: Not a Love Note but Recognition of Long-Term Importance

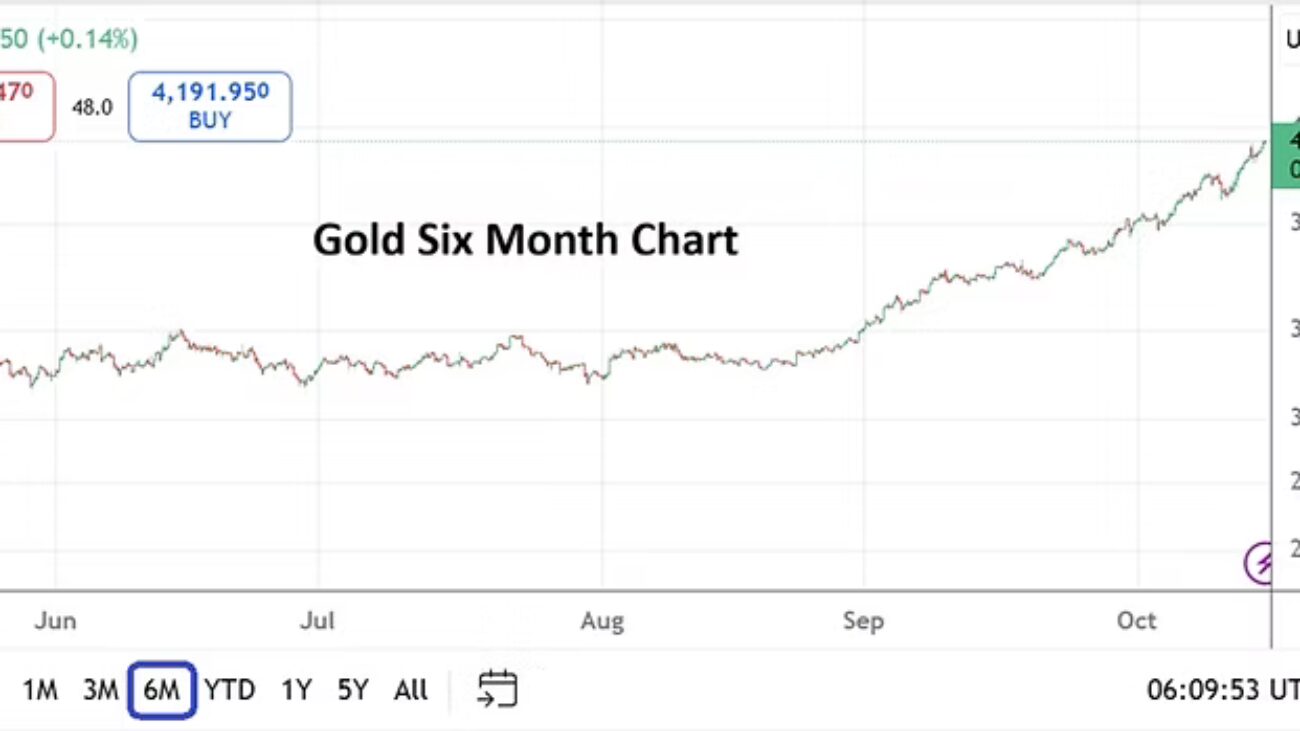

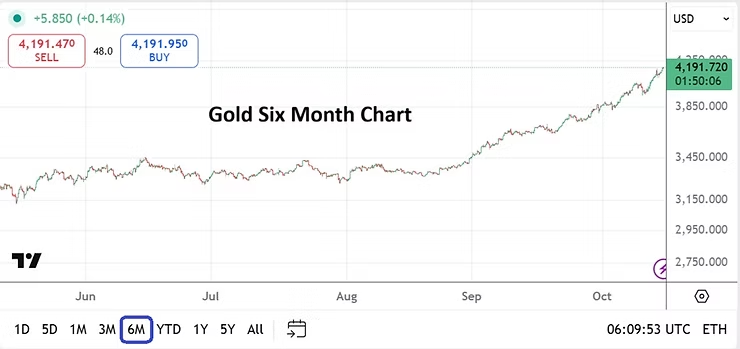

The U.S is now starting its second week of the government shutdown. Gold is near $4,190.00 as of this writing, which may be looked on as sign by some that some investors have bought into the precious metal because of a lack of faith in certain things. ‘Certain things’ being written in a way that points out the rather complex mix of perceptions that could quantify into all moving parts causing the bull run.

