The Israel-Iran War is soon to enter its 7th month even though last night was the first face to face confrontation between the two countries.

There was much less panic in the air on the “Israeli street” than one would expect after Iranian threats over the last week. I was clearly wrong in my assessment that Iran would not want to start something big with Israel and risk having a chunk of their strategic power degraded but it is hard predicting what fanatics will do. The question is if the utter failure of the attack will bring Iran shame in the Muslim world or if the fact that they sent missiles and drones will be counted as a “victory” even if no damage was done to Israel. Or it could be that Iran was counting on Biden-Blinken holding back Israel from responding and sure enough, NBC is reporting exactly that:

President Joe Biden has privately expressed concern that Israeli Prime Minister Benjamin Netanyahu is trying to drag the U.S. more deeply into a broader conflict, according to three people familiar with his comments.

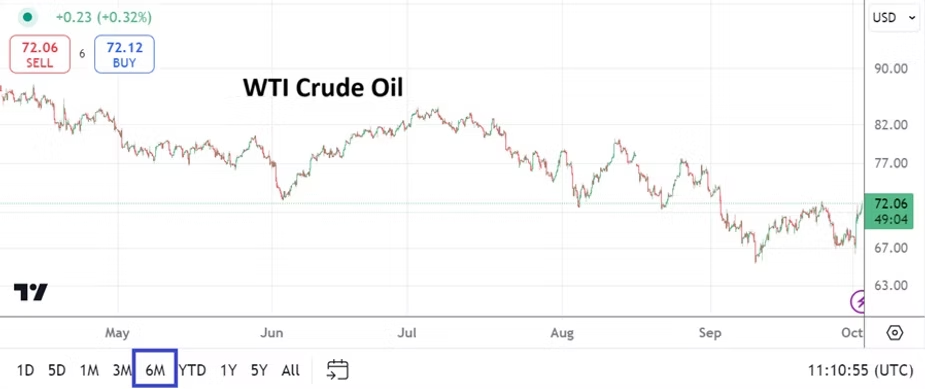

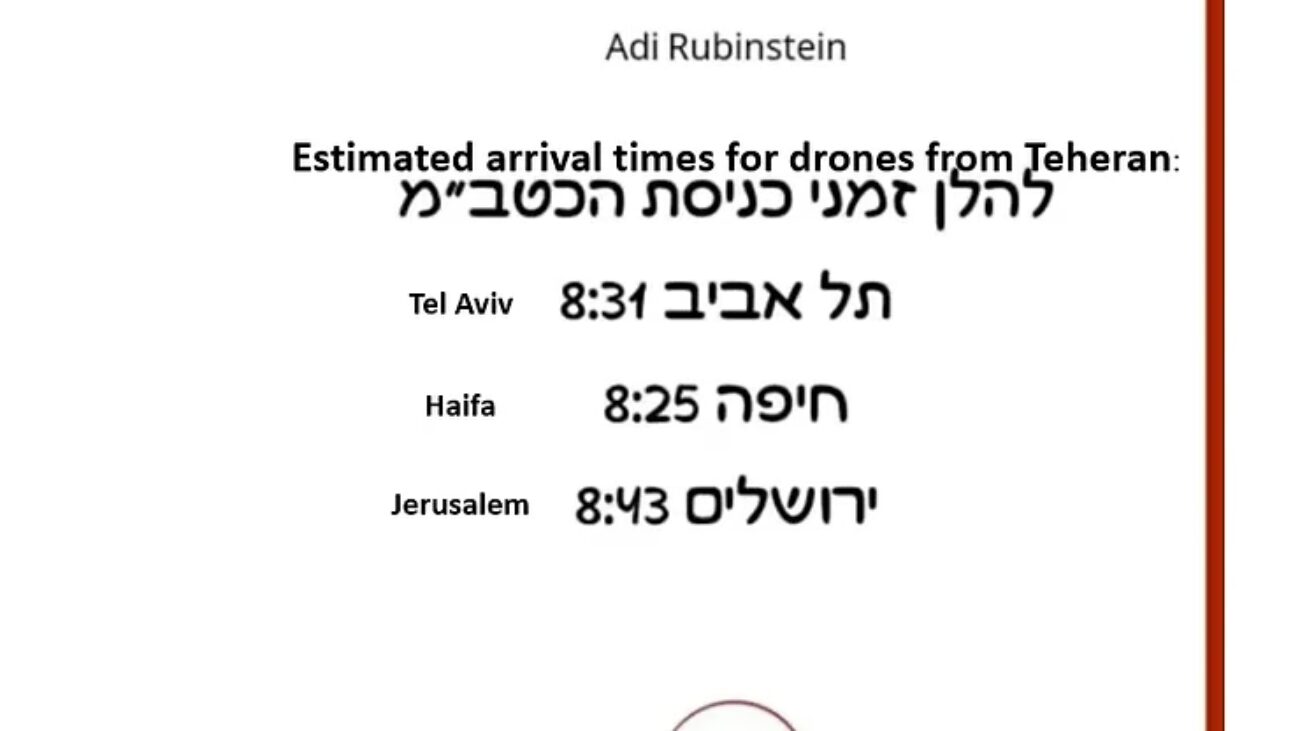

Last night at about 8:15pm IDF Homefront Command announced that all schools and all educational activity would be cancelled until further notice, angering parents everywhere. A few minutes later they announced that 10’s or hundreds of drones were launched from Iran and on their way to Israel. The news reported that it would take 8-10 hours to arrive, sparking this to make its round on the Whatsapp groups in this very interconnected country:

