Why No Major Panic in U.S Stock via Moody's Downgrade?

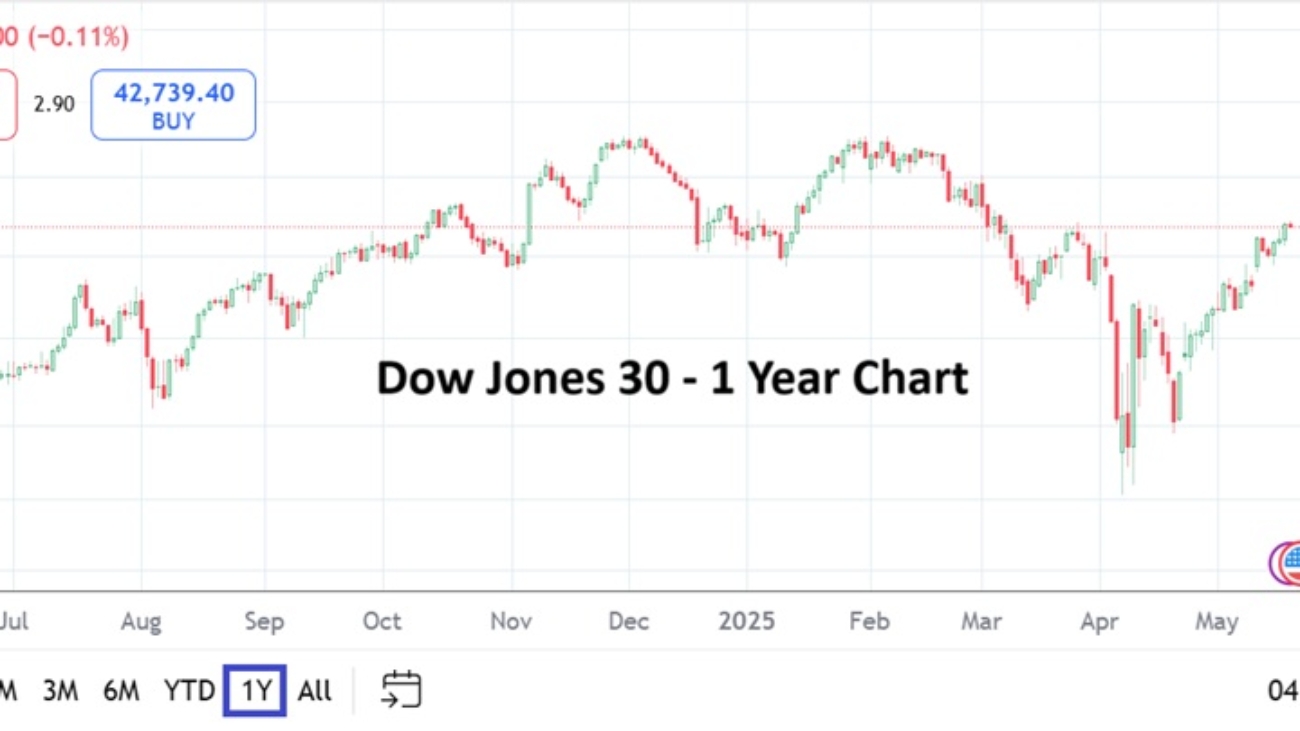

While Asian equity markets opened with initial nervousness yesterday after Friday’s late downgrade of U.S debt by Moody’s to Aa1. The U.S major indices did not respond with panic selling, By the end of yesterday’s trading the Dow30, Nasdaq100 and SP500 turned in rather mundane and positive results. Behavioral sentiment and knowing what experienced investors think remains important for people trying to mirror the actions of larger players while trying to take advantage of potential market action.

What was NOT mentioned widely in the press yesterday were the facts that Standard & Poor’s had actually downgraded U.S debt in 2011 from AAA to AA+, also Fitch had been warning of a downgrade the past handful of years and did so in 2023 to AA+. U.S government debt remains a definite burden on the U.S economic outlook, but investment institutions have been discussing the dangers of the 36+ trillion USD deficit for years. Talking about something doesn’t mean it is fixed, but it does mean it has been acknowledged and this is where sentiment comes into play.

Wall Street remains in many respects the only game in town for large global investors looking for quiet steady returns. U.S exceptionalism – or at least the concept that the U.S economy remains a true safe haven compared to other investment vehicles worldwide – continues to spur on a confidence game that sees money pumped into it by global pension funds and long-term investors which seek yields that outpace inflation. It can certainly be argued that this endeavor is not always achieved, but the concept that the ability to grow money faster in equity investments via the likes of index investing compared to letting money sit in a bank is noteworthy. The ability of large institutions to place considerable amounts of money in more speculative pursuits like singular equities in sectors they are interested in like AI and quantum also creates a dimension to outperform benchmark indices., but is riskier.

