Interest Rate Cuts and Cautious USD Centric Gusts in Forex

U.K inflation data this morning came in well below estimates, which almost assures the Bank of England will cut their Official Bank Rate on the 7th of November by at least 0.25 basis points. Tomorrow the European Central Bank will announce its Main Refinancing Rate and it is widely anticipated a 0.25 cut will be made official.

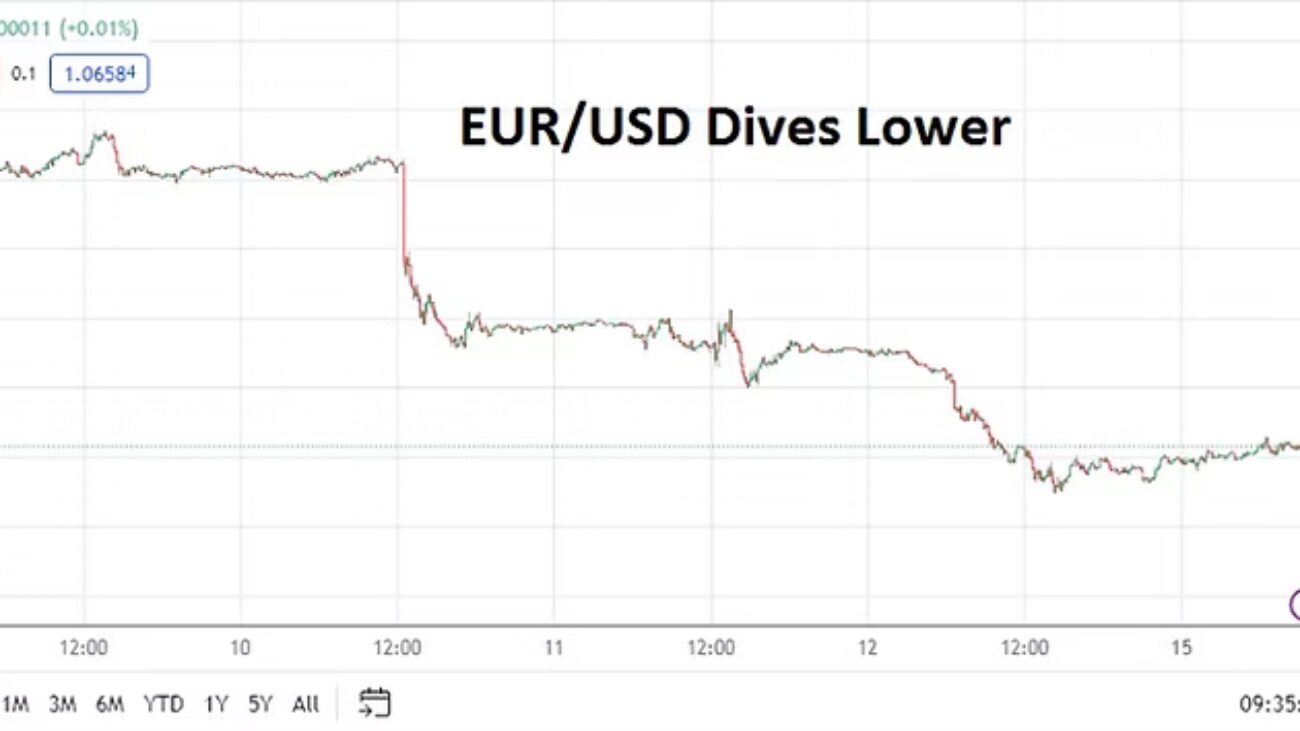