Friends and family in Jerusalem and surrounding areas were awakened by alarms and scurried to the bomb shelters, children in their arms. There were alarms also in the West Bank, the Golan Heights and the Northern Negev dessert. Apparently, the main targets were two air force bases. One was hit by one missile and minor damage was done and the other was untouched. One 7 year old Bedouin girl was critically injured from pieces of a rocket that was shot down. The headline ought to read: Shiite Missile Critically Injures 7 year old Sunni Girl.

The effectiveness of Israel’s air defense system seems to have surprised even the Israeli Air Force and special thanks has to be given to President Ronald Reagan for ignoring the comics and media (but I repeat myself) and many scientists and engineers (the experts!) as they made fun of his Strategic Defense Initiative and called it “Star Wars” – claiming that it was something undo-able and dangerous even to talk about.

Senator Joseph R. Biden Jr., Democrat of Delaware, pressed hard for reassurance about whether the proposed defensive weapons might be fired by mistake, thus provoking the Soviet Union to launch a real attack.

The Biden foreign policy theory for the last 40 years or more is based on not “provoking” your enemy, no matter the cost and appeasing your enemy at any cost.

Special thanks to the U.S armed forces who shot down numerous drones as did the U.K’s air force as well as Jordan’s. There might have been other Middle Eastern countries involved as there is an unofficial regional air defense system set up with Abraham Accord countries and others not part of the Accords. 100% of the suicide drones and 100% of the cruise missiles and 92% of the ballistic missiles were shot down by Israel’s layered “star wars” system.

