Nervous Trading Results End of Last Week Serve as Caution

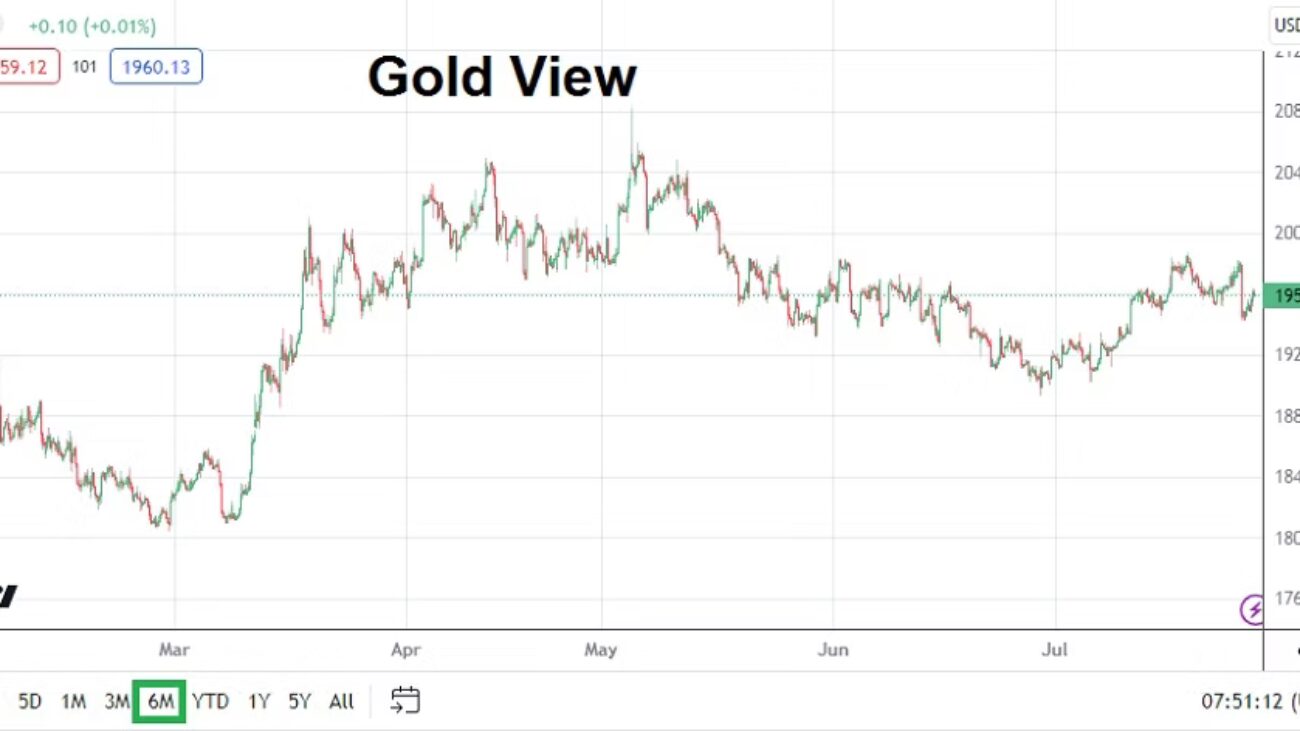

The end of last week saw mixed U.S inflation data and lingering nervous sentiment regarding outlooks about U.S Treasuries, create rather choppy conditions for day traders. Economic data this week should be more calm because there appears to be less significant risk events on the horizon. Financial institutions finished Friday within a USD buying mode, a bearish gold trend, and U.S stock indices declining – highlighting fragile conditions remain evident among larger market players.

Monday, 14th of August, New Zealand Business Services Index – this report may turn out to be the highlight of the day for some traders. The NZD/USD which will start tomorrow near values last seen in the middle of November of 2022, may find interested speculators glancing at the report. But the NZD is moving largely under a USD centric driven market, like most of the broad Forex market. Mid and long-term technical support levels are certainly in focus, and they have proven vulnerable recently as the NZD/USD trends lower.

Tuesday, 15th of August, China Industrial Production – economic data from the nation has been troubling regarding deflation. However, traders who lean towards a ‘Western’ bias should remember to keep their perspectives realistic, because weaker China economic results mean the global economy is struggling too. A slight decline in Industrial Production is expected. Weaker than expected numbers from China could indicate ‘soft’ demand via export partners.

As an aside financial institutions will keep their eyes on the China real estate market too, this as whispers about ‘Country Garden Services Holdings’ funding problems remain a talking point and potentially escalate. Values of properties are suffering from declines too in China and this is hurting the domestic economy.

Tuesday, 15th of August, U.S Retail Sales – a slight gain in spending by U.S consumers is expected to be seen. If the number can meet the anticipated gain of 0.4% the result may not spark too much volatility. If for some reason a higher outcome is produced, this could spark some concerns about U.S Federal Reserve rhetoric. Although it may seem counter-intuitive to some traders, a weaker number could help ignite some bearish selling of the USD.

Wednesday, 16th of August, New Zealand Official Bank Rate – the interest rate policy from the RBNZ is expected to remain in place. Although it should be noted both New Zealand and Australia have almost made it a habit to surprise investors over the past few months.

Wednesday, 16th of August, U.S FOMC Meeting Minutes – the report will be studied for clues regarding outlook. However, the Fed has a well-practiced ability to maintain tight lips and not disclose too much internal thinking, particularly when it comes to disagreement regarding policy – which is seemingly escalating in the Federal Reserve.

Thursday, 17th of August, U.S Weekly Unemployment Claims and Philly Fed Manufacturing PMI – in what has likely been a quiet week of data leading up to these reports, some analysts may try to get the attention of their clients regarding these results to create ‘noise’, but unless there is a strong miss the data is likely to simply be digested quietly into the broad marketplace.

Friday, 18th of August, U.K Retail Sales – last week’s better than expected GDP numbers from Britain will make the outcome of this consumer data rather intriguing. The GBP/USD could find some impetus from the results. The estimate is calling for a decline of minus -0.4% compared to last month’s gain of 0.7%. The GBP/USD which went into last weekend near lows will likely find plenty of attentive traders as this new week comes to a close.