India Insider: Reserve Bank of India Intervention is Limited

After weeks of steady appreciation due to Reserve Bank of India intervention on the 15th of October, the Indian Rupee has now returned to the same 88.72 levels against the USD before the policy action was enacted. The RBI’s recent offensive against speculators may have calmed the market temporarily, but it reflects a reactionary and short-term approach to deeper structural pressures facing India’s external administrative policies regarding the USD/INR.

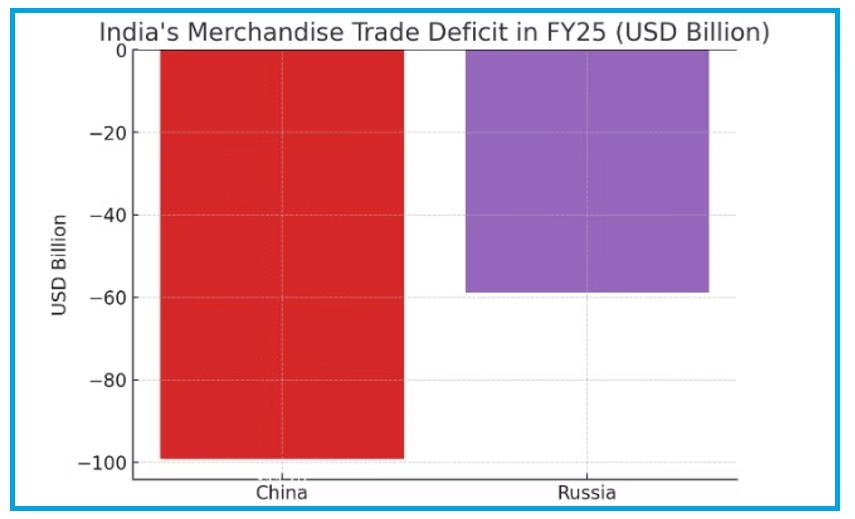

Despite the Reserve Bank of India’s efforts to influence the cash forward market, where Dollar shorts rose by 6 billion USD in September to $59 billion, fundamentals suggest that Rupee weakness is not purely speculative. It is a rational market adjustment due to rising trade barriers amid U.S tariffs on India’s merchandise exports. The added uncertainty regarding trade caused the Rupee to naturally absorb external shocks. Merchandise exports to the U.S fell 12% in September year on year, according to official India data, prompting some calls for government relief.

India’s Foreign Remittances & H1-B Visa Fee Hike

According to World Bank data, India received about 137.7 billion USD in personal remittances from abroad in 2024. From that amount, around $40 billion is coming from the United States. The Trump administration raised the cost of H1-B visa fees from below 10,000 USD to nearly $100,000. And there is now also an increased likelihood of measures aimed at limiting digitally delivered software services to the U.S from India. These combined measures would substantially reduce Dollar receipts via exports of technology driven software and IT services, as well as remittances from a reduction of workers on temporary U.S visas providing on site services to U.S clients. USD inflow has been crucial for India’s balance of payment’s stability.

Reduction of USD reserves when the trade deficit is already rising because of hikes caused by tariffs on India’s exports would widen the current account deficit. Concerns about a decrease in remittances leading to a potentially significant decline of India’s USD reserve ability is possibly discouraging the India Reserve Bank to voluntarily expend reserves to support the Rupee.

Service Exports Cushion India’s Balance of Payments:

India’s total service exports touched 400 Billion USD over the past year with a predominant amount coming from the U.S. In other words, India has had a $202 billion in services trade surplus over the last 12 months, which covered almost 114% of India’s merchandise trade deficit in 2024-25.

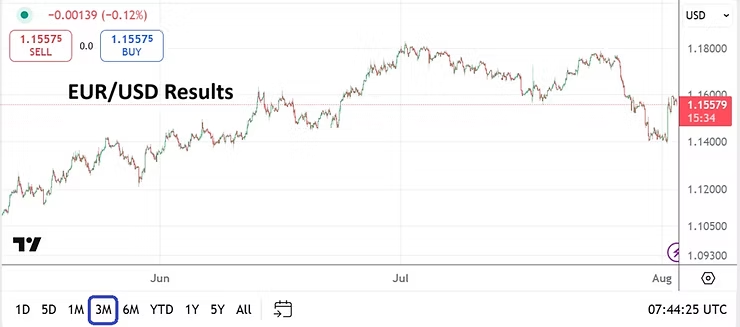

India’s goods trade deficit is matched by a services surplus, plus net foreign personal remittances. This USD equation is under threat because of prolonged paralysis from stubborn US and India trade negotiations debating Russian Oil usage and the U.S demand to allow agricultural products into India.

Foreign Investors Selling Indian Equities

In addition, the Indian Rupee is not getting support from investment portfolio inflows. A shortfall of AI related avenues in the nation’s tech sector, and perhaps because of valuations considered too rich, foreign Investors have pulled 17 billion USD so far this year. This sum is more than any other emerging market, which is eating away at the Reserve Bank of India’s FX reserves too.

Global and India-specific uncertainties spurred by the Trump administration’s actions are setting off a retreat of footloose portfolio capital invested into India’s equity and bond markets. If the Reserve Bank of India was confident that inflows of foreign capital would replenish reserves it would likely help the Indian Rupee, and thus investor confidence coming from abroad.

Policy Irony and the Limits of Intervention

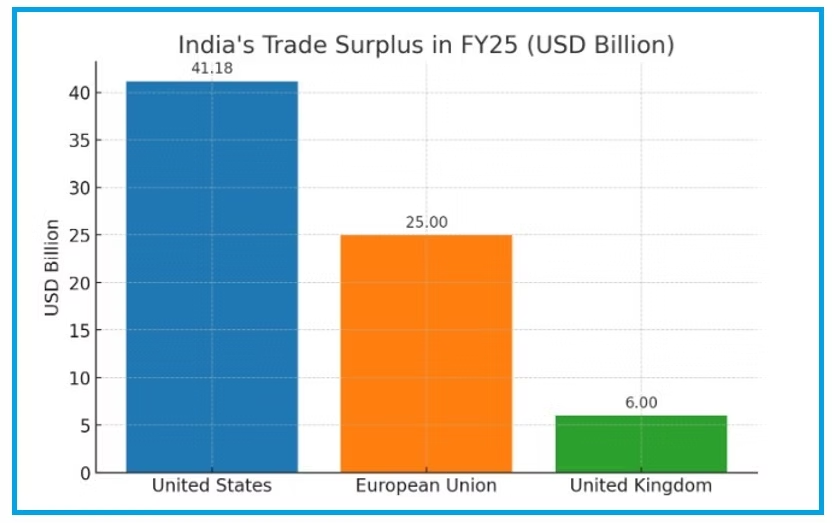

The U.S. remains India’s largest export market, but new levies of 50% tariffs are hurting labor-intensive sectors such as textiles, leather, footwear, and gems & jewelry.

While concerns about imported inflation are valid, the benefits of a weaker Rupee should not be overlooked. A mild depreciation could boost India’s service exports, improve the balance of payments, and partly offset the effects of U.S. tariffs on merchandise exports.

A material improvement in U.S and India trade relations is needed. Until a restoration is achieved in relations and a merchandise surplus is possible, alongside healthy services and remittance inflows occurring again, the Rupee’s weakness is likely to persist. In the meantime, Reserve Bank of India interventions could prove to be a short term tactic that proves vulnerable mid-term to the influence of market forces known and unexpected.