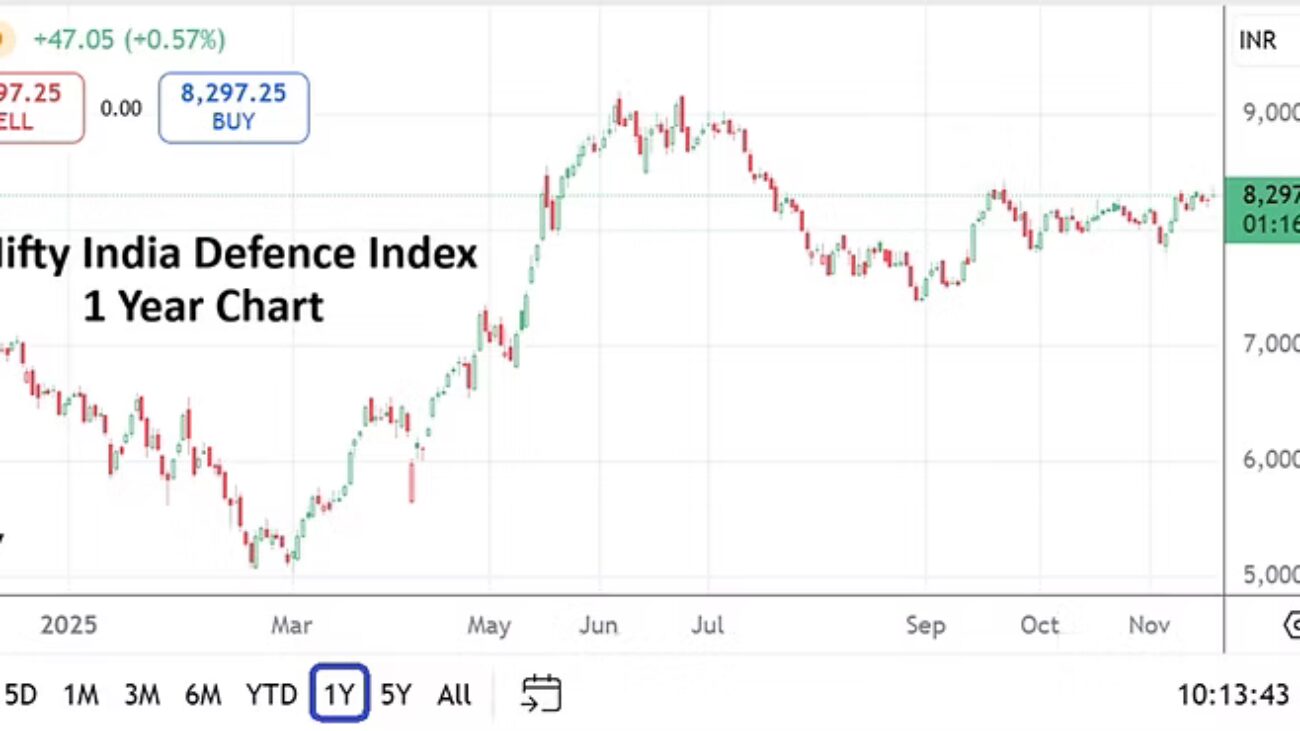

If the IRG is honest with themselves, they will understand that they have been defeated. A combination of 300 drones, cruise missiles and ballistic missiles were shot at Israel at once and no drones and no cruise missiles got through. Of the 110 ballistic missiles shot at Israel, 101 were intercepted and only one reached its target. Israeli defense firms closed higher in Tel Aviv Stock Exchange trading today. I imagine Iran’s potential clients are having second thoughts. China too, must be wondering about their own offensive and defensive systems.

So where does this leave us now?

The War Cabinet assigned to Netanyahu, Gantz and Defense Minister Gallant needs to decide on an Israeli response. I am not sure that Israel has the firepower to destroy Iran’s nuclear sites on its own and there is almost no chance we will see U.S B52’s involved.

So the most obvious target is probably off the table. It seems that the U.S Administration is pressuring Israel not to respond at all and to leave things as they are. This should not surprise anyone who has been awake for the last six months.

Israel and Iran have been at war for the last 6 months – one could say for the last two decades. This was clear to everyone except Biden-Blinken who could have shortened the war and the suffering by punishing Iran for their attacks on US sailors and soldiers. Instead, they appeased Iran and released $10 billion to them essentially letting Iran hit Israel with this money.

The Scroll is reporting that:

We are now waiting to see how Israel responds. Although an unnamed “senior Israeli official” has been quoted promising a “significant response” to the attacks, Iran appears to have pre-cleared the attacks with the United States via the Oman diplomatic backchannel. And according to Roi Kais of Israel’s Kan News, a U.S. official told Saudi Arabia’s Al-Arabiya on Friday, “the United States will take part in the response to the Iranian response if Tehran escalates the situation inappropriately”—which means that the United States tacitly approved an appropriate level of Iranian escalation, such as, we don’t know, a “symbolic” drone-and-missile attack.

The United States has also, as Barack Ravid reported Friday, demanded to “have a say before decisions are made about any retaliation by Israel.”

