USD and the Fed: Parade of Jobs Data Ready to Make Noise

U.S data last week created landmines for Forex speculators and the Federal Reserve. Global financial markets return to full action today following the long holiday weekend. Growth and inflation numbers from the States last week provided more unsettling results for financial institutions. While Forex has proven difficult for many traders, the major equity indexes are flirting with highs but also running into some intermittent headwinds.

In December of 2023 the Fed was interpreted as having confirmed it would be able to cut the Federal Funds Rate during the 2024 calendar year rather consistently. Dovish policy had been anticipated by financial institutions which began to sell the USD aggressively in November. But by the end of the Christmas week the USD had essentially hit lows in many major currency pairs, and as January started reversals intensified.

The last three months of trading has produced choppy conditions in Forex, but one thing is clear – financial institutions no longer believe the Federal Reserve will be able to aggressively cut the Federal Funds Rate. The Fed has now begun to show signs that it is nervous regarding U.S economic data, this as growth via GDP numbers has remained firm, inflation sticky, and consumers resilient. Clouds shadow Forex and day traders have been hampered by a lack of solid trends.

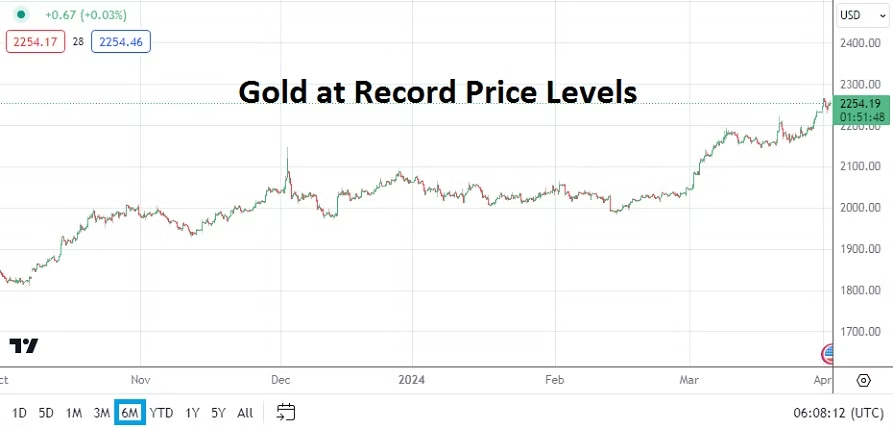

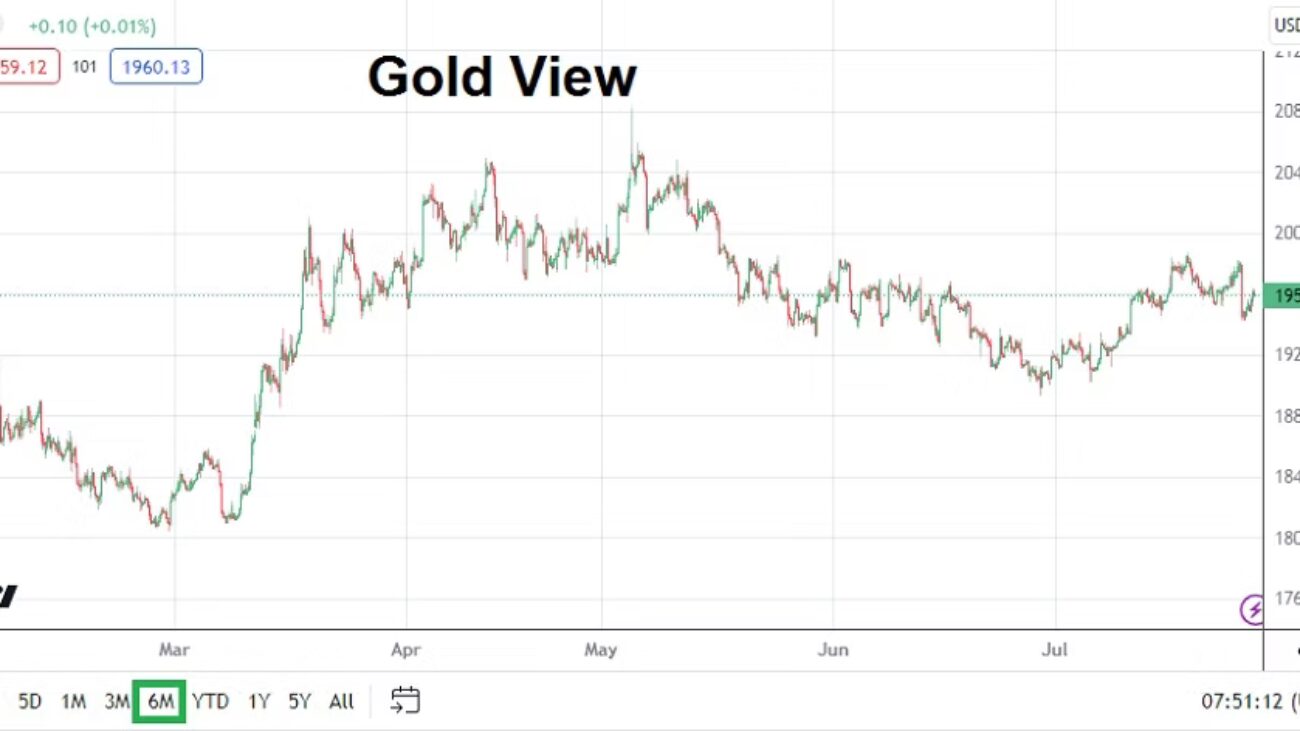

Gold is trading near record price levels. The fact that the precious metal is touching all-time values as the USD has been strong has flustered some speculators. But traders need to remember Gold is affected by large players, including nations, that may be hedging USD bets and preparing for political instability. The price of Gold may underscore belief the U.S Fed will have to cut rates at least a couple of times this year no matter the economic facts on the ground, because this is an election year and if the central bank doesn’t deliver on its ‘promise’ jobs at the Fed may be at stake.

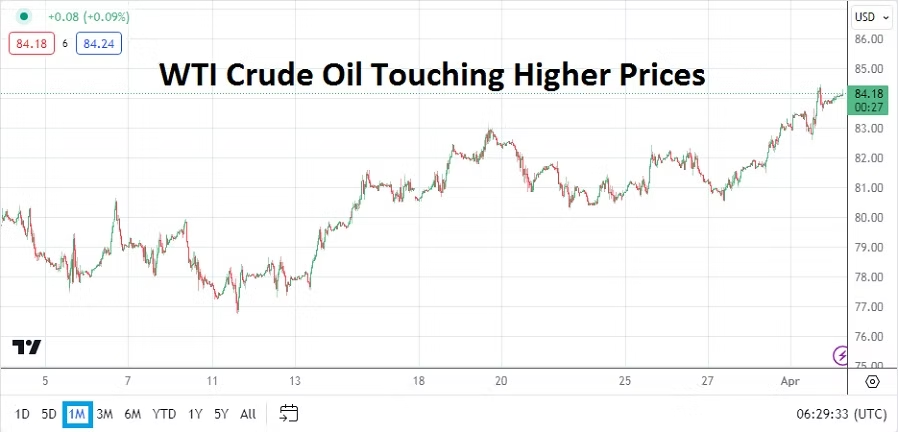

Not making anything easier for Federal Reserve policy is the higher price of WTI Crude Oil which has reached the 84.00 USD per barrel price. If energy costs go higher this will not help the fight against inflation. OPEC will be conducting a meeting this week. As an aside the price of Cocoa per metric ton is now over 10,000.00 USD, which is more expensive than Copper. While the price of Cocoa is not a game changer for global financial markets, the higher price will make chocolate more expensive, which some traders may find disagreeable as they try to relax and watch their speculative wagers while trying to nibble on their favorite snack.