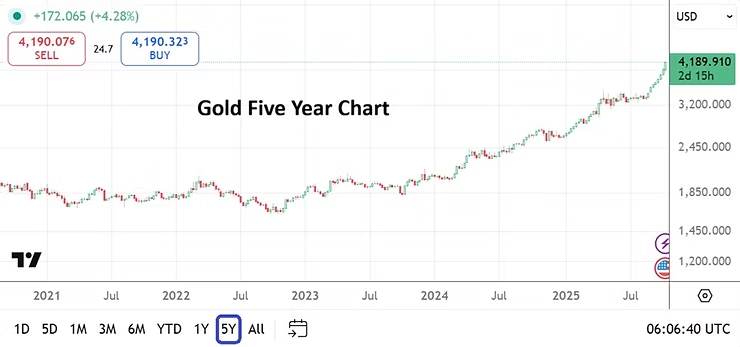

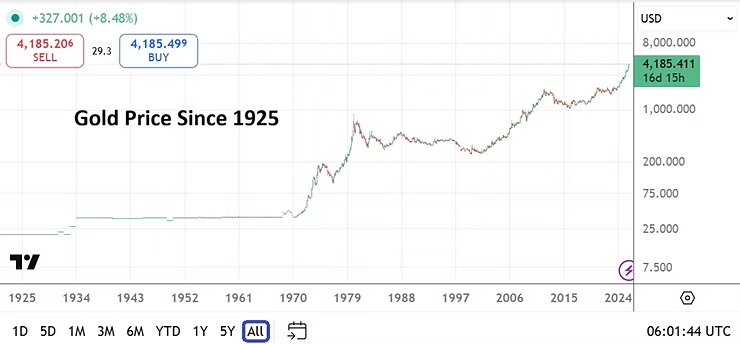

If you are a regular reader you will probably have figured out that I do not believe Gold is traversing higher because of a mere government shutdown. The precious metal has seen an upwards trend develop in earnest since the middle of October 2022 when it was trading around $1,640.00. Behavioral sentiment is important within Gold, and this has been the case for almost 6,000 years according to archeologists and historians.

In August 2011 Gold was near $1,900.00. In December of 2015 the precious metal was back to almost $1,000.00. This is written to show that in a little more than a four year period Gold lost nearly half its value in the relatively recent past.

This doesn’t mean I am writing to warn Gold is going to lose half its value suddenly and will be testing $2,000.00 in four years time. It points out that even though the precious metal is considered a hedge against inflation, that speculative elements are fantastically strong when large players buy and sell in unison and can cause periods in which Gold becomes overvalued and then experiences downturns.

We have seen this bullish show in Gold before. Milestone numbers are significant in the minds of the public, which often causes the thinking that they should have bought some gold in the past when it was cheaper. But interestingly enough for Gold is that it is almost always considered expensive by the general public. The value of fiat currency is highly correlated to the value of Gold in an unflattering way. While this is an obvious statement for many, it is important to note that we are all looking at the value of Gold while using hindsight.

Yes, I can hear influencers singing in unison in the background ‘do not forget about Bitcoin’, but I ask permission to do so. Hindsight is not always comfortable and I have been proven wrong about the digital currency frequently. However, I still remain somewhat optimistic that my bet on Gold is a better wager compared to Bitcoin regarding value in the future. And by future I mean for all-time. There is not enough foresight to know what Gold will be valued in one thousand years compared to Bitcoin. Yet, I remain much more confident about Gold being around than BTC in a millennium.

People can speak about a debasement of fiat currencies, including the USD. Like it or not the USD remains the dominant go to currency of global enterprise and this is unlikely to change over the next decade. The USD and other currencies are plagued by a constant loss of overall value due to inflation caused by a myriad of reasons. Rising prices in goods are unlikely to suddenly disappear, the costs of commerce and consumer products may start to gradually slow periodically, but the price of things seldom grows cheaper over the long-term.

Yes, the case can be made that by owning Gold it does not serve the economy well, because it is not an asset that is easily spent, but that is an argument for Adam Smith, John Maynard Keynes and Milton Friedman to enjoy in heaven. In the meantime down here on Earth, Gold can be speculated upon, bought and sold, and treated as a precious metal that will likely always be valued highly.

This is not a love note for Gold, it is meant as a way to say the precious metal is fairly priced considering the state of the world. $4,000.00 per an ounce of Gold could certainly turn into $5,000.00 in the not so distant future – like six months or one year depending on zeal. Speculative elements certainly aim for targets that psychologically please aspirations.

Day traders as always are faced with a dilemma. Looking for more upside and partaking in the bullish trend is a logical thought and perhaps even wager, but the use of leverage while battling the intraday and intraweek reversals in the marketplace make the ambition of profiting on Gold comparable to time spent at the casino. We know winners talk much louder about their money gained compared to the losers who vanish into the crowd and keep quiet.

So I write this as a warning, Gold may not be worth more one year from now than it is today. However, I will venture forth the notion that in ten years time Gold will be significantly valued higher than it is today. Will inflation suddenly be tamed globally, will confidence in fiat currencies emerge with a strong dose of optimism? No. Certain fiat currencies will do better than others via Forex. However, as a store of value Gold will likely remain an impressive asset to own.