Risks Ahead: Tranquil Data Mixed with Loud Nervous Chatter

Last Friday finished with stronger than expected Non-Farm Employment Change numbers, which essentially collided with dovish rhetoric via two U.S Federal Reserve FOMC members from the middle of the week; this while inflation clearly remains stubborn in the U.S.

All of which sets up this coming week for nervous trading results and until the 14th of June, when the Federal Reserve’s Federal Funds Rate pronouncements will be brought forth. Plenty of talk about interest rates will be heard in the days ahead and traders should expect to hear debates as the chatter grows louder.

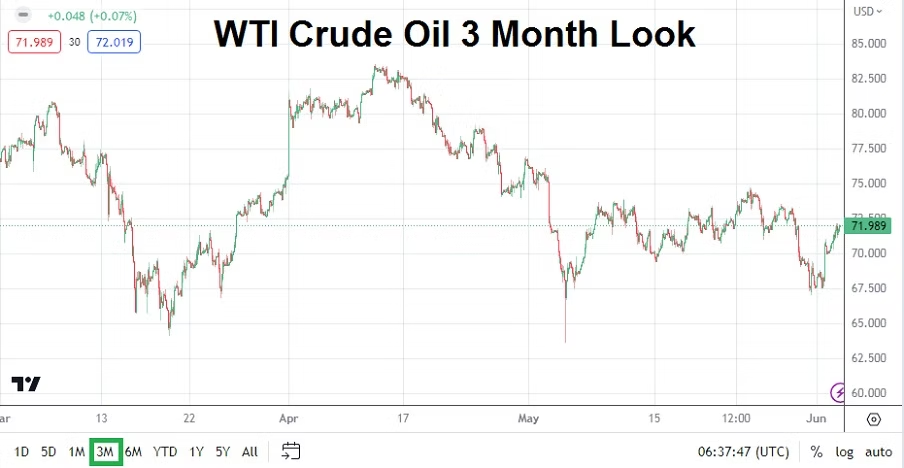

Commodity traders may be interested in the outcome of the OPEC+ meetings taking place this weekend. The cartel’s decisions regarding oil production will affect not only prices of Crude Oil futures, but is a direct reflection regarding global demand, which also tells us about the organization’s viewpoints regarding global economic conditions.

WTI Crude Oil Three Month Chart as of 4th of June 2023

Monday, the 5th of June, European Services PMI – Germany, France and Italy and will release their Purchasing Managers Index readings. The German outcome could prove interesting because the nation is suffering from recessionary pressures. The PMI results could affect the EUR/USD a bit. The U.K will also release their data too.

Monday, the 5th of June, U.S ISM Services PMI – this report will be of interest because some are expecting a better outcome compared to May’s results. A potentially strong reading could prove problematic and put more pressure on the Federal Reserve to raise interest rates next week.

Tuesday, the 6th of June, Australia RBA Rate Statement – the Reserve Bank of Australia surprised people with an increase of their Cash Rate last month. No increase is expected now, but the RBA’s rhetoric should be listened to as they comment about domestic and global economic conditions.

Wednesday, the 7th of June, Canada BoC Overnight Rate – Bank of Canada is expected to hold its borrowing costs in place, but inflation is still creeping into prices and the BoC’s Rate Statement may prove intriguing.

Thursday, the 8th of June, U.S Weekly Unemployment Claims – following in the footsteps of the stronger than expected jobs numbers last week, this report could get some media fanfare. However, it also may prove to be a lot of noise and have little real affect on market direction.

Friday, the 9th of June, China CPI and PPI – the inflation reports from China could prove interesting in wake of recent lackluster economic data from the nation. Last Thursday’s Caixin Manufacturing PMI results came in slightly better than expected, but data from China the week before was negative. The data from China gives investors and traders insights because of its importance as a global supplier of consumer products.