Monday, 1st of April, U.S ISM Manufacturing – both the Purchasing Managers Index reading and the Price numbers came in higher than expected. The stronger results show the U.S economy remains better than anticipated by the Federal Reserve, which has been counting on its higher interest rate to slow down growth and inflation.

Tuesday, 2nd of April, European Manufacturing PMI – the European Union and Great Britain will release their business readings today. The results will demonstrate insights regarding sentiment. Financial institutions are worried the European Central Bank and Bank of England may have to consider lowering their interest rates before the Federal Reserve. The EUR/USD and GBP/USD will react to the results.

Tuesday, 2nd of April, U.S Federal Reserve FOMC Members – there will be appearances throughout the day in the U.S from various Federal Reserve members who will make the case for their monetary policy outlooks. It should be noted that Jerome Powell will be speaking on Wednesday. The JOLTS Job Openings will come out before the FOMC members speak. While the JOLTS report will not cause earth shattering reactions, the jobs data is the beginning of the parade regarding employment statistics for this week.

Wednesday, 3rd of April, U.S ISM Services PMI – taking into account the Manufacturing report came in stronger than expected on Monday, the Services data will be watched by financial institutions. If this report is better than anticipated, USD sellers will not rest easy. The ADP Non-Farm Employment Change data will also be released on this day.

Thursday, 4th of April, U.S Weekly Unemployment Claims – the Federal Reserve has been counting on employment strength to erode based on their notion that higher interest rates would create ‘lagging’ reactions in the jobs sector. Jerome Powell has said the Fed is anticipating weaker employment data. The results from the weekly report will not be as significant Friday’s data, but should be given attention by day traders in Forex.

Friday, 5th of April, U.S Non-Farm Employment Change and Average Hourly Earnings – the climax for speculators this week will be these jobs numbers from the States. If the numbers produce less hiring than expected this would help USD bearish momentum. Wages will also prove crucial regarding behavioral sentiment for financial institutions. Simply put, the Federal Reserve is anticipating that weaker employment numbers are going to be seen, if this doesn’t happen it might cause major volatility in Forex going into the weekend.