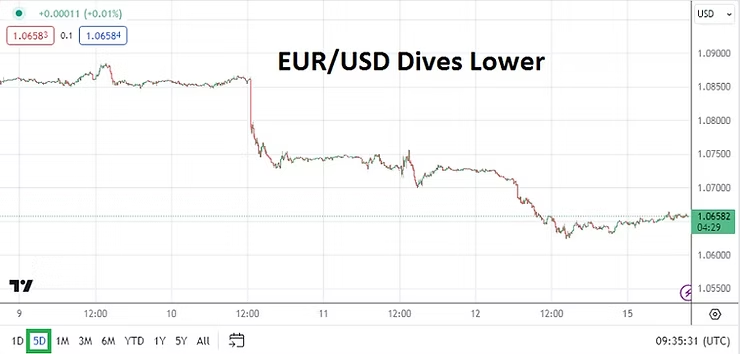

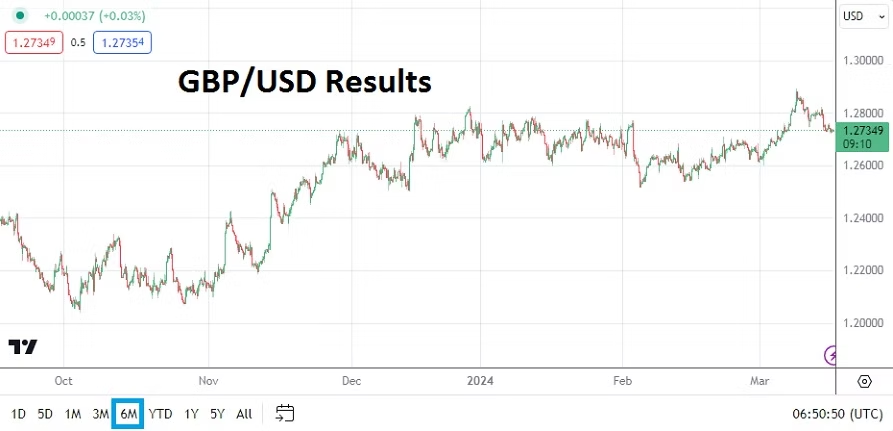

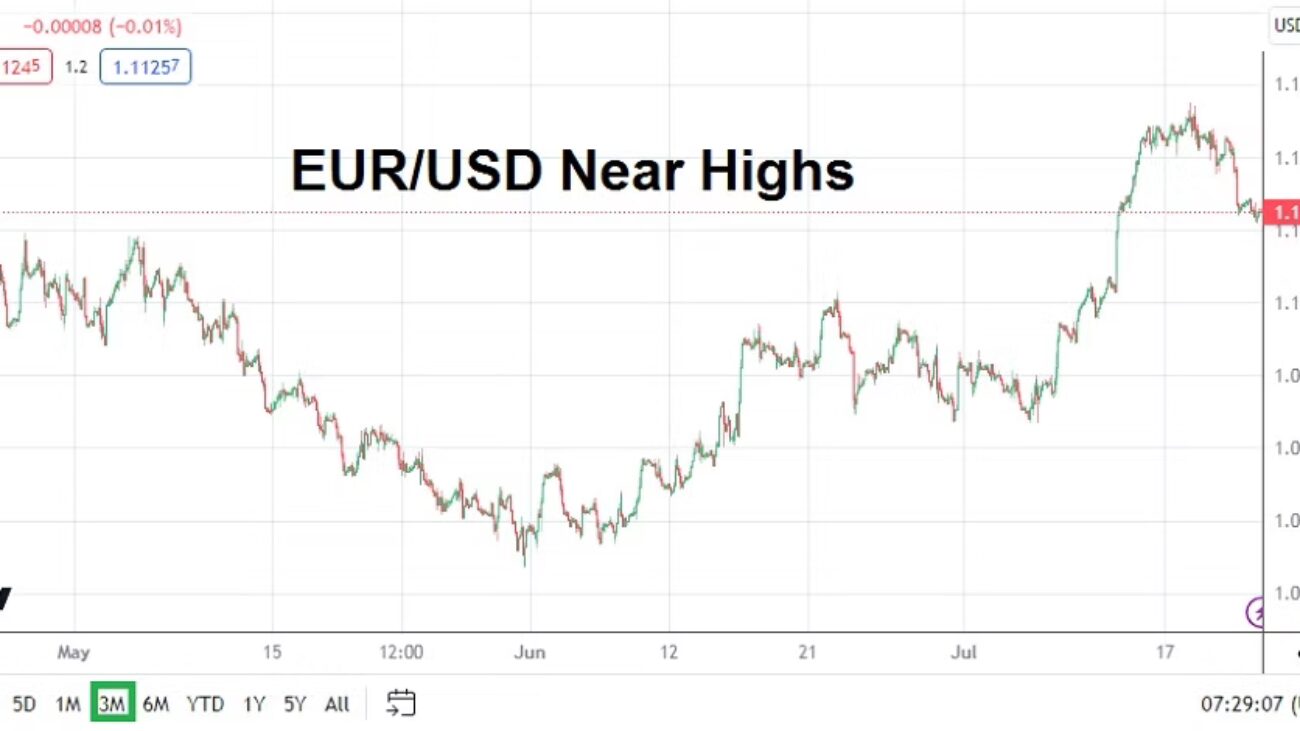

The downturns in the EUR/USD and GBP/USD are easy to see via three month technical charts, but both pairs remain above lows seen over the mid-term. However, the choppy and consistent selling in both currency pairs the past few weeks have likely caused pain for any day trader who has remained stubbornly bullish.

