Summer Optimism as Forex and Equities Focus on Fall Outlooks

Fed Chairman Jerome Powell admitted the obvious at the Kansas City’s Fed’s Jackson Hole Symposium last Friday. The realization the U.S Federal Reserve is going to cut interest rates confirmed what many financial institutions had positioned their trading desks for via forward cash Forex contracts over the past month.

The USD has been expected to grow weaker by many people because most knew the Fed would have to state a September rate cut would be delivered. The question that was also somewhat answered is the notion if the Fed will also cut in November. Though Powell certainly did not say a rate cut would happen in November, his rhetoric made it clear the Federal Reserve is considering a dovish perspective which could translate into additional cuts down the road.

The Fed has been criticized for being too passive and while Powell can be congratulated for his rather unemotional Federal Reserve leadership, he and the Fed can certainly be faulted for not reacting quickly enough to ‘transitory’ inflation and then not responding until this past weekend to the need for cutting interest rates with dovish rhetoric. Let’s also remember the U.S Treasury (government) is on the line to pay exorbitant costs for debt repayments because of bad U.S fiscal policy.

As an interesting related side note, the head of the Brazilian Central Bank, Roberto Campos Neto, made a strong appeal for governments to be fiscally responsible while speaking at the Jackson Hole Symposium this past weekend. While he could have been talking to any number of nations regarding spending, his points were obviously meant to highlight his disagreements with the Brazilian government led by Lula da Silva and the Workers Party. Roberto Campos-Neto stated that approximately 50,000,000 (yes, million) people in Brazil receive government allowances, while only about 43,000,000 people are earning money via employment and business enterprises. Traders who want to keep an eye on the USD/BRL this week may be entertained by the potential volatility within the currency pair which is trading a hair below 5.5000 before it opens today. The USD/BRL has certainly not been correlating to broad Forex USD centric weakness, and demonstrates the internal domestic fight between Lula da Silva and the Brazilian Central Bank regarding fiscal policy.

Jobs data from the U.S has continued to turn negative, particularly via revised reports which are being published rather ‘quietly’ as election season approaches. Yet, financial institutions have been aware of the weaker jobs numbers. While the poor jobs numbers combined with eroding inflation is good for USD centric weakness due to the knowledge the Fed will have to reverse from its rather high interest rates, the question becomes how much per the financial institutions selling of the USD has been acted upon in Forex. Is the USD oversold for the time being? It depends on trading timeframes certainly.

Weaker USD centric positions will need more impetus for further bearish trajectories to be seen near-term. Financial institutions may believe equilibrium is being approached, this because it appears interest rate cuts equaling a 0.50% decline seem to have been factored into Forex. Will the Federal Reserve be put into a position in which they will be able to cut by a full basis point (-1.00%) over the next six months?

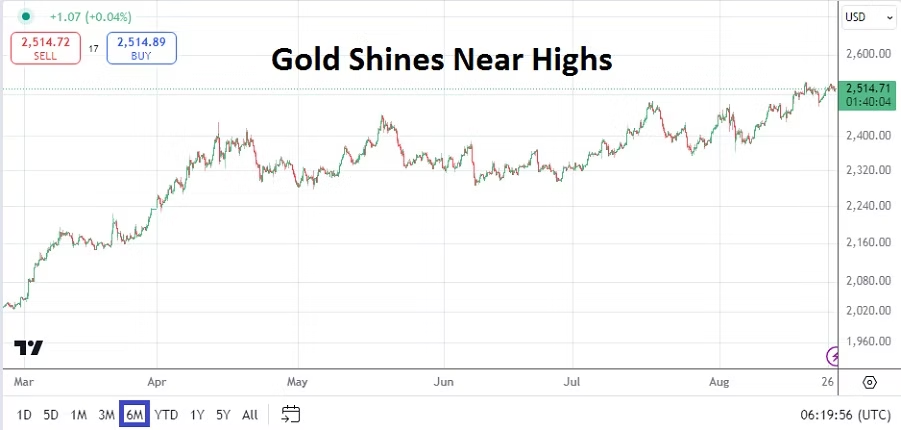

Gold is trading near 2,500.00 plus at the time of this writing. Gold has touched higher levels in the past week and is getting a round of applause from its throngs of believers who proclaim the precious metal the ultimate safe haven against inflation and erosion fears via fiat currencies – including the USD. As a reminder, Bitcoin is highly speculative and doesn’t have the historical (thousands of years) track record that gold has acquired.

The EUR and GBP are traversing higher territories not seen in a while. The EUR/USD is near the 1.11700 level, which was last traded in July of 2023, and it has been since 2022 that sustained prices above this current realm have been traded. The GBP/USD is near 1.32000 and is within a value ratio last seen in March of 2022. Central banks will remain in focus as summer ends and the fall trading season gets underway. The ECB will release their Main Refinancing Rate on the 12th of September, the Fed will present the Federal Funds Rate on the 18th, and the BoE will follow suit with the Official Bank Rate on the 19th.

However, those September dates are still a few weeks away and financial institutions do have data this week which could stir Forex, equity indices and U.S Treasuries in the near-term. Day traders often do not have the ability to rely upon mid and long-term outlooks, and instead have to be content with trying to ride the momentum trends being caused by larger players. While the USD weaker outlook is tempting to rely upon, speculators who are looking for quick hitting wagers need to judge technical charts and try to grasp existing behavioral sentiment which can shift rapidly depending on lengths of time.

Traders should remember the U.S will celebrate its Labor Day holiday next Monday, which sets the stage for potential sudden volatility to flourish before big financial institutions in the States leave for their long weekend. The last week of August should be rather tranquil. Certainly most long-term investors feel as if they have more clarity regarding interest rates and will be able to relax. The hope is that the current calm is not the quiet before the storm due to lingering political issues in the U.S, France and elsewhere. And that escalation of the Ukrainian and Russia war, and the Middle East conflict do not cause sudden surges of bedlam.

Economic data events the remainder of this week that should be given consideration includes the U.S CB Consumer Sentiment reading today. Yesterday’s U.S Durable Goods Orders came in with mixed results as the Core number fell by minus -0.2%, but the broad number came in with a substantial gain of 9.9%.

The Bank of Japan has published their Core CPI data today and the outcome came in below expectations with a gain of 1.8% compared to the estimate of 2.1%. The USD/JPY is trading near 144.790 at the time of this writing as it continues to show bearish tendencies. The Bank of Japan which was heavily criticized in many circles may actually be achieving what they have planned, this as they have tried to stimulate stronger export and confront inflation. Their battle is not over yet.

Australian CPI data will be published on Wednesday. And on Thursday, German Preliminary Consumer Price Index numbers will be released. The EUR/USD could react to this report, but the European Single Currency remains highly USD centric. Which sets the table for the U.S Prelim Gross Domestic Product report also on Thursday. The growth number from the U.S could diminish selling considerations for the USD if the report comes in stronger than expected. However, the GDP Price Index and weekly Unemployment Claims from the U.S could also impact short-term behavioral sentiment and cause a bit of turbulence if negative results are published.

Friday will see more CPI numbers from Japan, CPI and GDP numbers from France, and GDP data from Canada. But before going into the long holiday weekend the U.S will present one more major report with its Core PCE Price Index and the monthly statistic is expected to show a slight gain of 0.2%.

China watchers will get Manufacturing PMI numbers early on Saturday. Recent China data continues to show signs of economic stress regarding foreign investment, domestic consumer spending, and deflationary results. Buyers beware.