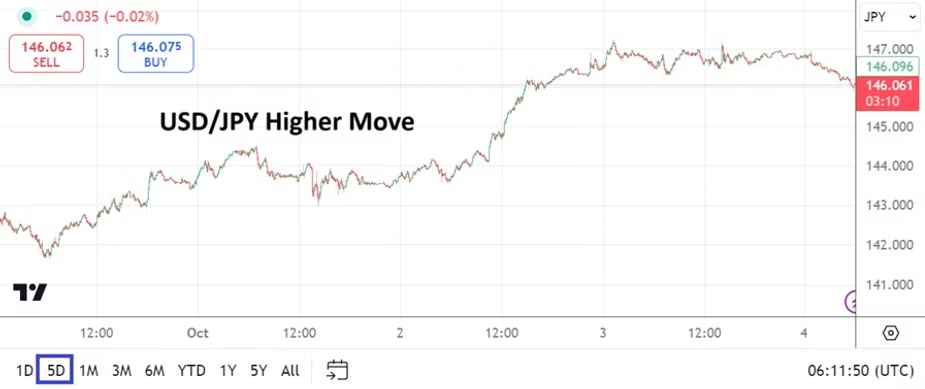

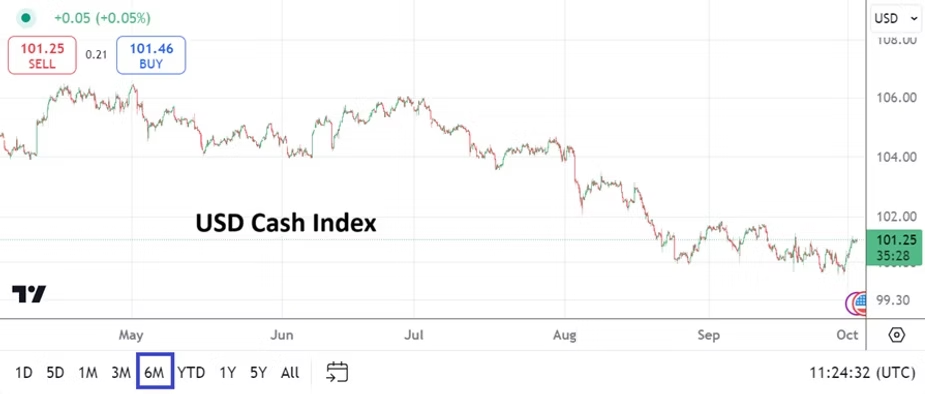

If true, that is cynicism taken to the ‘Nth degree’. True enough, the United States needs to watch after its own national interests, but is it possible that the U.S government considers Iran its equal and Israel its vassal? Were Israel faced with a missile attack from China an argument could be made that U.S interests take precedence over Israel’s – but Iran? The Iranian economy is in shambles, the Rial is at record lows, its only economic lifeline comes from China, bankrupt Russia, the $10 billion Biden gave them and illegal activities. As Israel just showed– Iran’s vaunted missile force is worth less than advertised. We have not even spoken about the way it treats women and gays and how it treats opponents to its theocracy, how it spreads terror throughout the Middle East and Africa, how it helps Russia destroy Ukraine, how it is a key player in the global drug trade and money laundering.

We have also not spoken about its foothold in the Western hemisphere and its attempts to infiltrate the United States itself via the porous southern border.

Worst of all, if the Scroll story is correct, it shows how Biden-Blinken don’t understand what the office of the Presidency of the United States is. It is not just another head of state or head of government, but rather the President’s warnings ought always to be backed up with actions. Biden’s “Don’t Speech 2.0” was laughed at by Iran in public, for all to see. And the Biden-Blinken response is to tell Israel, “don’t”.

Ignoring Biden-Blinken for the moment, Israel must think deeply about its response. It is clear that any response will be followed by more of the same from Iran. Israel must think a few moves ahead and not just attack for the sake of attacking or it will be in the middle of yet another war of attrition. The end of the multiple rounds of attacks must leave Israel in better strategic shape than it is now and must leave Iran substantially weaker.

Whatever Israel decides to do, it must degrade Iran’s military capability by destroying its weapons and bases and killing as many IRG officers as possible. Israel should not bomb the power stations in Tehran or do other non-military strikes. Air force bases, missile silos and Iran’s navy should be targeted in such a way that degrades capabilities. They could start by sinking the Iranian spy ship that is helping the Houthis in the Red Sea.

Israelis seem to think that by “allowing” Iran to attack them it gives them many diplomatic credits, but we already know that these “credits” do not last long. Whatever Israel does, it ought not to play the “message” game. Its attacks ought to provide tactical advantages in the coming months and not just “warnings to Iran” and “messages to Hezbollah”.

But let’s not ignore Biden-Blinken for a moment. What if they decide to threaten Israel that if Israel retaliates the US will sit on their hands?