Questions surrounding the Federal Reserve remain murky and this is creating USD strength and cautious selling in other currencies. After a rather dovish sounding round of rhetoric from Jerome Powell and a 0.50% basis point decrease in mid-September, financial institutions clearly have become more guarded about the ability of the Fed to remain aggressively dovish. Will the Fed will cut by another 0.25 on the 7th of November and then say they believe they are done being dovish until additional data backs up their stance? Is there a capability the Fed will still cut the Federal Funds Rate by 0.50 over the next handful of month as once envisioned?

However, there is a chance the Fed will not cut in November and some analysts have banged their drums regarding this idea. But the Producer Price Index results last Friday did show that inflation remains under control. So I hold to the notion the Fed will cut by another 0.25 in November. Let’s see.

On Thursday the 10th of October the U.S Consumer Price Index statistics were slightly hotter than hoped for and this certainly caused some of the USD centric storms now thrashing financial institutions and day traders. It should also be mentioned that on the 4th of October the Non-Farm Employment Change numbers came in better than expected. But revisions lower in the jobs data the past handful of months needs to be remembered, and, yes, there will be another jobs report on the 1st of November. Which will be followed on the 5th by this little thing known as the U.S Presidential Election. So caution will be a solid instrument for day traders and possibly financial institutions over the next three weeks. The stronger move by the USD since the end of September has caught many folks off guard.

