Pay Attention to Mid-Size Banking Noise

About a week and a half ago the U.S Federal Reserve ‘admitted’ they made a mistake regarding their oversight of Silicon Valley Bank. In essence, the Fed used the sports phrase that sprung to life in the early 2000’s by baseball players who said, “my bad”, as if by admitting when they made a mental error on the field it would soon be forgiven. “What a good guy”, some folks would say as a player took responsibility, but their team would lose the game.

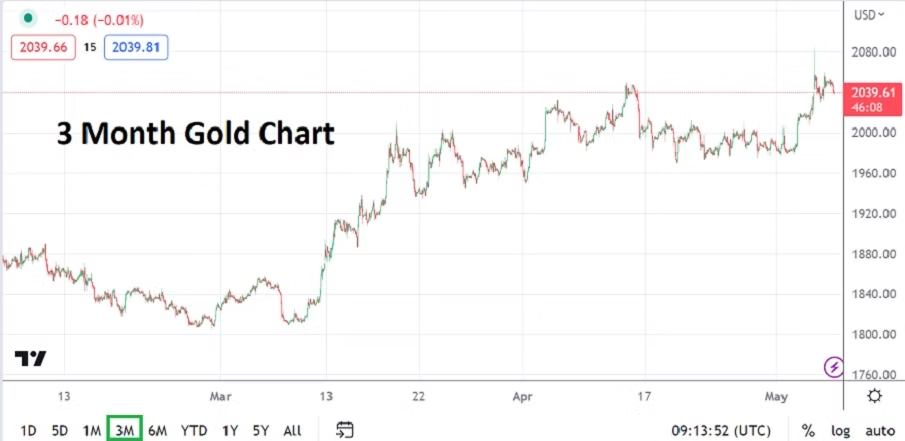

Gold 3 month chart as of 5th May 2023

The question for the Fed is what will they say when other so-called mid-size and smaller banks start to crumble from duress? The Federal Funds Rate was increased again this week by an expected 0.25% and the corporate banking sector in the U.S is under strain. Many banks are seeing share values on Wall Street disappear as they watch their trading screens with alarm.

Let’s not get caught up in hyperbole, or scare mongering, but these banks and the Federal Reserve have simply proven again they have no real grasp regarding risk analysis and what to do when the proverbial ‘fluff’ hits the fan. It is easy to point fingers now, yes, but the writing has been on the wall. It is much easier to make money for a bank when money is cheap. Little to no interest rates allowed banks to be speculative – compared to an environment when the lending rate is high and folks do not borrow, or pay back slowly. Deposits are also dwindling because bonds and other assets have become attractive for ‘clients’ who want to park their money elsewhere to earn better returns. The middle class and lower class are under pressure and small businesses are too as mid-size banks get nervous.

In the FOMC Statement this week which was somehow a unanimous decision – no dissension is a bad sign ladies and gentlemen – the Fed stated “The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation…..” However, they also pointed out that inflation remains ‘elevated’. And let’s dissect the banking is sound statement, the Federal Reserve did not elaborate. They surely cannot mean the mid-size and smaller banking sector which is losing value almost daily because of struggling corporate share values are sturdy. Financial houses of various types are clearly betting these banks will come under immense weight because interest rates remain high.

Oh, and borrowing costs can still go higher, because let’s face it, inflation is not going away soon. The Fed has helped ramp up inflation by creating ‘import inflation’ as they have ‘killed’ foreign currencies values. If you are a fan of body language watch Fed Chairman Jerome Powell answer questions during the Fed Press Conference from this Wednesday the 3rd of May, when pushed on details regarding the mid-size banking sector and the future of interest rates. He didn’t put his hand up in the air and say, “my bad”, but it would not have been surprising, however it did look like he wanted to walk off of the field. The stadium packed with depositors within mid-sized and smaller banks should be prepared to show their disdain. Middle America should be unwilling to take this loss.

No historical events are exactly similar, but the Fed and its continued ability to put on ‘blinders’ as the corporate mid-size banking sector in the U.S potentially cracks, smells eerily similar to what happened during the financial crisis of 2007 and 2008 when rumors became strong whispers and then turned into a nightmare. Please say hello to the possibility of another massive bailout from the U.S government, because J.P Morgan, BlackRock and other ‘banking’ mammoths do not have enough capital to keep everyone liquid and safe.

Nervous behavioral sentiment is rising its head and looking out over a dangerous landscape. Middle America should be prepared to react to the potential that their neighborhood banks might be in trouble. And the U.S had also better get ready for the very ugly word ‘stagflation’.