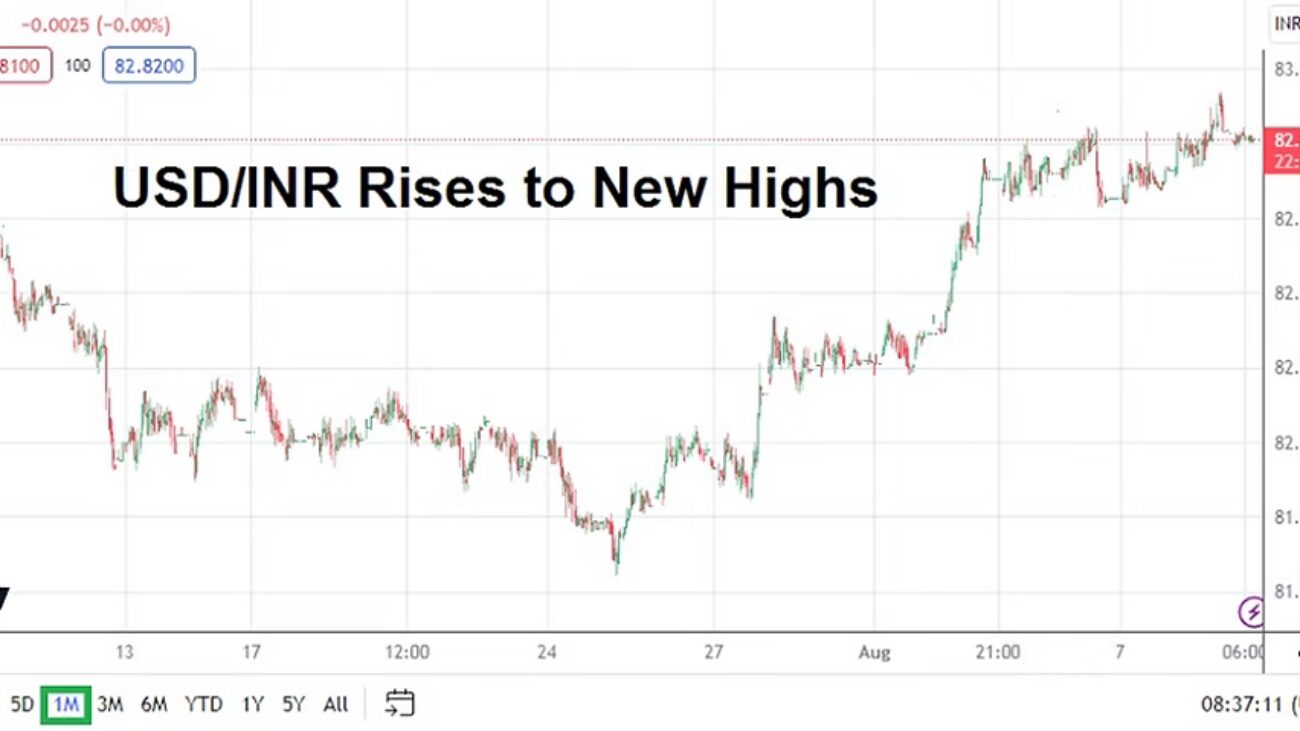

The USD remains the world’s currency of choice for effective trade and protection against the dangers of volatile Forex. The Trump administration likely wants a weaker USD in order to spur on export from the U.S, but it certainly doesn’t want to see the greenback killed. Nor does the White House want to see U.S Treasury yields balloon too high. Day traders may not have been told to watch yields in the 10 Year U.S Treasuries by their brokers, but it is an open secret that should be used as a barometer for investor sentiment. The signals may not work everyday, but over the long-term if U.S yields on the 10 Year U.S Treasuries are soaring it likely means major U.S equity indices are struggling with anxiety – and when the yields are turning lower it can be expected that U.S equity indices are gaining.

An important piece of the confidence game that speculators should note regarding confidence in U.S markets is that 10 Year U.S Treasury yields yesterday declined, and are now lower than values seen last Friday after the ratings downgrade by Moody’s, and are testing values seen on the 14th of May. Traders should certainly stay alert, but they must remember the U.S investment landscape is resilient and is likely not going to perish suddenly. Investors like most humans tend to be optimistic and believe things will work out with positive results somehow developing. It doesn’t mean stock values will always go up, in fact they can move lower violently periodically, but a long-term vision helps when investing in U.S equities.

There has been no panic in U.S equities and the world continues to look at the SP500, Dow30 and Nasdaq100 as places to position investments. Yes, other spheres exists which can produce greater yields, but this also includes higher risks. International diversification is a solid focal point for investors, and day traders need to understand a complex game is being played. Reacting to every soundbite of developing news probably does more harm to speculators compared to good. A steady approach and conservative risk taking tactics are vital.