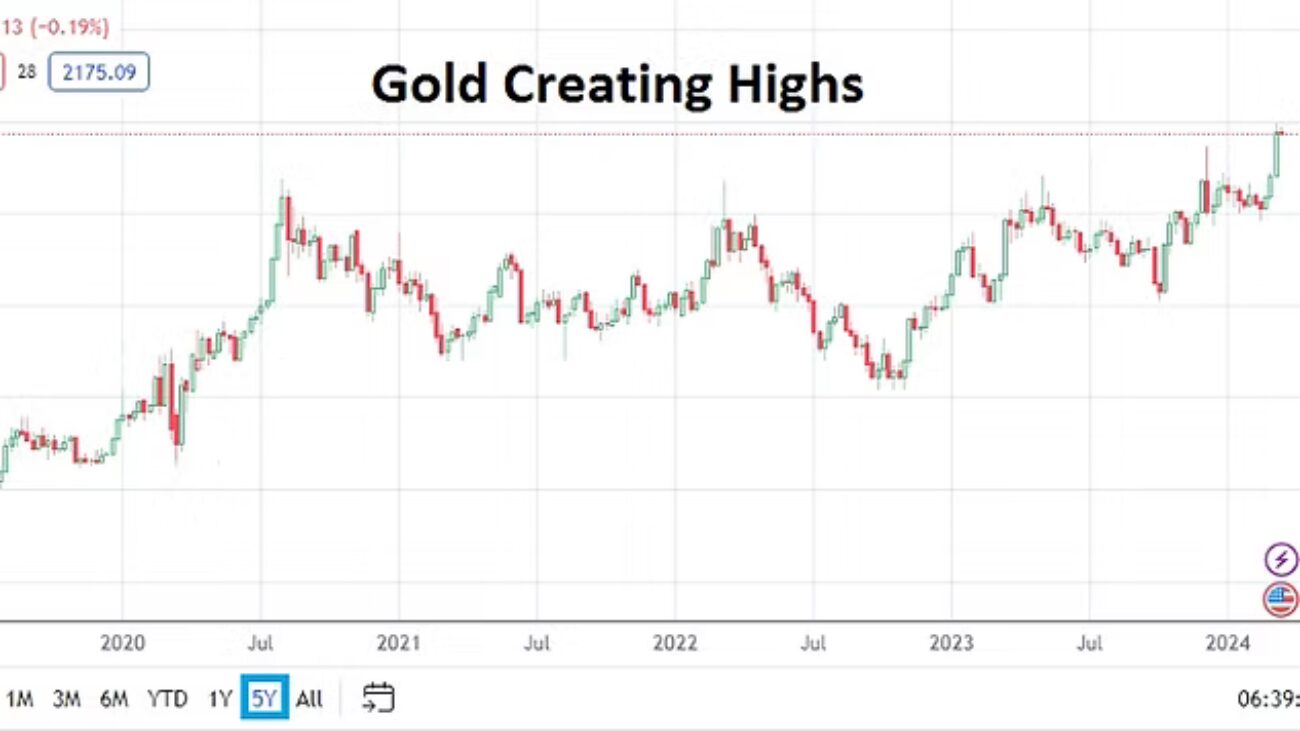

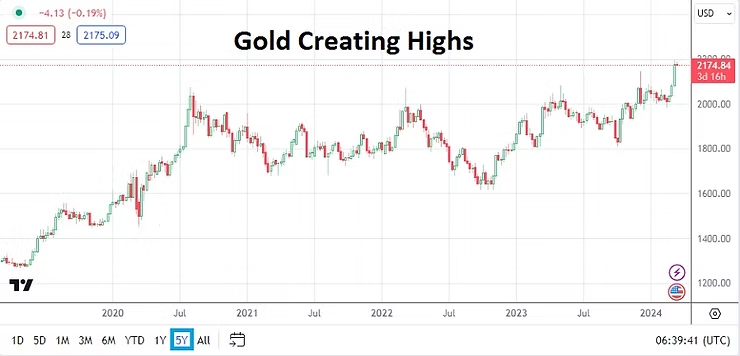

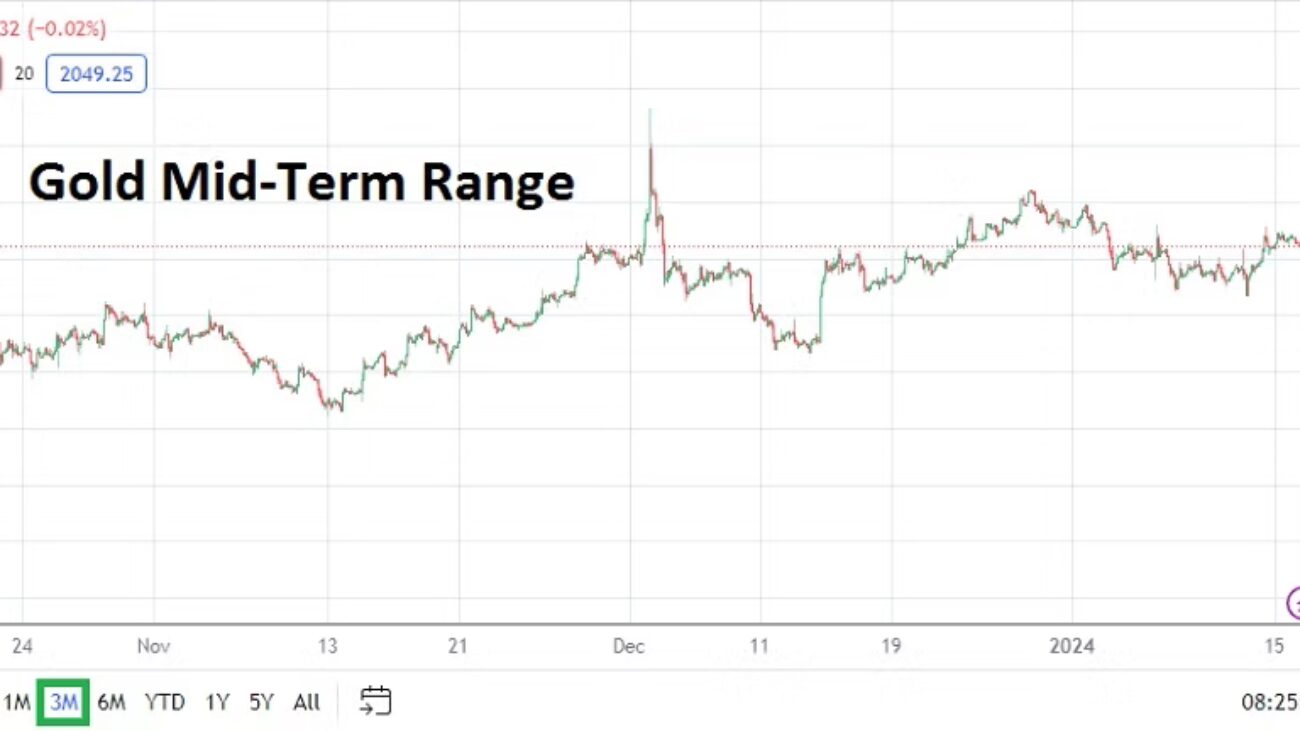

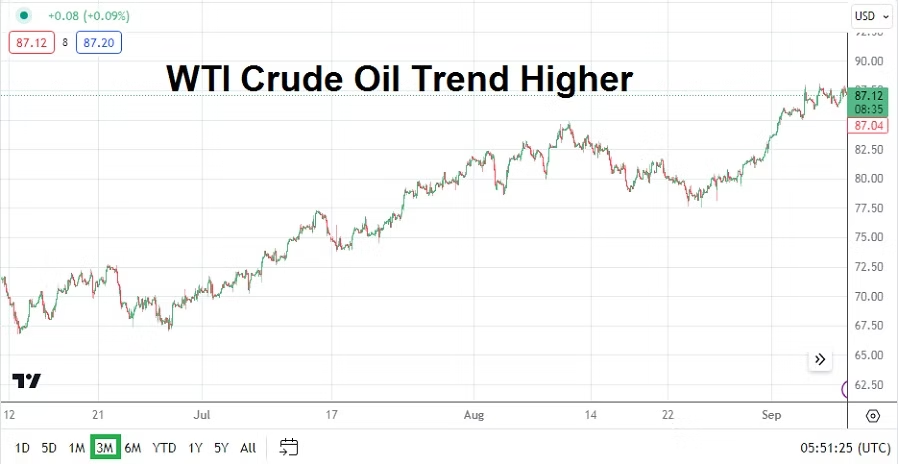

Gold is trading near record high levels this morning, but intriguingly WTI Crude Oil has calmed down and is challenging near-term lows. U.S Treasury yields have come down slightly to start this week. The point being that while Forex and gold have seen volatility because of interest rates uncertainty, risk taking actually appears rather solid. Yesterday did see selling in U.S equity indices, but there is no denying U.S stocks remain within sight of ultra-highs. And I might be about to sound contradictory soon, and my own personal bias needs to be carefully given consideration by myself and you the reader. Because while I feel rather comfortable about the higher values in the major U.S indices, I do not feel the same way about Chinese equities currently.

The Shanghai Composite Index has traded a little lower again, but this follows a massive swing upwards after Chinese stimulus intervention. But the U.S equity indices and the Chinese markets are not correlated. Perhaps mentioning the Shanghai Composite Index here is wrong, but the stimulus the Chinese government provided may prove to be window dressing on a storefront that suffers from poor economic infrastructure. Day traders in Asia and elsewhere who are betting on upside in Chinese equities need to be very careful, in fact they should be quite suspicious. Economic data from China to start this week has remained lackluster. On Friday GDP, Industrial Production, Retail Sales and New Home Prices data will come from China.

Major currencies which did very well against the USD since July have struggled the past few weeks as clouds have emerged regarding U.S interest rate outlooks. However, at some point day traders and financial institutions may believe the USD has sold off too much during this wave of caution. The JPY, GBP, and EUR have all lost value during this time. As always day traders need to remember they will find it hard to pick the correct time a strong reversal starts to take place. And it should be remembered because of the risk events lined up Forex volatility may rage a while longer. Certainly the outcome of the U.S election will be a factor in the days ahead and may create sideways trading outcomes in many assets until a winner is known.

USD/JPY Three Month Chart as of 16th October 2024

But the global markets will remain open and trade. While shouts of danger should be listened to and given heed, tomorrow’s ECB meeting and outcome will be a good start to the parade. If the ECB plays the expected song and cuts the Main Refinancing Rate by 0.25 this will prove interesting, because financial institutions have already priced in the rate cut in most cases and they will wonder if their outlooks regarding the Fed and BoE are correct. The U.S will release data tomorrow with Retail Sales and weekly Unemployment Claims. On Friday housing sector results will come from the U.S also. These reports will provide USD impetus into the markets as the near-term is considered and wagered upon.