FX Trends: Brutal Months for Day Traders and Happy Brokers

The past few months for day traders have likely not been pleasant experiences for many. Forex, equity indices and other assets have experienced plenty of volatility and finding a trend has not been easy. While speculators who are wagering on the ups and downs in the marketplace have been getting crushed, their brokers likely have not been getting hurt.

Day traders need to understand that CFDs are virtual. Your broker is merely placing a wager for you on chosen direction, in most cases they are acting as ‘the house’ and know the volatility is going to knock you out of your trade. They pocket your losses as their winnings in many cases. The brokers are not only making money from the differentials from the bids and asks (the spread), they might also be charging you a transaction fee.

If a broker feels less confident about their ability to make a profit off your poor results (I am not kidding about this), then they sometimes insure your wager via a liquidity provider who in many cases is literally betting against your broker, because the liquidity providers believe your broker is likely being overly cautious. (A vicious circle). In other words brokers allow your trades to work virtually (not in the real marketplace) on something many risk management rooms in Forex call the B Book. If the broker is not certain if you will lose money, they put your trades into something called an A Book. And, yes, many liquidity providers (the A Book providers) are betting against their clients (who are brokers seeking to mitigate their risks).

Again, the brokers and the liquidity providers do not believe you will make money most of the time. They are allowing you to bet and they are happy to take your wager, because historical evidence shows retail bettors in Forex tend to lose money via their trading accounts at least 85% over long durations. Depending on what source you look at regarding CFD statistics, speculators tend to do a little better against their brokers but still lose money more than 50% of the time. Some statistics claim up to 75% of the CFD outcomes via trading accounts equate into losses for speculators.

And if all of this sounds like sour grapes, it is not, it is a warning to you the bettor. Brokers in many cases are glorified casinos that provide you an opportunity to wager. You need to acknowledge the above before your start trading. Speculating on Forex and CFDs ( via equities, indices and commodities) is like betting on a horse. The racetrack doesn’t lose money, they know most bettors simply enjoy the thrill of gambling and don’t mind losing. Racetracks are happy to pay the occasional winner. If you choose to wager on Forex and CFDs you need to practice risk management.

You probably didn’t come here to be reminded about risk management, you have heard it before – conservative leverage, price targets, timeframe parameters, entry – stop loss – take profit orders are standard warnings. You want to read about trends, you want to know which direction you should take, yet there are no guarantees and that is why speculating is gambling. You are wagering.

If you intend on improving your odds, by following solid risk taking tactics – including trying to understand behavioral sentiment via the financial institutions you are trying to emulate, you might find better results. And still, speculating will be tough.

The U.S will release Non-Farm Employment Change numbers today, but traders should pay attention to the Average Hourly Earnings report which will give insights about inflation too. However, the jobs numbers may prove to be a false narrative, because more importantly, whether you like him or not, there is the Trump Effect to ponder.

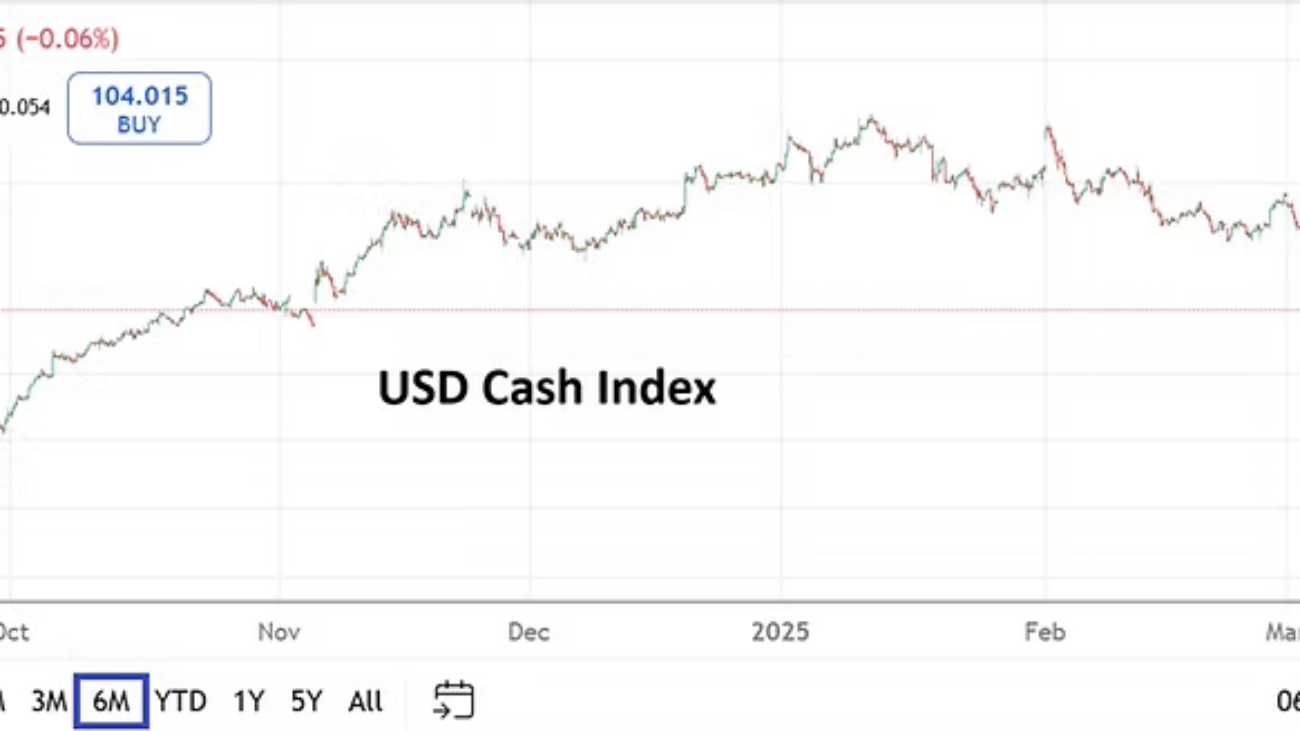

Tariff mantras and fears, negotiations regarding the fate of Ukraine, and a myriad of other concerns have financial institutions anxious as they try to seek clarity. Equity indices have been a mess. Yet, the USD Cash Index has given back a lot of its gains since February the 4th – this after the Forex bloodshed caused by nervous reactions to fear of tariffs being implemented. And now, not so coincidently the USD Cash Index is traversing values it saw on the 5th of November 2024, yes, U.S Election Day. Speculators and financial institutions have returned full circle to big unknowns.