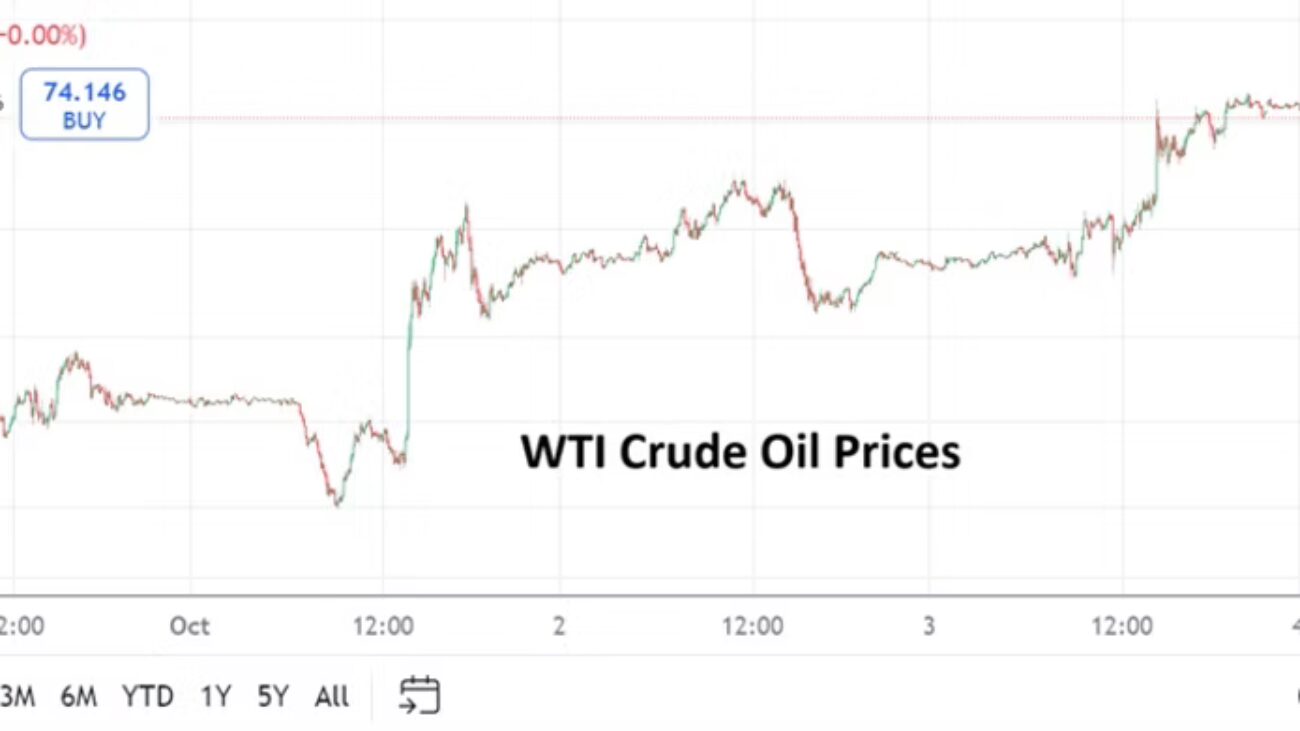

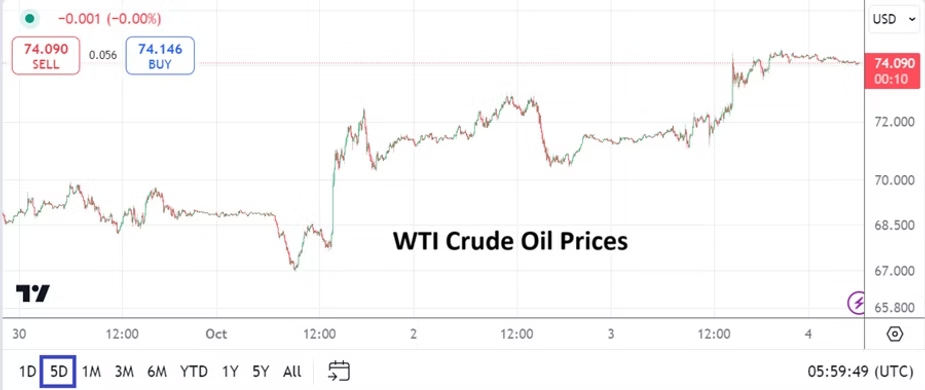

This would be the time for Israel to do a little threatening of itself. The worst thing for a sitting President running for re-election is a summer gasoline price spike. Israel could certainly threaten to destroy Iran’s oil facilities and help push the price of oil. High gallon gasoline prices this summer will lose Biden more votes than he can gain in Dearborn, Michigan. In exchange for leaving Iran untouched, Israel can demand a free hand in Gaza, including Rafah as well as in Lebanon.

Would that be worth letting Iran off the hook? It might. Iran was defeated in this battle, but it still believes it will win the war. Giving Israel free reign to destroy Hamas and then Hezbollah means that Iran will lose the war, too. Without Hezbollah, Iran will lose its most important asset in its overall goal of destroying Israel, chasing the US from the Middle East and establishing Shiite dominance in the region. It would turn October 7th into the day that Iran started on its road to defeat.

Israel needs to be opportunistic and aggressive in its dealings with its allies and its enemies. It has to let its allies know that it too is playing the long game and that it will not only hurt those who hurt it – as Netanyahu loves saying – but that it will destroy all who even try to harm it.

More importantly it needs to show its enemies with actions and not with words that threatening Israel means you will be destroyed.

The Biden-Blinken team must be told in no uncertain terms that Israel is not a vassal. The end result of this war cannot only be the destruction of Hamas, it must also be the destruction of the Islamic Republic of Iran as a regional power. By sending over nearly 60 tons of explosives to Israel, they have put themselves front and center.

Disclaimer: the views expressed in this opinion article are solely those of the author, and not necessarily the opinions reflected by angrymetatraders.com or its associated parties.